After a few months of developing, a lot of screen hours and a lot of code reviewing I am happy to announce that this week I will be releasing a new system – Watukushay No.6 – to the Asirikuy community. This new system is called Quimichi – more on the name later – providing a very important diversification element to our current Asirikuy trading system portfolio. On today’s post I will talk to you a little bit about Quimichi, what my objectives with its developments are, what it achieves and why this system will likely become a very important strategy within the Asirikuy trading community. Quimichi is very different from previous Asirikuy systems for several fundamental reasons which I will share with you within the next few paragraphs.

Before I started the development of Watukushay No.6 I deeply analyzed current Asirikuy systems and their potential flaws with the objective of developing a system that would counter at least some of them. Perhaps the greatest potential problem people have pointed Asirikuy systems to have is a possible lack of robustness due to the fact that most systems trade on the one hour charts and lack the use of various instruments and even when various instruments are used there is generally some difference in the parameters to adjust to the market conditions of the different currency pairs. The most conservative traders out there view this as potential curve fitting and lack of robustness because they view any system that doesn’t trade “a lot of instruments” as potentially over-adapted to the inefficiencies present in the past on a given currency pair.

Even though I believe this curve fitting hypothesis to be wrong due to the fact that such changes are needed to diversify systems into additional instruments in lower time frames -where different pairs have inherently different trading characteristics – it is true that proof of this will be missing until we complete the first 5 years of live testing within Asirikuy. With the longest tests currently being only over 18 months, we can say that results are already encouraging but not determinant.

–

For these reasons I decided to develop Quimichi, a system which tackles all the above problems quite decisively. This trading system is the first Asirikuy system – after Ayotl – to trade exclusively on the daily time frames, using a very simple logic set with the EXACT same parameters on 6 different currency pairs. Quimichi uses a very simple trend following logic – combining breakout entries and momentum exits – to capture long term trends in all of these different currency pairs. Quimichi solves any robustness related problems as the system shows to work on many different instruments without changes in parameters over a period of almost 11 years.

–

A very special thing about Quimichi is that on any single instrument the system does not achieve any special or spectacular results, as a matter of fact individual Quimichi pair results are often very mediocre and statistically poor as only a handful of entries (30-70) are made on any given currency pair and the average compounded yearly profit to maximum draw down ratio is – in most cases – lower than 1:1. The win to loss ratio is however very good on all instances – as you would expect from a long term trend following strategy – with an average risk to reward of about 1.6.

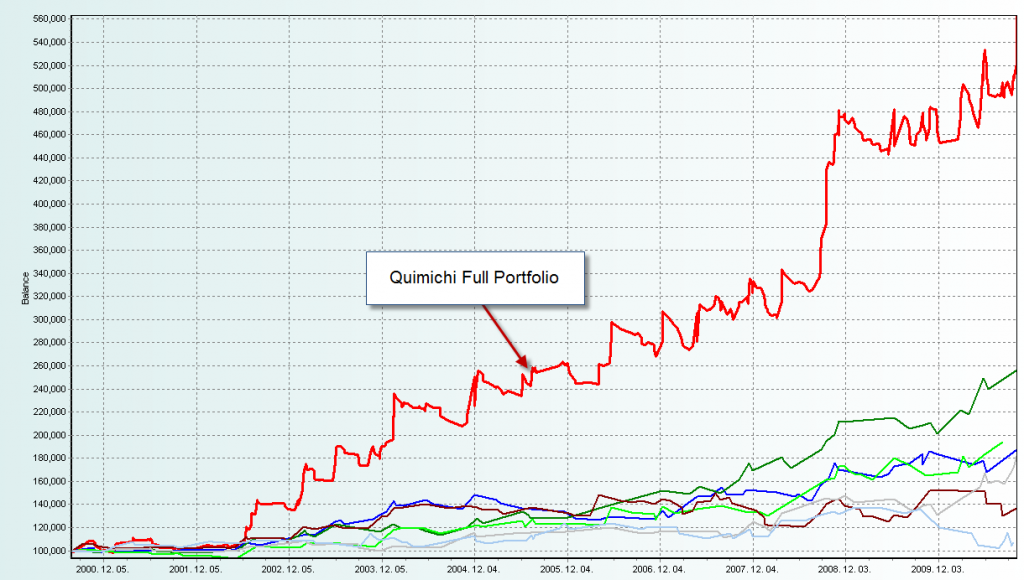

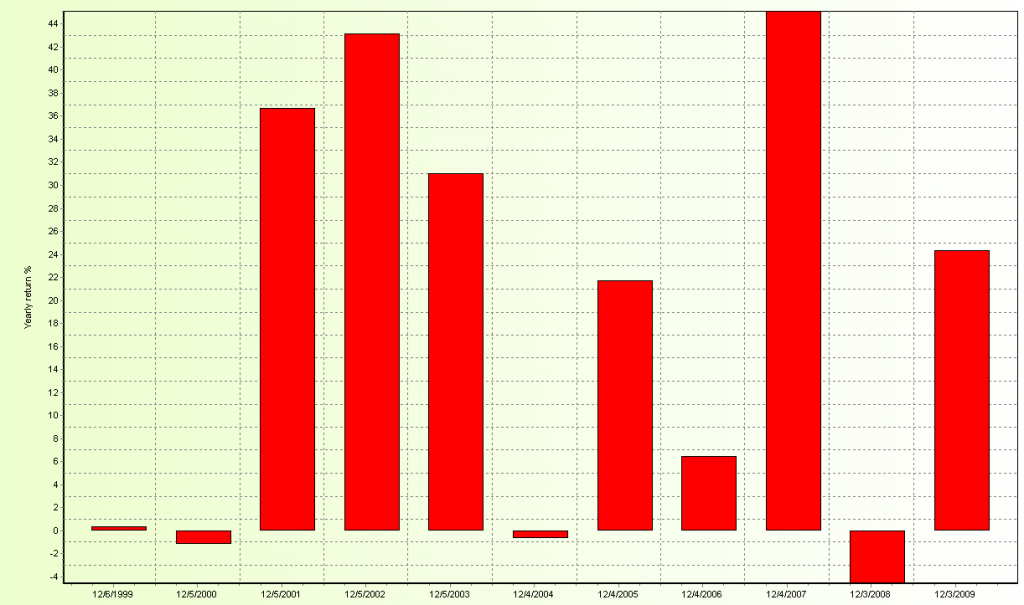

The great thing about Quimichi is that when you put all the instances together to form a portfolio the system behaves very well and the defects of the individual currency pair results seem to ease out as more instruments are included. This is how Quimichi is able to achieve – on its almost 11 year 6 instrument portfolio – an average compounded yearly profit to maximum draw down ratio of 1.55 with an average compounded yearly profit of 18% with an 11% maximum draw down (of course, higher profit and draw down targets are possible by increasing overall risk). The portfolio does take a statistically significant number of trades (398) and only faces a few slightly negative years that are more than compensated by the high profits achieved on profitable years.

Quimichi therefore introduces a very important diversification element to Asirikuy since it is a daily system -meant to be traded only as a full portfolio – that trades on six different currency pairs with the EXACT same settings, achieving profitable results during the past 11 years in backtesting (note that since the system makes its decisions on previous bars after bar closes back/live testing consistency, as with Ayotl, can be almost warranted). Another great feature that makes Quimichi different from Ayotl is that it doesn’t pyramid positions or use any special portfolio rules, reason why the number of instances can be increased significantly without overly increasing risk (Ayotl has higher capital requirements because of the draw down generated by its pyramiding technique).

–

For those of you who are curious about the name : Quimichi means “mouse” in Nahuatl (the language of the Aztecs in Mexico). I have decided to name all daily trading systems as animals in Nahuatl (as these systems follow the same ideas of the “turtle traders”) while other Watukushay systems will continue to be named in Quechua (like Atipaq and Teyacanani). If you would like to learn more about Quimichi (which will be released this Sunday) and how you too can develop your own long term trend following systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)

Daniel,

Thanks for sharing knowledge with retail traders!

I’m waiting for the video which will allow me to understand the system and the portfolio in more details.

Maxim

Hello Maxim,

Thank you for your comment :o) Certainly the video will help you understand the system in a lot more detail !

Best Regards,

Daniel

Hi Daniel,

Can you elaborate please on the explanation why you think mediocare individual Quimichi pair results are turns a 1:6 average risk to reward ratio on all instances?

Could it be that some pairs contribute much more and some create loses, and if you select only some of the pairs, the results will be better?

Or do you find it logical that all together compensate on individual loses? How exactly does this happen with Quimichi?

Thanks!

Hi Arnon,

Thank you very much for your comment :o) I will now try to answer your questions.

1) This happens merely because of the nature of the systems. Since the systems follow long trending periods they have naturally favorable risk to reward ratios (NOT 1 to 6 but 1 to 1.6). However their lower winning percentage makes individual results mediocre

2) No, all pairs have similar profitability and removing even the “least profitable” harms the portfolio to a significant extent.

3) It seems that the strength of Quimichi lies in the combination of the different currency pairs. The fact is that for portfolios individual system profitability is not as important as overall profit/draw down period hedging, something that Quimichi instances seem to do fairly well for each other. This is how individual seemingly “irrelevant” results turn into a very profitable portfolio when run together.

I hope this answers your question :o) Thank you very much again for your comment,

Best Regards,

Daniel