First of all, there are probably many ways in which successful system design can be approached. I am going to discuss mine because it has worked for me and has led to the generation of many long term profitable systems but you should use my approach only as a guide to develop your own way of tackling the system design problem, as something different may work better for you.

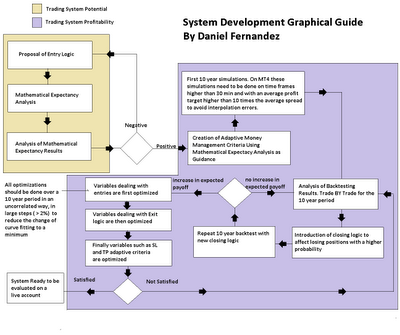

What are the necessary steps to successful system development ? I have prepared a practical diagram (click to enlarge) showing you graphically the process I take in order to develop trading systems – including all those within the Watukushay Project – and all other experts. You will see that the first step I take is a design of an entry logic followed by a mathematical expectancy analysis which defines the trading system’s potential. If the mathematical expectancy analysis is not positive, then I modify the entry logic or the evaluated number of periods and time frame until I am able to achieve a positive value. Most people would be surprised to know how little importance the entry logic actually has as most entry mechanisms have some degree of positive mathematical expectancy on different time frames or periods. The problem with the usual system development tactic used by most new traders is that they don’t do a mathematical expectancy analysis at all, therefore, they truly don’t know the potential of their system or if it is being used on the adequate time frame or if they are targetting adequate profit and loss values per trade.

– –

–

After doing this analysis – and having positive results – I continue to develop the system’s money management which will be the KEY to the system’s long term profitability. Using the previous mathematical expectancy analysis I figure out what exits (as adaptive TP and SL) and what time frame will be the most beneficial to my system, always taking care to use time frames and profit targets to preserve the reliability of the simulations being done. Defining an adaptive lot sizing technique which modifies positions against both balance and volatility is also vital to ANY trading system’s long term success. Many people underestimate the HUGE importance lot sizing has, having a fixed lot size or adapting lot sizes against a fixed percentage of account balance is a death sentence for most trading systems.

The next steps are probably the most important and the ones new traders and most designers never do. You need to do a 10 year backtest and then a TRADE BY TRADE analysis of the results to design adequate internal exit logic mechanisms to increase the profitability of the systems. After you introduce a new trading logic you need to check if the expected payoff (which measures the relationship between profit and draw down) is increased. If it is not, then you need to go back to a TRADE BY TRADE analysis until you come up with a logic that works.

After you find a closing logic that increases the expected payoff you need to optimize variables in an uncorrelated way – one by one – with large steps to prevent any significant curve fitting that may happen (some variables however, like the SL and TP adaptive criteria, may be optimized in a correlated fashion). After this is done you need to evaluate your results and ask yourself if you are satisfied with the draw down and profit targets of your system. If you are, then you are done. If you are not, then you need to go back and analyze TRADE BY TRADE a 10 year backtest to come up with other closing mechanisms to increase profitability.

I believe that this approach, which attempts to increase system profitability through analysis and sound development is incredibly powerful at generating long term profitable systems. Usually people focus way too much on the potential of the trading strategy – the development of entries – when in reality very simple entries have very good potential and only the development of adequate exit mechanisms really guarantees that large profitability levels are achieved. If you see the graph, most of my efforts are around the development of profitability as only the initial mathematical expectancy analysis is devoted to potential.

In the end, profitable system development is NOT easy and requires many hours of hard work and development. Each analysis of a 10 year backtesting result can take me hours – sometimes even days – of work but in the end this analysis is absolutely necessary as it gives me the understanding necessary to implement good exit criteria that will bring my systems to new profitability levels. All this effort that goes into development also allows me to deeply understand my systems and trade them with confidence under very varied market conditions.

Good post Daniel,

I have to admit with my first EA, Tiger Tail, I have implemented with a couple of bad tactics mentioned… (I will say in a minor way). Some good things I did do that you mention are keeping my TP and SL at around 10x the spread. My time frame is on the daily, and I have 10 year successful back tests, having analyzed just about every trade.

As I continue to try to find other systems I have not come up with anything real significant mainly because I believe my approach does not narrow in on the management of the exit of the trade. Like you said finding the entry is not too hard, it is managing a good exit that makes some significance.

Thanks for that insight in this post Daniel, as well as other things mentioned. I will try to keep those things in mind when attempting further EA development.

JT