A few days ago I wrote a post about the new data I have been able to obtain from Alpari UK (1 minute full 10 year Bid data) and how the quality of this data is far superior to the indicative data currently available for download through Metaquotes and the history center. The changing of the data set has been an important move in Asirikuy because most of what we know about our systems – beyond their live testing – was taught to us by the simulations. Changing simulations means that our systems will change their profit and draw down characteristics potentially making some of those unacceptable and others worse or better than what they were. But what has been the effect of changing data sets ? What has been the main difference between Metaquotes and Alpari UK reliable data and how has it affected the systems within Asirikuy ?

First of all we need to understand what has changed in the data and how this can potentially affect any system. The first important change between our previous data set and this new reliable data is the absolute absence of errors and the completeness of the data set. This is especially true for data sets like the NZD/USD and USD/JPY which showed important holes in their history as well as for recent history of the EUR/USD and GBP/USD. One of the most relevant things here for Asirikuy is that the value of the daily indicators can change significantly for a given period of time due to the addition of some missing dates. Therefore systems that use daily ATR values (especially those with low periods) and systems that trade a lot changed significantly as the data set changed from the previous Metaquotes indicative data to the full and complete Alpari 1 minute Bid data set.

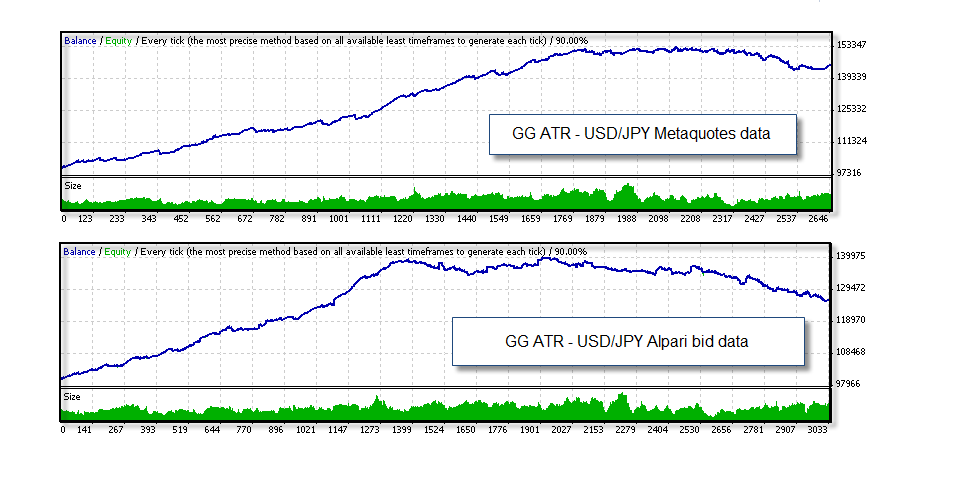

How deep were these changes ? Actually the changes were only catastrophic for one single backtest – the God’s Gift ATR USD/JPY instance – since the addition of a whole missing year in the previous data (2004) revealed that the system went into draw down pretty early and has showed absolutely no signs of recovery ever since. This – contrary to the Metaquotes data backtests – shows us that the system is already too risky to be traded on this currency pair, given the large amount of draw down it has gained and the inability to reach a new equity high for almost 6 years of simulation. This of course means that the two current Asirikuy live tests of this instance are pointless since they are trading a system which doesn’t have appropriate long term characteristics to begin with (there seems to be a lack of a proper long term statistical edge).

How deep were these changes ? Actually the changes were only catastrophic for one single backtest – the God’s Gift ATR USD/JPY instance – since the addition of a whole missing year in the previous data (2004) revealed that the system went into draw down pretty early and has showed absolutely no signs of recovery ever since. This – contrary to the Metaquotes data backtests – shows us that the system is already too risky to be traded on this currency pair, given the large amount of draw down it has gained and the inability to reach a new equity high for almost 6 years of simulation. This of course means that the two current Asirikuy live tests of this instance are pointless since they are trading a system which doesn’t have appropriate long term characteristics to begin with (there seems to be a lack of a proper long term statistical edge).

Other systems also showed significant differences between the Metaquotes and Alpari data backtests. Teyacanani for example showed a decrease in profitability on its EUR/USD instance, particularly because the system turned out not to be as profitable under earlier market conditions (2002-2003) as on the Metaquotes data. Truth be told, the results for Teyacanani now seem much better from a quality point of view since different market cycles can in fact be seen through the system’s equity curve. The system continues to be very profitable – reaching very good profit and draw down targets – but tits overall profitability has been reduced due to the inclusion the much more reliable testing data. Such a reduction seems to have been caused by differences in the 4 period daily ATR on this period. The Metaquotes data is particularly different around this time (regarding high/low/open/close values) something which appears to have caused the reduction of profitability. Of course, a re-optimization of the system on this new data might seems like a good idea but it turns out that the current settings (coarsely optimized on the previous data) seem to already be quite a good match for the new data set.

Other systems actually showed some improvement between both data sets. Several of Atipaq’s backtests and the non-daily ATR adaptive Teyacanani instances showed improvements when compared to the previous data, potentially because of the better quality of the hourly time frame which allowed them to better exploit the inefficiencies they were designed to take advantage of. This shows that the results of changing data sets are not going to be only “bad” as systems that whose profitability was hindered by the previous lack of quality of the indicative data we were using are now able to better manifest their profit and draw down achievements.

There were also some systems that showed little or no changes around their profit and draw down targets, particularly GBP/USD based systems seem to be pretty consistent amongst both data sets with Watukushay No.1 and the God’s Gift ATR GBP/USD instances behaving in a very coherent manner between both sets. Watukushay No.2 on the EUR/USD also showed very consistent behavior with almost no changed from previous behavior. Watukushay FE, which also uses a longer period daily ATR (14) also didn’t change its profit and draw down targets very much when going from one data set to the other. It seems that overall the most affected systems have been those with low ATR daily periods or a very large number of trades, however systems like the AUD/USD instance of Teyacanani (also using a lower period ATR) was almost not affected by the change between data sets.

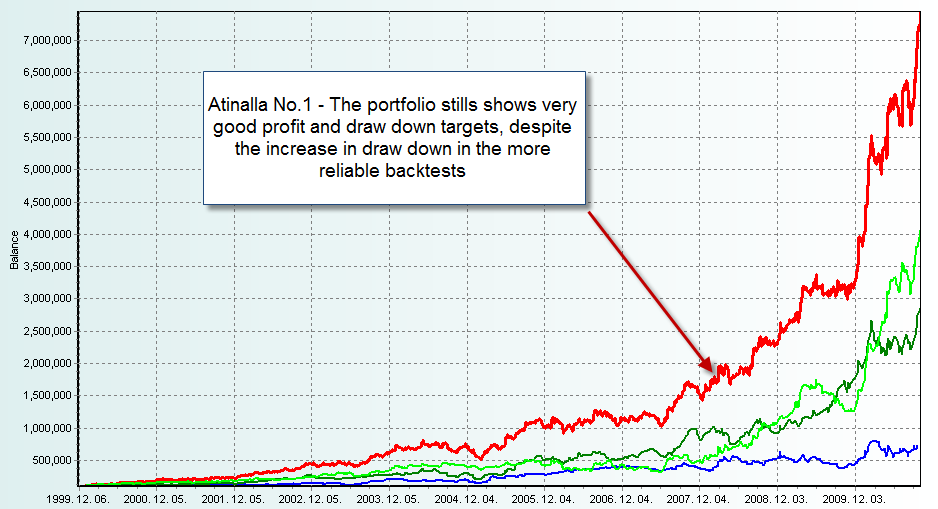

Of course, when it comes to our portfolios – since all of them use Teyacanani on the EUR/USD – there were some changes amongst their profit and draw down targets with a general decrease in the average compounded yearly profits to maximum draw down ratios. Particularly the most affected portfolio seems to have been Atinalla No.1 which went from a worst case scenario (double the maximum draw down) of 36% to 74% showing that there was an underestimation of real draw down of about 50%. Actually I had mentioned before – when I first talked about Atinalla No.1 – that the profit targets I had found were just “too good to be true” and certainly simulations with truly reliable data have shown us that this was in fact the case and that a larger draw down was necessary to achieve the profit levels brought by this portfolio. An interesting fact however is that the portfolio using the non-daily ATR Teyacanani settings still preserved its worst case scenario almost intact (48%).

Other portfolios however did not have such a bad increase in the worst case scenario since they do not rely that much on this Teyacanani instance. Surprisingly almost all other portfolios kept their profit and draw down targets almost intact with increases in the worst case scenario of about only 2-3%. Perhaps the portfolio that remained the less changed was Atinalla No.2 which kept its profit and draw down targets almost intact. The improvements in Atinalla No.3’s NFA-compliant version (mainly due to the improvements in Atipaq’s backtests) also made it decisively superior to the non-NFA compliant portfolio, meaning that only the NFA-compliant version will be traded from now on.

–

I am definitely happy with this new data set change and the increased reliability it brings to our simulations and our expectations within Asirikuy. I believe that the current Atinalla project now shows some very good, realistic and well-diversified portfolios that will – with a high like hood – achieve the financial goals we have set for ourselves in the future. The new backtests revealed some underestimations of draw down we were carrying out and it also showed us the true nature of some of the systems we were trading. It is important to note that the robustness of Asirikuy systems and the lack of curve-fitting shows here as – even though we completely changed data sets – all the systems remained profitable (even if to a lesser or even greater extent). As you see I am not afraid to make any changes which might be necessary to achieve more reliable simulations and better expectancy results, as always my main goal is capital preservation and for this reason reliability in simulations will always have the highest priority within Asirikuy.

undistractedly I am currently in the process of remaking all the Atinalla videos within Asirikuy to match all this new backtesting information :o)

If you would like to learn more about this new data set and how you too can build and design systems that are robust and reliable with sound profit and draw down targets please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general. I hope you enjoyed this article! :o)

Hello Daniel, do you suggest to change the setting to daily ATR = false of Teyacanani in Atinalla 1 portfolios in order to keep the DD acceptable? I just tried to backtest Teyacanani eurusd with the daily ATR setted to false and true but I had right the same results, no even a minimal difference. So maybe a problem in the code? Thank you.

Regards.

Maurizio

Hello Maurizio,

Thank you for your comment :o) If you see the backtests within Asirikuy the code is executed correctly (check the non-daily EUR/USD backtests). Please redownload the EA from Asirikuy to ensure you don’t have any corruption or problems within the code and run the backtests again. Please remember that you need to change the daily ATR, multiplier, Stoploss, TakeProfit, ATR period, etc to the same as the non daily EUR/USD Teyacanani backtests or otherwise you won’t be able to reproduce the results. Thank you very much again for your comment,

Best Regards,

Daniel

PS : You should also run the EA with half the risk on the non-daily ATR implementation as it carries a much higher inherent risk due to the higher number of trades

Thank you Daniel. My question was also about the Atinalla 1 challenge accouunts. It is wise to go on with this portfolio and these settings after we saw that with the new Alpari data the drawdown increased up to 74%? Not better switching the Teyacanani to the non daily ATR settings for all the Atinalla 1 challenge accounts?

Thank you.

Best regards.

Maurizio

Hello Maurizio,

Thank you for your reply :o) Well, it is worth mentioning that the draw down does NOT increase to 74%, this is the worst case scenario which is TWICE the historical maximum draw down. You should take into account that this is necessary to maintain the high profit targets of this portfolio and that using the Teyacanani non-daily ATR implementation reduces draw down but also the profit targets by some amount. In the end it is up to each challenger to gauge the risk levels and choose whatever settings or EA setups match their risk aversion. The good thing about Asirikuy is the liberty it gives to members to choose and trade whatever they consider best and most in line with their financial goals. Of course, in the case of challenge accounts any changes should be reported so that we can accurately follow the portfolio setups. Thanks again for your comment,

Best Regards,

Daniel