Classifying systems is – as I pointed out in yesterday’s post – a quite difficult thing to do since there are different preferences amongst traders which cannot be categorized objectively as a consequence of the “system quality uncertainty principle” discussed on my last blog post. However the idea of classifying systems according to our own particular views is quite interesting, reflecting our particular compromise between robustness and expect profits and draw downs and giving us a portfolio composition which is ideal for our own personal goals and perceptions. The idea of building complex and personalized classifications is explored with the idea of custom ratios, as I will be highlighting through the rest of this post. By using custom ratios between the different characteristics of a system we can get a much better idea of which systems better fit our risk aversion and trading styles.

In order to understand the power and usefulness of the custom ratio idea (which was suggested by an Asirikuy member in the development of our ADA tool) we first need to understand some very typical ratios which have appeared in system classification through the years. For example the average reward to risk ratio which is simply the average profitable trade over the average losing trade, lets a trader classify systems in virtue of how their average profit looks when compared with their average loss, a trade who classifies systems like this is choosing systems that have the highest expected profit for each winning position. Other ratios that have become popular, including the average annualized profit to maximum draw down ratio, allow us to classify systems according to different sets of characteristics which have different relevance depending on the trader’s personality.

–

–

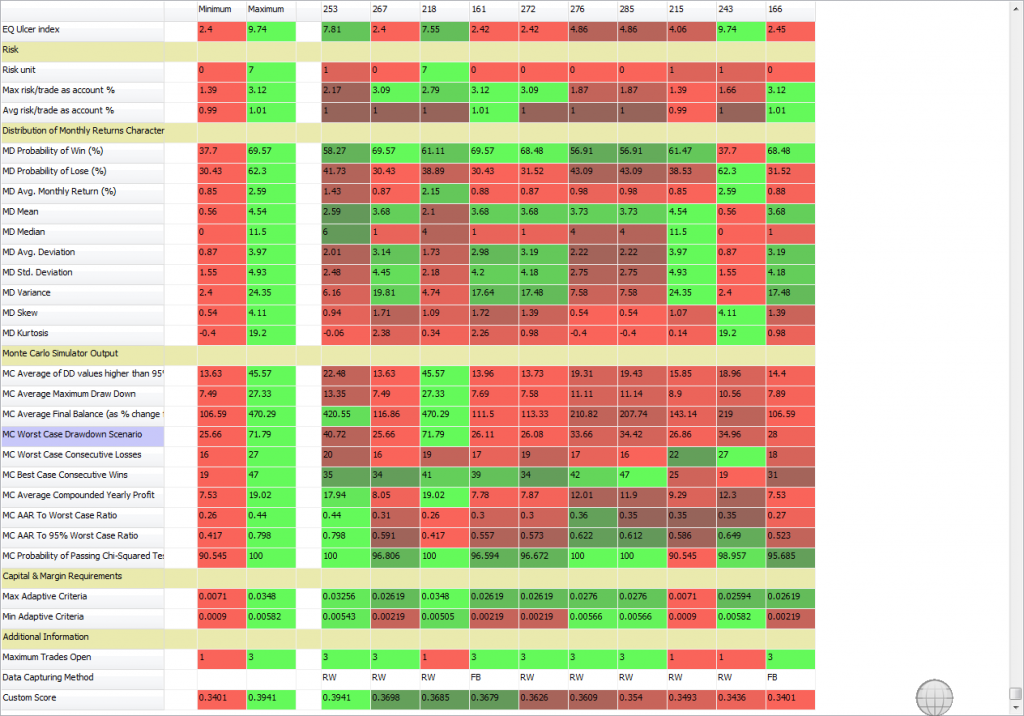

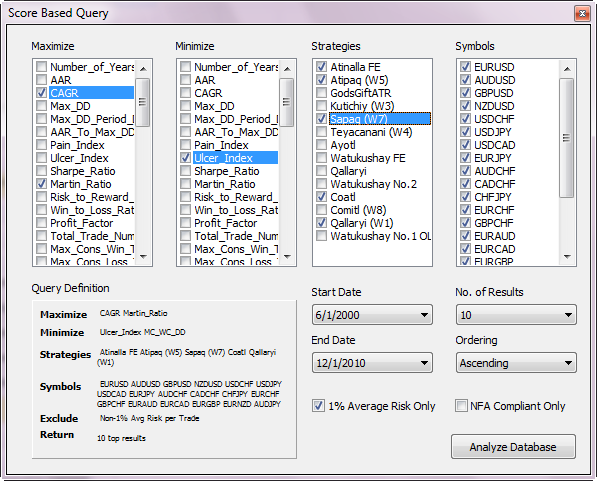

The idea of custom ratios in our Asirikuy profit and draw down analysis tool is to allow traders to choose a set of maximizing and minimizing criteria which they can use to build a custom ratio that reflects their particular view of how a system works. For example if I am interested in having systems that has both a high reward to risk ratio and a high winning percentage but a low Ulcer Index I can build a custom ratio that rewards systems which have high maximizing characteristics and punishes systems that have high minimizing characteristics. In the end I can get a strategy classification mechanism which rates systems according to the particular compromise I have devised, a classification mechanism which has put weight as I intend it to. The above picture shows a selection using a custom ratio (last field, named Custom Score) using 5 different selection criteria.

The power of this custom ratio analysis becomes evident when you think about ratio to ratio comparisons and other such calculations that can lead to very efficient ways of classifying systems. For example I could build a custom score that maximizes the average compounded yearly profit to maximum draw down ratio while it attempt to minimize the average draw down periods in days. This way I can classify systems in such a way that their ordering will be a compromise between their profit to maximum draw down ratios and their draw down period length. The possibilities here are endless since custom ratios can be generated to maximize or minimize any selection of criteria, allowing a trader to build a portfolio that is suited to what THEY want to trade.

–

–

In our previous ADA implementations the trader was limited to only order systems according to a certain fixed criteria or predefined ratio but with this custom ratio ability a trader can now include any set of criteria that will determine the ordering of the systems. For example I could choose to trade systems that minimize the Ulcer index (a criteria for psychological pain) maximize the Monte Carlo Worst Case DD and minimize the Historical Maximum DD. Although maximizing the WC Draw down can seem like a counter-intuitive choice the minimization of the Historical Maximum DD creates an implicit maximization of the Monte Carlo Worst Case DD to Historical Maximum DD which is a proxy for system robustness. As you see the possibilities here are truly endless and can lead to very smart system choices according to the trader’s own risk aversion and the statistical characteristics of systems which he or she wants to follow.

The new version of the ADA along with this feature and many others will be released hopefully within the next few weeks to the Asirikuy community. If you would like to learn more about my work in automated trading and how you too can learn to code and evaluate your own strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)