When people start to look into algorithmic trading the journey usually starts with the desire to build a single trading system that provides huge returns, what retail traders generally call “the holy grail”. This whole effort is usually frustrated by either an inability to be able to achieve that in the first place or problems with the “chosen system” after it faces the real live trading world. On this post we are going to see why the holy grail is most probably not going to come, why if it comes it will not last and why in order to really have long term success in trading you need to diversify your trading towards as many trading strategies as you can get your hands on. We are going to take a look into the great power that diversification offers and why this power only becomes more prevalent as more trading algorithms are added.

–

–

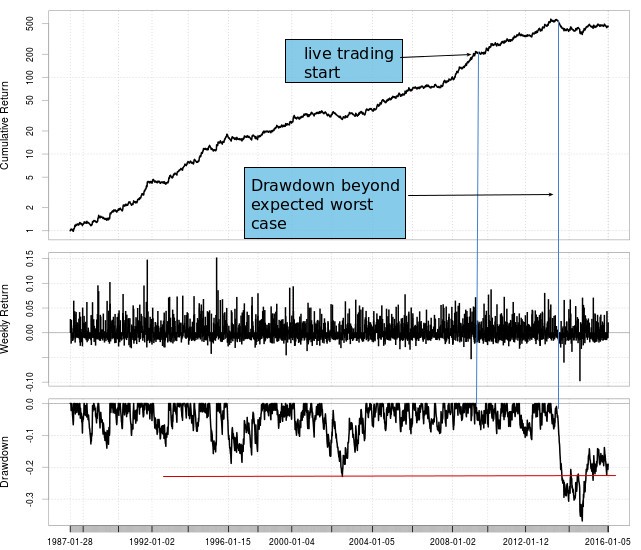

What is the problem with the “holy grail” hypothesis? Isn’t there a single system that is somehow able to reap huge benefits from the market? You can conceivably find systems that provide extremely good risk adjusted return statistics that pass all the bias tests you can throw at them. I found a few of these systems back in 2008-2009 and it was extremely satisfying to use them while their long term statistics held (which was until around 2013). However the fact of the matter is that all trading systems eventually fail and no matter how beautiful the back-testing statistics are or how well the system has performed in the past – even in real live trading terms in the past – there are new market conditions somewhere along the future where your strategy simply fails by performing outside of what is expected from its historical distribution of returns.

If your beautiful holy grail fails and that’s all you have, then you’re finished. This was the feeling I had in 2013 when these systems failed to continue performing, you suddenly find yourself in a position where you have no guidance about what to expect from your strategies and your statistical analysis is clearly telling you that if you continue trading you’re in unknown territory. This is the moment when I realized both that I needed to have techniques for the automatic generation of viable trading inefficiencies and a very large number of uncorrelated trading strategies to use. If you have an arsenal that is made up of hundreds or – even better – thousands of systems then the probability that a significant portion will fail at the same time is incredibly lower.

–

–

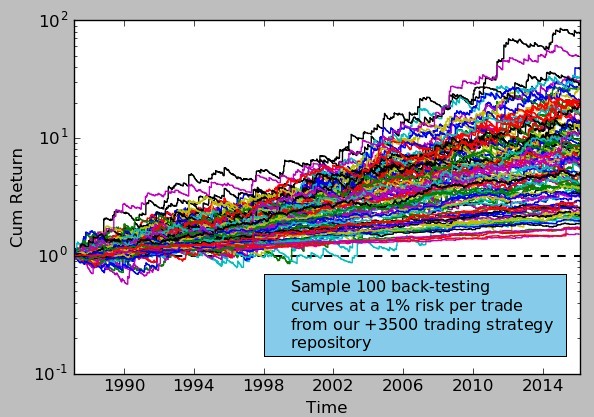

All that said, there are other reasons why you want to have large numbers of uncorrelated trading strategies — besides simply safety. You want to always be able to be in the market in order to take advantage of most potential big moves in some manner but you also want to be in the market for a good reason (you want to have a positive statistical expectation for every open position). The only way in which you can achieve that is if you have a very large number of historically profitable systems that are uncorrelated. All the systems have an independent edge and a positive expectancy, they all expect to make money when they enter trades but they enter at potentially different times, close at different times and expect different types of price behaviors. If you have only 1 strategy then you have only 1 good reason to be in the market at any given time, if you have 500 then you have 500 reasons to be within the market at different times.

Trading our massive system repository we have indeed found out that what generally happens is that we always have positions opened in different directions and as soon as there is a directional move in the market we start to accumulate positioning towards that side and we close positions that were wrong. Our systems are designed so that they give up quite easily when they lose (cut your losses short) but winning positions can stay open for as long as the trend can match their function based trailing stop mechanisms (let your winners run). In the end what you have is a mechanism where there is always some opportunity to capture directionality, where you have tons of good reasons to expect movements towards either side but you always end up committing to the side that shows the most potential.

–

–

Having as many uncorrelated systems as you can to trade the markets is therefore a necessity, it has a high chance to improve trading results and protect from fatal failure. Designing and caring for a single “holy grail” is bad practice because in the end that grail will fail and all the hopes and money you put into it will be gone as well. If you don’t put your eggs in one good basket but instead in hundreds of good baskets you will both be able to capture many more opportunities when they present themselves and have much less concern for the fate of any of the individual trading results. Psychologically a “holy grail” is dangerous because you will be inclined to continue trading something that has failed because you put so much effort into it while if you have 400 hundred trading strategies it really won’t matter if a dozen fail because you’re not emotionally tied to any of them. This point is very important, I have seen people lose much more money than what was necessary simply because they were too emotionally connected to a trading setup.

In the end it may seem that – as the trading proverb goes – diversification may indeed be the only holy grail. If you would like to learn more about the building and live trading of large portfolio setups or if you would like to create your own large trading system repository please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.

It’s funny we wrote exactly about the same theme on the same day on our blog. We cover the concept from a slightly different angel, but the main points are the same. You put a bit more colour on the psychological aspects of trying to invest and trade the one holy grail trading strategy.

https://predictivealpha.wordpress.com/2016/02/16/trading-strategies-no-need-for-the-holy-grail-2/

The biggest quant funds in the world are not running their portfolio on a few large sharpe ratio strategies. If they have some few large share ratio signals their capacity is so low that it scales poorly. As a result they opt for weaker signals that are as uncorrelated as possible. Another advantage of weak signals is that they are discarded by other firms and they are closer to the border of random/luck. This makes them harder to detect by competitors so they have a higher probability of working for longer.

Another point worth mentioning is that going up in frequency automatically tilts your signals towards being more uncorrelated. Let say you trade the 20 largest equity futures markets in the world. On a monthly frequency these markets are highly correlated and almost no matter what features your use in your models they will tend to provide you with the same direction most of the time, which is an unintended consequence. But as you dive into intraday prices even European equity markets begin to get quite uncorrelated.