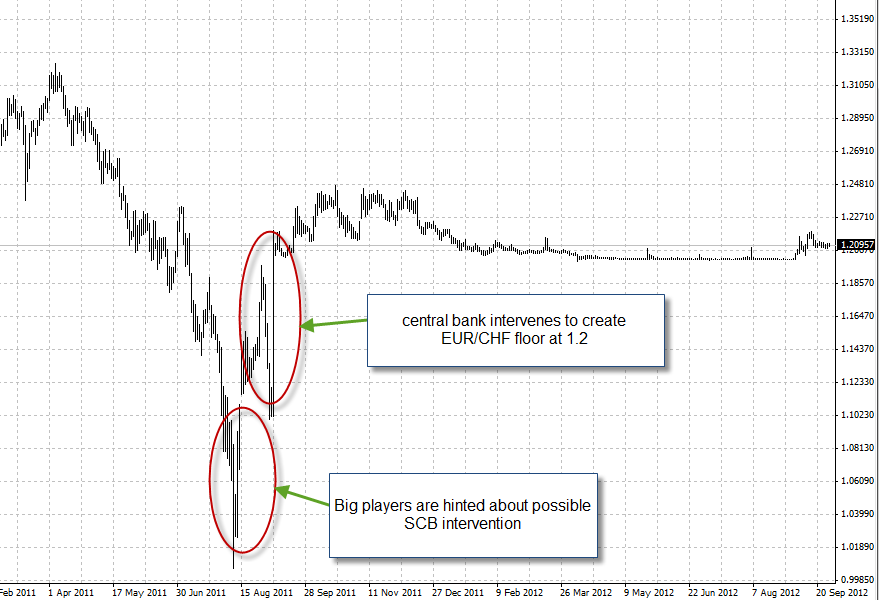

In September 2011, the Swiss Central Bank (SCB) decided to create a floor for the EUR/CHF currency pair in order to prevent any movements below the 1.2000 level. This decision was taken to prevent further strengthening of the CHF, which could have important consequences for the Swiss economy. A strong Swiss Franc decreases the amount of money received by Swiss exporters and also creates a deflationary pressure in the Swiss economy. The difference between this move and previous interventions by the SCB – which is a rather interventionist entity amongst central banks – is that this floor was proclaimed to be “unbreakable”. In other words, the SCB said that they would print as much money as necessary in order to prevent any move below the 1.2000 level. Today we are going to discuss this move, taking a closer look at the effects it has had across the CHF pairs and some trading strategies designed to trade on this pair.

First of all, we should consider the political and economical situation in which this “peg” happened. We were – and are still – at a time of significant uncertainty about European debt-health and we are therefore at a time where investors are seeking safer assets (although the climate might start changing rapidly depending on how things develop). In summary this means that people put their money in places where inflation is going to be low and safety of capital is going to be high, in our world this means US, CHF and JPY bonds. Countries where your money is safe and inflation is bound to be low. This meant that people wanted to buy francs and people have in fact continued to do so. What the peg did was simply to establish an endless sources of Bids at the 1.20000 price level which would be filled by the SCB, not allowing anyone to go too much below this level in the EUR/CHF exchange rate (whether this is sustainable is another interesting point for another blog post –> I believe it is not but it might also not be necessary). Price did not venture far above this level – and this is a key point – because people continued to feed on the SCB bids, there is no willingness to take the EUR/CHF higher. If price had venture higher we might have had trading on the CHF instruments at it usually is, because the floor would not be enforced, but the constant testing of the trading floor causes anomalies in how the pair behaves.

–

–

How did trading change ? Well the above graph says more than a thousand words. Trading on the EUR/CHF basically flat-lined, hugging the price level imposed by the SCB. Although trading almost never reached as low as the 1.2000 official peg, trading was – for more than 6 months – pegged completely against the ground suggested by the SCB. Interestingly the fact that the price is hugged by this level initially created a sort of market inefficiency as people took profit from the knowledge that the SCB would eventually “pickup” price. For example if you’re holding EUR/CHF near the 1.2050 level you know that the SCB will not go below 1.2000 so you place a stop at 1.1950 and leave this trade until it reaches a higher level (whichever that is). When traders push price lower you can pyramid on positions and then gain on the upside. Since upside is unlimited but downside is limited by the SCB, you can have trades with very favourable risk to reward ratios. In fact, all the profit achieved from such transfers is a wealth transfer from the SCB to you. However, with a spread rounding the 10 pips, fast scalping is not something easy to do.

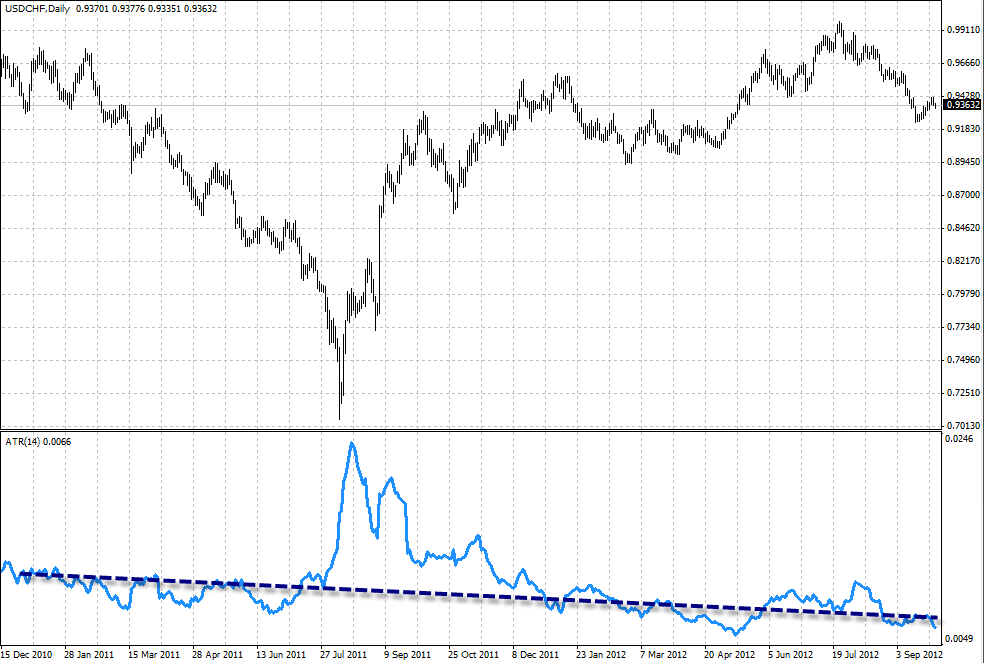

However the most interesting thing is to look at other pairs to see the effect that the EUR/CHF floor has had. It is important to remember that the SCB is not guaranteeing any exchange rates against the USD or other pairs, so these pairs are affected rather indirectly by the SCB’s move. This can in fact lead to some otherwise rare things such as cross-pair arbitrage opportunities due to mismatches in the exchange rate equivalences. We know that the EUR/CHF should be equal to the EUR/USD x USD/CHF exchange rate but this is often not the case right now. This is another reason why the spread has widened so much when trading EUR/CHF, in order to prevent use of the problems in correlation created by the trading floor to lead to market inefficiencies. There could be an indirect appreciation of the CHF through secondary means by speculation (excessive decrease of the USD/CHF rate with a loss of correlation with the EUR/USD) but this is still to happen.

–

–

Let us look into the USD/CHF in more detail, what we have had is a steady drop in volatility (which has happened since 2010 so it cannot be attributed to the floor) but there has also been a much greater increase in correlation with the EUR/USD. Since the EUR/CHF exchange rate is basically constant, all variations in the USD/CHF x EUR/USD equation need to be compensated by extremely highly correlated movements between both pairs. As a matter of fact the USD/CHF and the EUR/USD have been close to mirrors since the establishment of the USD/CHF peg. However – and this is very important – you should consider that this high correlation exists because the EUR/CHF rate is almost constant and “nailed” to the trading floor. If the CHF starts to depreciate the floor will not be enforced – there will be no need to – and correlation levels in the USD/CHF will return to normal. The main reason why we have seen this important changes relates to the enforcement of the floor but this doesn’t apply if the EUR/CHF starts moving up.

In essence the SCB intervention – under this year’s market conditions – created an almost constant EUR/CHF rate coupled with an extremely highly correlated EUR/USD|USD/CHF scenario. For our trading systems this implied trading a USD/CHF that behaved like a EUR/USD and – for our few EUR/CHF trading systems – it involved taking positions that have now lasted for almost a year (as there is no movement to hit SL/TP targets). The USD/CHF is naturally highly correlated to the EUR/USD but it did have some feature differences that our systems were prepared to. Under this climate none of our USD/CHF systems has made a profit but their loses are still to fall below what we would consider statistically derived worst case scenarios. As a matter of fact, the months of October and Novemeber 2011 were quite profitable for some of these systems, but the performance collapsed once the trading floor started to be brutally enforced (since February when the EUR/CHF basically became glued to the 1.20-1.21 range). This is because – while above the floor – the USD/CHF behaves alright (as you would expect it to) but when it moves close to the floor the SCB starts to play the game, something which changes the characteristics of the USD/CHF tremendously.

–

–

The evidence right now points to the fact that we are trading a rather strange CHF. It behaves like itself when it moves towards the upside but then it turns into something completely different when it falls into the hands of the SCB’s floor. Our systems behave differently when this floor is enforced and therefore it is difficult to trade anything on CHF pairs with certainty about what to expect. If the EUR/CHF moved significantly higher we could trade the CHF pairs with no problem (especially if a carry trade gets established) but we wouldn’t be safe trading near the floor’s level (as trading is different). http://cyberblogue.com/centos-how-to-manage-network-interface-and-association/ The soundest decision is then to stop trading CHF based systems at least until there is an establishment of trading clearly above the 1.2000 floor (or if the SCB removes this restriction).

The new versions of Atinalla portfolios in Asirikuy will start trading within the next few weeks, without including any CHF based instruments. Obviously if you want to learn more about algorithmic system creation and trading portfolios please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hi Daniel-

Good find, too bad we didn’t figure this out before giving back all our profits in this pair! But better late than never and something to look out for going forward.

Thanks,

Chris

Hi Chris,

Thank you for your comment :o) Well, hind-sight is always 20-20. As you say we now know how trading floors like this will affect pairs, so in the future we have an idea of how to act and when we should stop trading an instrument that is subject to such treatment. The good thing is to learn. Live and learn :o) Thanks again for commenting,

Best Regards,

Daniel