Gold is definitely something most of us want to trade, not only because it is a significantly liquid asset but because it is offered by many different Forex brokers and provides a solid alternative asset class against currencies. If you have a system for spot metals that can also trade spot currencies then you’re most probably after a solid market inefficiency and even if you have separate systems for spot currencies and gold the degree of diversification you gain by investing in gold might increase the future chances of survival of your strategy basket. However creating a system for gold is not very easy since the market conditions that determine gold price have fluctuated significantly during the past twenty years and some of the assumptions made for currency trading simply do not apply to gold.

When developing systems for spot currencies I usually do a development process based on 10-20 years of data which in the end reveals a strategy that is able to profit across a wide variety of market conditions. In currencies the assumption that a strategy that gives 10 years of profit will continue to profit is valid for the most part as systems that have been developed over the 1990-2000 period and then out-of-sample tested from 2000 to 2010 give profitable results overall. This means that the market structure around currencies seems to have some sort of coherence which has not disappeared within the past 20 years and which has a high probability of growing even stronger into the future. For me it is therefore not hard to develop a system for spot currencies as I have a high degree of confidence in the like-hood of success of the development process.

–

–

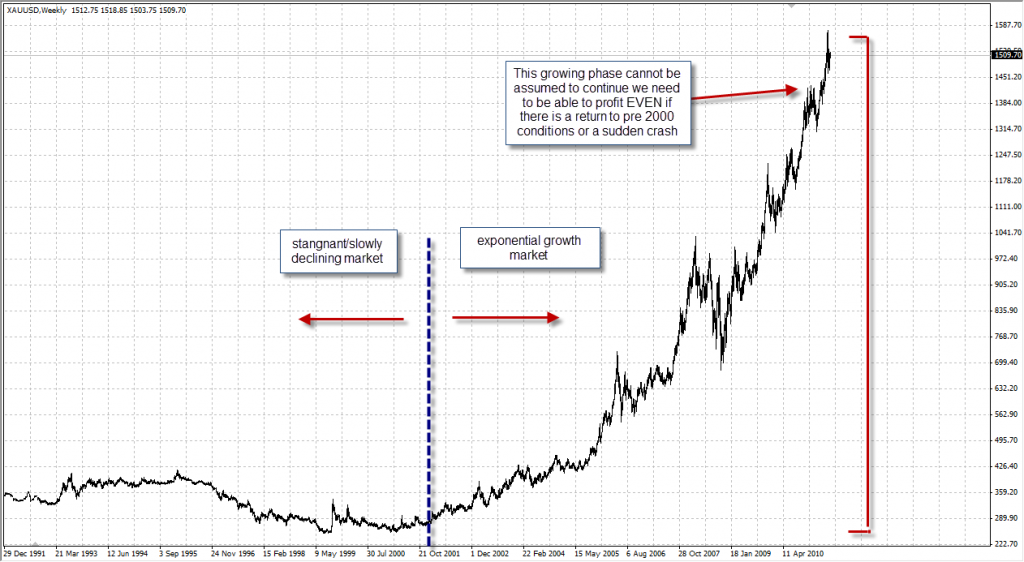

Now silver and gold are a completely different story. If you develop a system using EOD data for Gold between 1994 and 2000 (which is what we have available) you’ll find that these systems always fail in the 2000-2011 period, simply because gold has “changed gears” and entered an exponential growth phase during the past ten years which is very unlike anything seen within the 1980-2000 period. When developing systems with even the slightest degrees of freedom it becomes evident that any curve fitting to the gold 1994-2000 era yields unprofitable results under a later out-of-sample testing time. It is therefore evident that any strategy developed from the 2000-2010 period will most likely suffer the same fate. Gold has increased almost 8 times in value since 1998 and this growth phase seems to be simply unsustainable in the longer term so gold will most likely either arrive at a “still phase” (much slower ascent or decline) or crash hard during the next 10 years (check data from 1960-1980 to see a similar scenario happening). the important thing is that we simply cannot assume that exponential growth will continue, we must build systems that may profit if it does or if it does not.

Does this mean that we cannot develop a gold system? No, it certainly doesn’t mean that but it means that we need to develop systems for gold that take into account everything that has happened within the past 17 years (from 1994) so that we do not simply crash and burn if there is in fact a change in gold’s trading tendency. We want to be within a scenario where we can profit from both a steady continued ascent (further valuation of gold) or a change in gold’s trading (crash or change to “stand still”). I could not comfortably develop a system based only the past 10 years of exponential growth because all systems are heavily asymmetric (rely almost entirely on longs to profit) and fail under previous conditions (which we will eventually see again as the economy cycles).

Another interesting part comes when we attempt to develop trading systems for the past 17 years. Using our Asirikuy genetic framework (Coatl) there are almost no positive results and those that do show up have a very limited number of trades. Coatl is indeed quite confused by the hard change in trading character and despite its very large decision space it is unable to find a meaningful fit that can achieve significant profit on this asset’s charts for the past 17 years. It seems that the change in market conditions was nothing but abrupt and therefore genetics do not achieve success as the “grip” they attempt to put around gold is just “too tight” to put it in words.

–

–

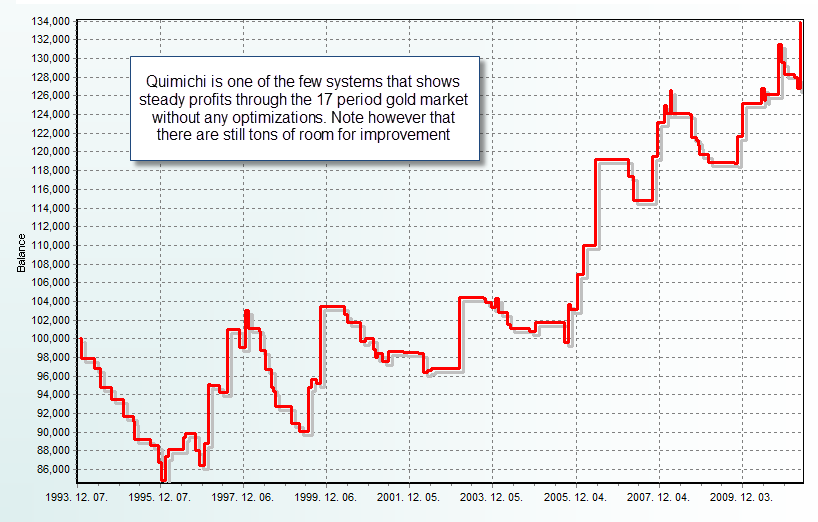

What can we do to build a successful trading system for gold ? Well we can always think of gold a as as regular commodity and attack it with a symmetric trend following strategy that makes no assumptions and has no optimizations (Quimichi) and see what happens. Not surprisingly Quimichi is one of the few Asirikuy strategies that does manage to reach a profitable outcome on gold’s 17 year data without any optimization and with the exact same settings used on other currency pairs. This shows – yet again – Quimichi’s power as it is able to profit from things as varied as the USD/JPY and the spot gold XAU/USD pair. Sure, results aren’t very good (average compounded yearly profit to maximum draw down ratio of 0.2) but overall results are positive which is the first step into the building of a really robust gold system (which will resist even a “hard crash” in gold).

Certainly I will continue to explore this area with some similar trend following techniques and some additional genetic modifications and hopefully I will be able to find some robust implementations to trade metals within Asirikuy which can help us compliment our currently currency-only trading portfolios. If you would like to learn more about automated trading and how you too can perform long term evaluations using EOD data please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hey Daniel,

I personally think, and the evidence is there, that the price of gold dramatically increases during troubled times such as oil crisis and economic collapse. So what I would do is use a semi-auto trader, that only trades long positions, during wordly unrest in terms of war, economic collapse and oil problems. The EA can be turned on during these times, and turned off when everything normalizes again.

I would use an EA with tight stops and a very high reward to risk ratio in case the tactic backfires.

The 90’s was basically a golden age in terms of economic growth for the world, and I believe that is why the price of gold was steady.

I have also seen that the oil price is highly correlated with the gold price, indicating that we should only trade gold in times of crisis.

Hi Franco,

Thank you for your post :o) Although you’re right about the relationship I believe you might probably not be able to use it successfully without a lot of discretion as usually when gold bubbles pop they do so fast and any long-sided algorithmic strategy would get killed, also remember that gold doesn’t trade “steadily up” but does have some retracements so probably a “tight strategy” might also not be successful as you’ll get kicked out of the trend on all steep retracements. Probably the best way to trade this might be to use a neural network that is able to “connect the dots”, a neural network trading gold based on the USD index and oil might be a good choice although some sort of leading fundamental data might also be necessary. Well, tons of things to test :o) Thanks again for your input,

Best Regards,

Daniel

Best method for trading commodities is with the effects of support and resistance.

Forex (especially large liquid pairs most notably the EUR/USD) is driven by macro-economic fundamentals rather than by speculators speculating, therefore when trading Forex using the trend is best.

But not so with gold. Gold is driven by speculation, speculators want to buy low and sell high so support and resistance has a huge effect on the short-term price of gold.

Support and resistance and the trend are almost mutually exclusive, the stronger the effects of one, the weaker the effects of the other.

For a mechanical system for trading gold I would use the trend only as a filter to stop the shorting of bull markets or going long into bear markets and then trying to use support and resistance to identify good buying and selling opportunities.

From what I’ve read here and there, I’ve the impression that gold should be traded taking into account correlations with 1) USD and 2) $XAU. Probably the neural framework is the way to go.

BTW only EOD data from 1996?. I would think data for gold are available almost as for the DOW. Almost nothing more followed.

Hi McDuck,

Thank you for your comment :o) Remember that we are not talking about gold futures here (which go back almost to the dow) but spot gold which is a far newer instrument. Anyway, the data source I have goes back only to 1994 but certainly if you have a spot gold source that goes back longer I’ll be glad to use it. Thanks again for commenting,

Best regards,

Daniel

interesting article, Daniel.

this oanda site has a bit more – going back to jan 01 ’90:

http://www.oanda.com/currency/historical-rates/

maybe one could contact oanda and get rates sent from them directly in a zipped format or the like (?)

kind regards

jacob

or this one (also from oanda):

http://www.oanda.com/currency/historical-rates/