Through the past two years at Asirikuy we have developed a substantial amount of knowledge in the generation, evaluation and live trading of automatically generated trading strategies. The first of our software development efforts in this field, Kantu, has now become deprecated within our community (see why below) and I have therefore decided to release this code into the open community in order to avoid wasting all this work and instead encourage others to also explore the possibilities of algorithmic system generation using an already built open framework.

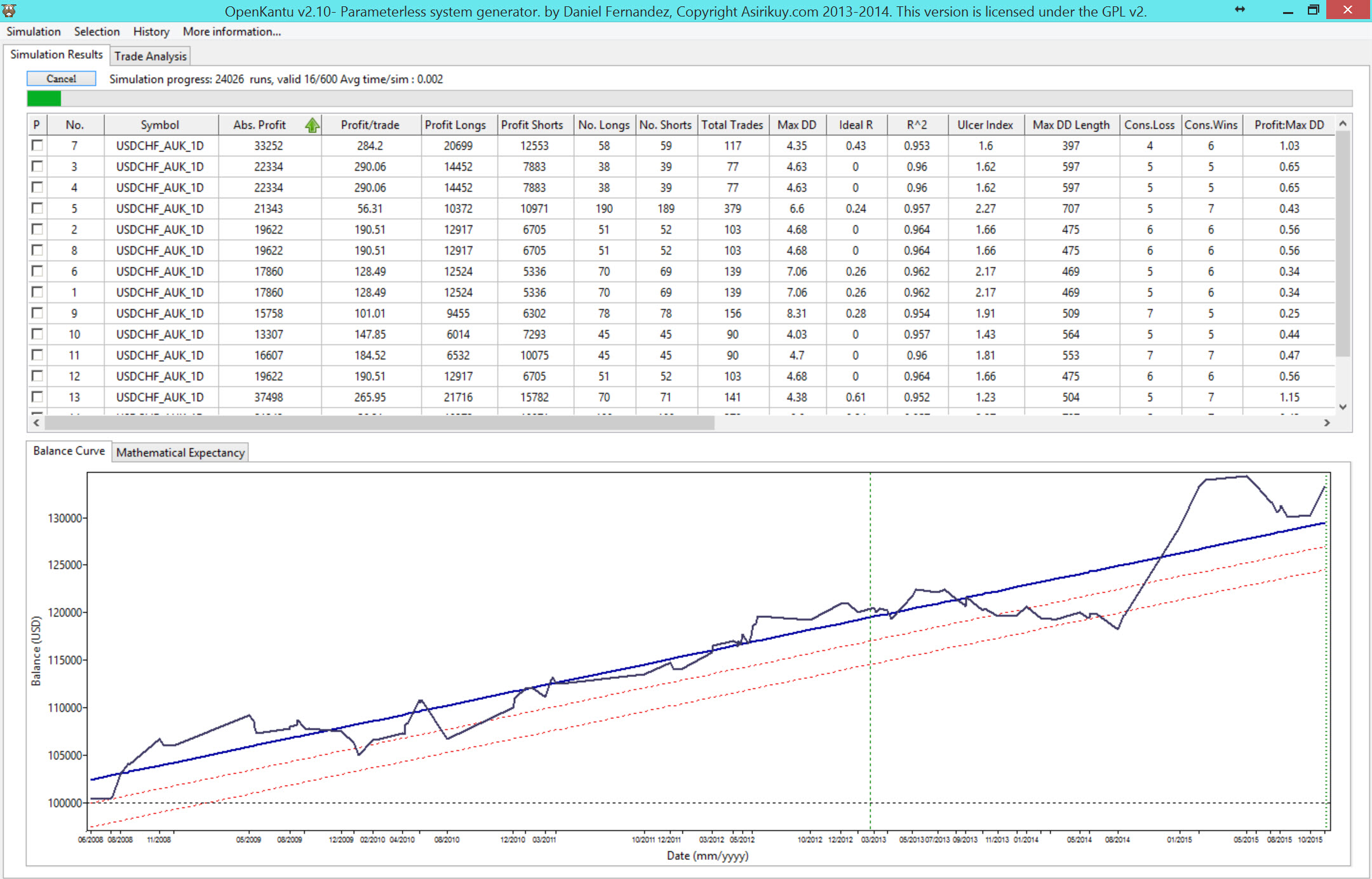

Kantu is a trading system generator that creates trading strategies based on price-action derived rules (comparison of different open/high/low/close values) using OHLC data. Using it you can search for strategies within a selected logic space, finding those that match the statistical characteristics imposed by the user (for example you can search for systems which have a given Sharpe, reward to risk ratio, winning percentage, etc). You can see how the program looks on the image below:

–

–

These are the main characteristics of the software:

- This and all future versions of OpenKantu will be available for free with fully open source code :o)

- Coded in FreePascal/Lazarus , full source code available under the GPL v2 license.

- Manual included.

- Simply export data from your MT4 history center to use it with OpenKantu

- Multi-platform support. Precompiled binaries available for Windows but the software can be compiled from source on Windows, Linux and MacOSX.

- Fast simulations, a 25 year test using daily data takes only 3 milliseconds while a 25 year 1H test can take around 60-80 milliseconds. This allows you to perform millions of tests within a realistic amount of time.

- Multi-core support, you can perform tests using as many computer cores as your computer allows

- Configure the system creation process to search systems with or without SL/TP within a set rule complexity (maximum shift, maximum rule number, etc)

- Configure an out-of-sample window if this is desired

- You can search for strategies on any financial instrument.

- Filter systems using the pre-built statistics or a custom built filtering rule

- Get trade-by-trade system results

- Simulate portfolios made up of different generated systems

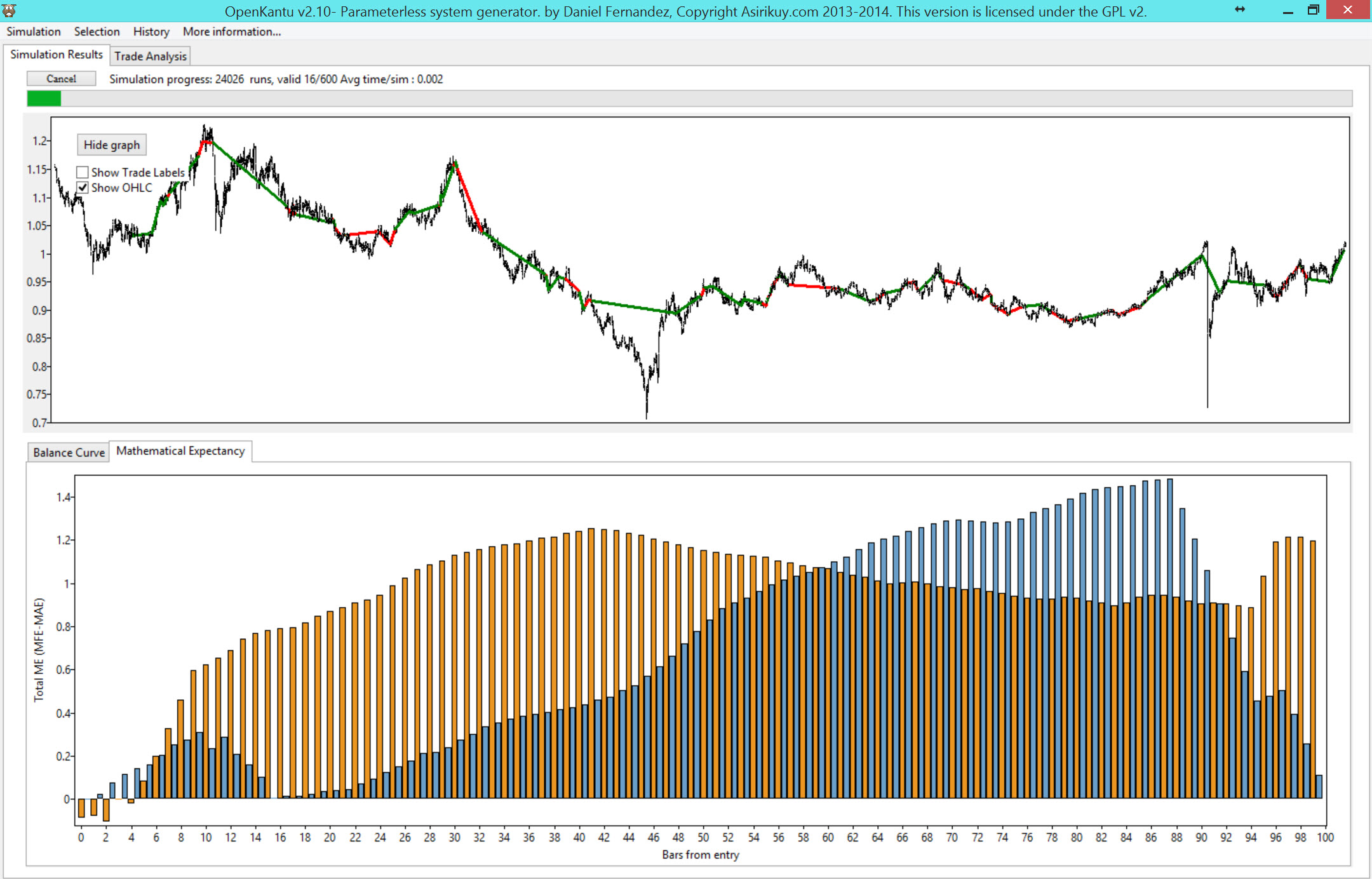

- Get a mathematical expectancy analysis (MAE-MFE) for long/short trades for all generated systems

- Get balance graphs with trade results showing on an OHLC graph of the data (see where the system has traded)

- Export generated strategies to MT4

Kashipur I would also like to point out that OpenKantu is NOT a holy grail generator and that use of the program without a good understanding of potential sources of bias (curve-fitting bias, data-mining bias) is bound to lead to losing strategies in forward/live trading. Remember that past performance is never a guarantee of future results. Although OpenKantu is coded in good faith end users are responsible for all uses of the software. The software is provided as-is, with no guarantees, implicit or implied. OpenKantu is also provided without any support, please refer to the manual for instructions on how to use the software. You can download windows binaries and the program’s source files by using the following links:

http://ramblingfisherman.com/home/ Current program version is v2.40.

notes on building from source: If building from source make sure you install Lazarus, then install the synapse and ZMSQL packages included within the github repository before attempting to build the software. If you would like to make code contributions please contact me (leave a comment on this page) and we’ll coordinate so that you can contribute on github. All contributions that improve the software for the open community are welcome.

Remember that to reproduce the same testing results obtained in OpenKantu on MT4 simulations you need to use the exact same data within the generation process and the MT4 backtesting. Along the same lines your live/demo broker’s GMT, DST and weekly opening/closing times need to exactly match those of the data used within the generation process. Using different data leads to unpredictable changes in simulation results between the programs.

You may wonder why we decided to discard use of Kantu within our community (given all the above positive characteristics) we decided to move to pKantu as it has many advantages over our initial Kantu (now OpenKantu) implementation. With pKantu we have the following features:

- Coded in OpenCL/Python with speed as the top priority

- Explicit evaluation of the entire logic space (openKantu uses random sampling instead which can lead to important issues when attempting to evaluate some sources of statistical bias)

- Extremely fast simulations using GPUs, around 100-1000x faster than OpenKantu

- Evaluation of data mining bias using automatic random data generation

- Community cloud mining implementation that allows us to sum up all our system creation and bias evaluation efforts

- Many alternative stop loss evolution mechanisms (which means we have access to more advanced exit techniques)

If you’re interested in learning more about sources of statistical bias in automatic system generation and using pKantu, our latest automated system generation software please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general.

Dear Daniel,

I have read the manual about the parameters about simulation types (e.g. fixed quota, random dates,IS/OS study and walk forward simulation) but I still cannot understand what are they and how do I use them. Can you explain it in details? Why do we need to run them instead of using ‘single cycle’? Also, can you provide me a process/procedure how to generate a system and test it to make sure it is robust enough to run in demo/live environment?

Regards,

RC

Hi Rapheal,

Thank you for your post :o)

Each different procedure provides you with a different type of result. The single cycle simulation only generates X systems but the number of systems that are valid from all those generated is somewhat random. For example a single cycle run might generate 100, 2 or even zero valid systems, depending on how complex your filters are. If you want to be sure that you will – in the end – have a given number of valid systems (systems that comply with your filters), then you should run a “fixed quota” simulation which runs new patterns until you get the number of requested results. The walk forward analysis allows you to simulate a generation/sorting/walk forward trading methodology while the random methods allow you to see if any statistical conclusions depend on the chosen period for in/out of sample testing or if the conclusions are generic through the whole testing period. You should experiment with each one and post any questions or doubts you may get in the process.

It would be irresponsible to give you any such procedure because no procedure can guarantee success in demo/live trading. Any procedure I give you would have a probability of failure, it is up to you to experiment, study and come out with a procedure that satisfies your needs. As it says on the manual and above, Kantu is no holy grail, you still need to study hard, experiment and come up with your own conclusions through your own analysis. Kantu is a tool, nothing more, nothing less. If you want to learn more about algorithmic trading and get a full education on the matter then I would advice you to join Asirikuy.com where you will receive in-depth knowledge about the problems of system design, robustness, etc. If you have purchased Kantu, then this purchase counts towards an Asirikuy membership (email me directly and I’ll send you a link with the remainder of the payment and the subscription link if you’re interested).

If you have any specific questions about the functionality, please feel free to post them here or email me directly and I’ll be glad to answer :o) Thank you very much again for your post,

Best Regards,

Daniel

Program keeps telling me Unable to open file “EURUSD_DAILY_DATA_SAMPLE.CSV” which is included in archive with demo version. Maybe something in Regional settings of Windows needs changing? Tried to play with them but no results. Help pls!

Hi Alexander,

Thank you for your post :o) Kantu sets its own date and decimal separators so this shouldn’t be a problem. If you want to experiment the decimal separator used by the program is a “.” and the date separator should be a slash “/”. Let me know if you continue to experiment problems,

Best Regards,

Daniel

I’m from Russia and on Russian Windows it keeps telling me “Unable to open”. I tested it on english copy of Windows and everything works, i tried to set Regional settings the same as on english copy, but not working.

Good day Mr. Fernandez

I am very interested in your program Kantu generator.

Unfortunately my English is not so good I’m still learning.

I want to ask about whether I understood correctly that the

KantuGenerator strategies are generated based on candlestick patterns?

Can the order management to be adapted with trail stop or break even?

Are supported in the software 4-core processors?

I hope I do not ask stupid questions

Greetings from Switzerland

Hi Chris,

Thank you very much for your post :o) Let me now answer your questions:

1. Kantu creates systems based on price action. This means that systems are created based on comparisons between the OHLC values of different candles. Sometimes the results may be interpreted as candle-stick patterns but other times they may look more like what some people would recognize as “harmonic” patterns. Kantu just looks for relationships between the OHLCV values of different candles.

2. No. Kantu has the option to implement an ATR adjusted SL/TP mechanism but it does not have trail or break-even order management options. The reason is that these two features are not compatible with the fast “ohlc only” simulations carried out by Kantu (results wouldn’t be accurate if break-even or trail stops were used).

3. Yes, a version will be released in a few days with multi-core support (I have already implemented the feature).

I hope this answers your question,

Best regards,

Daniel

Extracting kantu Unsupported Method

the unix version extract fails on the main file – kantu

Ok different extractor worked.

What did you write this in? Python?

It’s written in FreePascal

if you buy this do you get the mq4 version?

If you buy this you get the option to export resulting systems to mql4 code

Hi Daniel,

I’ve been playing around with the demo for the last few days and am interested in buying the full version. If I purchase the full version now will I have access to upgrades in the future?

Any chance of multicore support in the future?

Also, have you considered customizing the historical data input to allow import from other trading systems or alternate date formats? I’ve successfully imported data from NinjaTrader with a few tweaks to excel but it would be nice to be able to skip that step.

Very impressed thus far. Great work and thanks.

Thanks,

Charles

Hi Charles,

Thank you for your post :o) I will now answer your questions:

1. You will only have to pay for major updates. Major updates include large re-workings of the software to build new functionality. However your purchased version will continue to work indefinitely (major update purchase is optional). Right now – since the software is quite new – you will get many significant updates for free before the first major update comes up.

2. Yes, I already implemented multi-core support. It is currently being tested and an update to Kantu users will probably be released next week (as I need to update the manual as well). Note that this is considered a minor update so if you buy Kantu now you will get this update free of charge.

3. I hadn’t considered it but certainly it can easily be done.

Thanks again for posting and for your kind words about my work :o)

Best Regards,

Daniel

Hi Daniel,

thank you for your great software, I’m very keen on genetic optimization. But I have some problem with WFS – Normal. I have just tested it on my notebook with Intel Core i7 2620M, and on my desktop with AMD A10 5800K. On the notebook program simply stops responding, and Win7 offer “Close program”. I tried to wait, but without effect. On my desktop (also Win7) WFA ends with Kantu error: Invalid floating point operation. Could you help please? If you wish, I’m able to send screenshots, or any further details for debugging.

Best Regards,

Petr

Hi Peter,

Thank you for your post :o) This is probably a known reported bug that has already been fixed on the latest release. A new demo version will be released later today,

Best Regards,

Daniel

Hi Daniel,

new version has the same problem. Kantu error: Invalid floating point operation has apeared after six steps of Walk Forward Simulation (Normal). Currently on my computer at work – CPU Intel Core i7 3770.

And second – small detail – path to the CSV can have only about 57 characters from GUI. It’s possible to edit it manually in symbols.txt and paste there more, of course.

Best Regards,

Petr

Hi Peter,

Thank you for your post :o) Please load all the setting you’re using for the simulation, then close the program without running any simulation and send me a copy of the config.ini that is saved in your installation folder (send me a zipped copy to dfernandezp at unal.edu.co). You’re probably using some specific settings that are causing a crash because not enough trades are generated in the OS and some selected instances come out without trades (this can cause a crash). Try to raise your OS sample size or change your minimum trade filter to only get strategies with a higher number of trades. Thanks again for the help in debugging :o)

Best Regards,

Daniel

PS: Thanks for the heads up on the csv path length bug on the DB editor. I will fix it on the next release.

HI Daniel,

I have the same issue as I cannot input the whole path as it is limited character. I propose to browse the directory and it can scan and save any usable database. It saves a lot of time and easier for us.

Rapheal

Hi Rapheal,

Thank you for your comment :o) I will fix this error on the next release (the limited character issue). However you can also edit the symbol.txt DB file manually and add all your instruments in this way. About the automatic addition, you cannot add data automatically because the spread, slippage and commission need to be defined manually (as per my answer to your other comment) as these values are not contained in the OHLC data. I hope this helps,

Best regards,

Daniel

Hi again,

What should we enter other parameter in DB manager?

It would be easier if it can scan the csv file and input those data automatically.

Hi Rapheal,

Thank you for your post :o) Data such as contract size, commission and desired slippage cannot be gathered automatically from the OHLC data, therefore they need to be entered manually. It only takes a few seconds to add each instrument’s data. Thanks again for posting,

Best regards,

Daniel

Dear Daniel,

I still cannot input the data path correctly. Also I cannot change the timeframe because it only limit to 2 digit (e.g. I cannot input the time frame as “1440”)

Also every time I open the program, I need to enter the code and cannot save it. I am very frustrated about the program. Frankly speaking, I am thinking about the ‘refund’….I am sorry to say that…

Regards,

Rapheal

Hi Rapheal,

Thank you for your post :o) If you are having trouble editing the DB fields using the Kantu included editor you can simply manually edit the symbols.txt file included within your symbols folder (open it up in notepad and change the values to whichever values you want). By editing this in notepad you can change the values to whichever values you want. About the license file, in order for it to be loaded automatically you need to save it within your Kantu installation folder as license.lic (make sure you check the box that says “Save data to file”). Also please make sure you install the program outside of your “program files” folder as this can cause problems due to the way in which windows caches program data.

Last but not least, please feel free to email me if you have any problem and I’ll be glad to help you out until you get them fixed. Also please remember there are no refunds, this is part of the purchasing terms (as it is stated in clear bold red letters above). If you are not happy with the newest version you can continue using the first version you purchased. However – as I said before – I will be happy to help you get around any problems if you email me directly. Thanks again for writing,

Best Regards,

Daniel

PS: These bugs dealing with the DB editor will be fixed on the next update

Interesting program.

Can I use ASCII datafiles (Metastock format)?

Hi Quattro54,

Thank you for your interest :o) Please feel free to try your data with the demo version, it will work if the format matches the description within the manual. Thanks again for commenting,

Best Regards,

Daniel

Is a discount available to join the Asirikuy.com site if I purchase Kantu System Generator software?

Thanks

James

Hi James,

Thank you for your post :o) If you purchase Kantu this purchase counts towards an Asirikuy membership if you later wish to get one (meaning that you would pay 121 USD less). Thanks again for posting,

Best Regards,

Daniel

Is there plans to add Candle Stick formations/patterns to the current version of Kantu System Generator?

Thanks

James

Hello,

I Am unable to generate a csv file from the provided Ea. Also It might be due to to fact that I am unable top open the ea in the tester to alter the parameters. Is there any other way to make a kuntu compatible csv file?

Kind regards,

IJ.J

Hi J.J,

Thank you for your comment :o) I am unsure of what you mean by “unable to open the EA in the tester”? This EA has no parameters, simply load the EA on the strategy tester and run a back-test on the time frame you want to export using the “Open price only” simulation method. The csv will be created under your tester/files folder in your MT4 installation directory. I hope this clears it up :o)

Best Regards,

Daniel

Hi, @admin can I please request a contack from your side on my mail bx in order to ask some technical details about the product ?

Kind Regards,

Will tick data be supported in the future ?

I wonder if for a 5 digits EURUSD CSV file exported via your EA the following symbol definition would be correct:

“EURUSD”;”C:\Program Files\Kantu\symbols\EURUSD_5.csv”;”5″;”0″;”0.00013″;”10″;”0″;”1″;”100000″;”2″

it looks OK at first sight. If the csv formatting is correct it should work. Please send me an email if you have any issues and I will help you out.

Dear Daniel

I think KANTU has several bugs, is the project still alive or not?

Cheers,

Nuno

Hi Nuno,

Thanks for posting :o) Yes, the project is still alive! I have worked on many additional features and bug fixes, which will be released this week. If you have any bugs feel free to email them to me (dfernandezp at unal.edu.co) so that I can fix them if they haven’t been fixed yet. Thanks again for posting,

Best Regards,

Daniel

Hi, if i want to use Single Cycle Simulation Kantu gives me error : “” is an integer …

Yes, this is a reported bug that was introduced on the last update. It should be fixed within a week :o)

Great! ill looking forward :)

[…] Kantu System Generator […]

[…] Kantu System Generator […]

Was recently introduced to your website by a friend.

I see no recent posts for Kantu and wonder of the project is still alive and being updated; and if the free system FE has been advanced?

Also, has your FE system been tracked on MyFxBook or any other forward test venue? If not, why not?

Thank you.

Hi Anthony,

Thanks for posting. Yes, the Kantu project is alive and continuously being developed. The Atinalla FE system had two, 3 year profitable myfxbook accounts but these were removed since I am moving away from MT4 so I closed all my accounts on MT4 brokers. I hope this answers your questions,

Best Regards,

Daniel

Hello Daniel

I think the program keeps some of the old bugs. I was generating systems for more than 1h when suddenly I get the message “0.5 is an invalid float” – and the process is aborted. Oddly enough, the only way to get through this in order to be able to re-run the program is to manually edit the dates in the config.ini file and replace the hyphens with the slashes: 01-01-1985 with 01/01/1985 for example.

Cheers

Nuno

Hello,

Is it possible to add a “Pause” button to the app? there’s only a “Cancel” button.

Sometimes I need to let my computer in sleep mode and resume the simulation later (without restarting the simulation from the beginning).

Regards,

Massimo

Is included the RecordBarsMQL4 EA in the payed version??

Sorry for my bad english

Yes it’s also included.

Hi Daniel,

As you’ve mentioned from one of your reply that you’re moving away from MT4, just want to clarify if you will continue to support queries related to MT4 since all brokers here in my place only support MT4/EA at this time? Hopefully i can join asirikuy in the future. Thanks.

Regards,

Jonjon

Hi Jonjon,

Thanks for writing :o) Yes, I will continue to support MT4 as I am aware that this is what many Asirikuy members will keep on using. However I will personally move away and recommend moving away from MT4/MT5,

Best Regards,

Daniel

Hi Daniel,

Is there any way of adding additional data sources to Kantu? I would like to add Gold Gauger data from http://www.metatick.net/goldgauger/. This uses some kind of DLL to get the data. Is there any way to tie this in and use it in conjunction with the normal data?

Kit

Hi Kit,

You can use any data source you want within Kantu, just download the data using any tools used by your data source provider and then make sure the data is properly formatted as required within the Kantu data csv files,

Best Regards,

Daniel

Hi Daniel,

I really like the look and feel of Kantu. But, I managed to get it to work only once and now the patterns per cycle parameter always reverts to zero when I try to run a simulation. I have loaded the data file and followed the directions in the manual to try and run a number of different simulations, but the patterns per cycle parameter always reverts to zero.

I even went to the extent of correctly creating a 15minute data file by exporting data from MT4 and correcting the fields for use with Kantu, but I got the same result.

I am using v1.19-Demo.

Please tell me how to fix this problem.

Hi Phillip,

Thanks for writing :o) If you want send me a screenshot of your kantu configuration window and filters to dfernandezp at unal.edu.co and I’ll help you out,

Best Regards,

Daniel

I wonder if there is an open community of users of OPENKANTU (there is no technicall support) that can help others, especially the settings issue … just give 600 options (always) and the number of bars (3) always stays in 3 (even if you change it in INI file). Thank You!

Thanks for posting Jorge. Try posting on FX trading forums about the software to see if you can find developers interested in generating a community around OpenKantu. I will also look into the bugs you mentioned when I have the time, see if I can issue an update.

That would be a great help for people like me who are not programmers!. So, for example, I don’t know how to do the “OK” button to appear in the menus (not shown) or let the program read the INI file when changed(if it’s changed, it goes back to the original version that is downloaded). Thanks anyway for responding!

hello. Please excuse my insistence, but I wanted to know if you have had time to verify the issues that I mentioned before. On the Internet there are no sites that are dedicated to this software (due, in principle, by the language) and as for those (as me) who are not programmers, it is difficult to fix them

thnks a lot!

Can I hire you to back test my EA that I have just had developed by an MT4 programmer. I need an Optimization of the EA to get the best numbers and then back test the ones that work for a period of a year or more. I can send you the EA if you can give me your email address. Thanks, Howard

Hi Daniel,

first of all thanks a lot for open-sourcing the Kantu System Generator.

I have been playing around with it in the last few days and am gradually discovering its potential. However two things about the inner mechanics are left unclear to me about which I couldnt find any information. I would be very gratefull if you could answer me the following:

1. How are trades entered if a signal has been generated? Is the trade opened with the next Open price bar after the last closed bar that has generated a signal or is it opened with the close of the same bar that generated the signal (which would give inaccurate results since it is much harder to open a trade on the Close then to open on the next Open)

2. How do SL & TP get triggered? Is it the Close that determines if a SL or TP was triggered or is it the High/Low which again would be difficult to replicate?

I know that you offer only limited if no support at all for the open version of Kantu but I feel that an answer to these question is vital for the use of the program. I could of course read through the pascal code but thought that just asking you would shorten the process by a factor of 100 ;-)

Regards

Juergen

Hi Juergen,

Thanks for writing :o) I am happy to see that you like the software! Let me answer your questions:

1. Trades are entered on bar Open. Signals are always formed by previously closed bars so when a new bar opens the program determines whether a new trades should be entered.

2. The SL/TP is triggered using the high/low values of bars. If a bar’s high/low (adding spread when needed) breaches the SL/TP of the trade then the trade is assumed to have hit the value within that bar. If the SL and TP values are hit on the same bar then the program always assumes the SL was hit first to prevent overestimation of profits. You need to use high/low values as using closes would imply that an SL/TP could be hit within a bar and you would miss it (so simulations would be very inaccurate).

Let me know if you have other questions and also feel free to spread the word about OpenKantu,

Best regards,

Daniel

Hi Daniel,

wow, thanks for the very fast and accurate answer. Now that I know about the inner entry/exit logic I can start using Kantu in a truly serious way.

Using the Hi/Lo to trigger the SL/TP as Kantu does, makes sense. In my own testing design I always try to differentiate the time of exit by either triggering the TP with the High and the SL with the subsequent Close (or the other way around). This way I keep the possibility to close in profit on intraday movements while keeping the difference between simulation and execution at a minimum.

I will spread the word and even become a member of Asirikuy at some point.

Thanks again,

Juergen

i have a problem. i tried to make an EA out of the strategie that i wanted to use. but now the EA can only use the data feed from the broker you trade on.

if you use data feed placed on forex websites( that is based on a collection of source to make up the data).

now it the broker because every broker the close, open , high, low are different so i get a different result not in a good way.

now i am trying to find a solution for it. the data from the website i can not use. how can i make the outcome match the outcome when you trade manually with the data from the websites.

Tom

Hi Tom,

Indeed, feed dependency is very problematic in Forex trading. This is why you need to develop a programming framework that allows you to implement data-refactoring, with features like GMT/DST corrections and week structure adjustments so that your problems due to data differences are reduced to the minimum. If you’re interested in learning how to minimize broker dependency I would invite you to join the Asirikuy.com community where we have worked extensively on solving these issues. Thanks for writing,

Best Regards,

Daniel

Hi Daniel,

after some weeks experimenting with your OpenKantu System while following your articles on DMB and other interesting topics I just tried to do a run in OpenKantu with custom inputs. As it says in the Manual I extended the data in the form:

Date,Time,Open,High,Low,Close,AdditionalInput#1,AdditionalInput#2

OpenKantu loaded the data successfully but doesnt seem to regard the extra columns for rule building. I expected the additional input to appear as a tick box like the O/H/L/C does. Is this feature not implemented in the OpenSource Version of Kantu or am I missing something?

Thanks in advance,

Juergen

Hi Juergen,

Thanks for writing and using the software. This feature was removed since there were some problems with it and when using it it wasn’t possible to do automatic code generation because the nature of the additional columns was not known by the program. In order to allow for correct automatic MQL4 code generation and remove other bugs this feature was removed. Let me know if you have other questions or comments,

Best Regards,

Daniel

Hi Daniel,

I just dashed in your blog and the asirikuy page. I’m a young developer and programmer from germany – I started trading about 2 months ago and learned some general things about forex robots and how to use them. I just used some on a few demo accounts but I’m looking forward to get in more professionall and also profitable with robot systems. For the beginning I started with MT4 and optimizing some bought systems – but the result wasnt that good and fast with the backtest & forward test from MT4.

My question now is, when I’ll start using asirikuy what can I expect from it? Can I learn how to get a better programmer for trading with it and write code – and can I learn from other members which are sharing their systems and profit from it?

I also read that I would get access to a program would which would be far better to optimize & backtest systems as metatrader – is that right? And I can then start the optimized systems still on my brooker in Metatrader?

I’m looking forward for your answer and I’m really happy that I found your page!

Best of luck

Ron

Hi Ron,

Thanks for writing, I’m glad to hear you’re enjoying reading the page and are considering to join our community. About Asirikuy, sure you can expect to learn how to write different types of trading programs and to benefit from other members who share their code. Of course whether you are able to profit from any of the knowledge you get cannot be said – I certainly cannot predict the future and past performance is not indicative of future results – but you’ll certainly become a better algorithmic trader and will learn lots of new things. We have been developing and trading within a community since 2009 so you’ll be able to learn from all the successes and mistakes we’ve made through all that time. I think that a good hint for joining is whether you enjoy and find the contents on this blog useful, if you do then our community is probably a good match for you.

Regarding our back-testing software, sure you’ll get access to our back-testing and programming framework. The systems you code within our framework can indeed be tested and optimized in MT4 as well as within our own back-testing program. There’s a lot of knowledge in Asirikuy so if you join take a few months to get familiarized with everything. Of course, you’ll get my personal support once you join so you’ll know I’ll be there to answer questions when you need me to. Thanks again for writing and feel free to post any other questions you might have,

Best Regards,

Daniel

Hi Daniel,

thank you for your long answer! I really appreciate :).

I’m looking forward to get in Asirikuy, soon & to start with you a new chapter of trading.

See you soon!

Best wishes

Ron

Hi Daniel!

Thank you for your wonderful blog and OpenKantu System Generator. Your approach to portfolio generation (i.e. creation of many independent strategies and trading all of them) looks like an advanced version of what I’m trying to do in my own humble trading. However, I see one major difference : Openkantu creates symmetrical systems (long entry rules are just the opposite of short entry rules), while I’m trying to generate systems for longs and short independently, because I think there may exist some patterns that work only in one direction. It seems that’s impossible to reproduce with OpenKantu without code modification. What do you think about this approach – does it make sense or it’s flawed and you intentionally avoid it?

Hi Andrey,

Thanks for writing. The problem with approaches that violate symmetry (long only or short only) is that you start to suffer from much larger data-mining bias. If a pair spent 70% of the past 10 years trending towards the downside almost any random short-only strategy would have made money, your short-only systems therefore do not exploit any real historical inefficiencies but were just lucky because they were short-only strategies within a period that was mostly favorable to short trading. You can create long-only and short-only systems that work above bias but you must make a lot of effort to evaluate data-mining bias and have a very high measured confidence that your systems do not come from randomness. Sticking with symmetric strategies is a much safer bet. Thanks again for writing,

Best Regards,

Daniel

Hi Daniel. Just one question… Do you remove some posts here in the “response” area?. I’m asking this because I left a commente two days ago asking for help for the modules that appears in the GITHUB page, but now it is remove. Could you please let me know then where can I find some site of developers using OPENKANTU? (i googled it, but there is no such site).

thnks a lot!

Hi Gabriel,

Thanks for writing. Sometimes the spam filter removes some comments automatically, I guess it removed your comment by mistake (sorry about that). There are no “modules” in OpenKantu that you could load independently, the functions that do things like pattern generation and back-testing depend on many other functions distributed through the entire set of program files. If you want to extract some code from it you’ll need to get into it and understand the code. Please also bear in mind that OpenKantu is licensed under GPL so any software created by a third party that includes its code must also be free and open source. Let me know if you have any other questions,

Best Regards,

Daniel

Thnks a lot for your answer Daniel. Well, as I told you in the first post (the deleted one :)) I just want to know how the program performs the pattern search (well, really, it would be very useful to me to my thesis). I do know that the program Works as an entire body, but I just want to know (or to “see”), how these pattern searches are done. THnks a lot!

Hi Gabriel,

Thanks for your reply. Well the code is entirely open source so you can take your time to get to know it and understand how it works, sadly I don’t have the time to give you a more guided description of the source but as I mentioned it’s there for you to explore if you wish. Thanks again for writing,

Best Regards,

Daniel

Hello Daniel and staff. I have just attended your webinar with Sapienza Finanziaria. Awesome!

I have a question before joining the community.

If I’d like to use my broker instead of Oanda, of course loading a very small number of experts compared to your portfolio, is it possibile to export the expert advisors into mql code in order to load them into metatrader 4?

thanks in advance

Hi Claudio,

Thanks for writing. Trading of the price action based repository is only possible through Oanda using our servers, it’s not possible to trade through other brokers. However we do have a machine learning system repository and other trading strategies which can be traded through any MT4 broker. Do let me know if you have other questions,

Best Regards,

Daniel

Thanks Daniel, I understand there are two different possibilities (interesting). I’ve just subscribed, I believe in your algorithmic trading and I hope everything will be clearly explained in order to operate in both ways.

Hi Claudio,

Thanks for writing. There is a lot of content on our website so take your time to digest everything (it can take a few weeks) and make sure you email me or post any questions on the forum. Also make sure you check the wiki first so that you can get a good general idea. In any case remember that I am there to assist you with whatever you need. Welcome to our community!

Best Regards,

Daniel

Hello,

thank you very much for a great OpenKantu.

How about custom inputs that you mentioned in 2013?

http://mechanicalforex.com/2013/05/developing-system-generation-with-endless-potential-implementing-custom-inputs-in-kantu.html

It is very very usefull function when you create systems for stocks.

Because stocks prices often depends on indexes or other inputs, most of my systems use such dependences succesfully.

Do you plan to add it or maybe you have some beta already?

Hi Artem,

Thanks for writing. This feature was implemented in the closed version of Kantu – which was available only to Asirikuy members – and was removed when OpenKantu was released. There are no plans to add this feature to OpenKantu in the future, however since the software is open source you can modify it as you wish. Let me know if you have any other questions,

Best Regards,

Daniel

Hi Artem and thank you for your software,I don’t know if is possible a new feature in your software,export a portfolio systems in a single EA,

would be very useful.

Thanks

Hi, (sorry for my english, but its not my language)

first of all great thanks for you job and your sharing.

About youy software I have many question:

1/ I readed the documentation but I didn’t understand very well (because my english) how you calculate the SL and TP.

I understand it’s a % of 20 period daily ATR, but for me it’s not enought mostly for intraday bars.

Could you give me an example please like:

for 15 min chart, if there is 2 for SL, the SL will be: 2*ATR(20)*coef(for intraday bars)

Because I did many test with R and I never found the same results from your software.

2/ An improvement you can do it, I think, it would be to have the possibilité in the result and with the EQ, to chose with all type(Buy and Sell) or only buy or only Sell.

Also in the BT because the market don’t work exactly in the same way when it go up or down.

Thanks in advance for your answer.

Hi Patrick,

Thanks for writing. Let me answer your questions:

1. Check the MQL4 generated files, the formulas for calculating volatility are there. Note that the intra-day strategies do NOT use the ATR, they use an ATR proxy that is calculated very differently than the ATR because intra-day volatility is cyclical (so you cannot simply use the lower timeframe ATR and multiply it by a coefficient).

2. This is implemented in pKantu, our GPU enabled mining software available within Asirikuy. It will not be implemented in the OpenKantu software (at least by me). However the source is available so you can modify openKantu to do this if you wish.

Please also bear in mind that OpenKantu is provided without any support. Thanks again for writing,

Best Regards,

Daniel

Hello,

I am interested pKantu But I would need a 32bit Windows version,

Also the code of “kantu_template” produces 9 errors

I have read the manual and I find it interesting, I would like to try a working version

good job

Best regards

Carl

Hi Carl,

The “kantu_template” code is not finished code but just a template that the program uses to generate an mql4 file when you export a system to be used in MT4 via the menu it is NOT supposed to be compiled or used on its own (you need to first generate programs in mining and then export them using open kantu). OpenKantu is fully functional in its current state.

About a 32-bit version, pKantu works under 32 or 64 bits, however it has no graphic interface – it’s only a command-line tool – and does not generate mql4 files directly but csv files meant to be used through the F4 framework’s MT4 frontend. Thanks for writing,

Best Regards,

Daniel