On a recent post I talked about ways in which you can reduce the influence of swap rates in your Forex automated trading strategy or at least implement them in a way that reflects the worst possible case. Today I want to talk about ways in which you can actually build a strategy who’s main objective is to actually profit from swap credits. Historically these strategies have had several problems that we will discuss through the article as well as ways in which we can alleviate and potentially completely eliminate the crash-risk associated with the Forex carry trade. I will walk you through some important academic papers on the matter that suggest that not only is the carry trade “still alive” but that there are several ways in which the risk associated with the traditional carry trade can be reduced.

–

–

The carry trade is a strategy based on the “forward premium puzzle”. When you lend a currency pair with a higher interest rate by borrowing a currency with a lower interest rate you gain the difference between the borrowing and lending rates of these two currencies. Interest rate parity would predict that the higher interest rate currency would depreciate against the lower interest rate currency such that an investor sees no difference between holding any of the two while in reality we tend to see an increase in the value of the high interest rate currency, an unexplained forward premium that should not exist. The carry trade takes advantage of this strategy by holding positions that generate this credit, such as AUD/JPY longs, EUR/MXN shorts, etc. In summary you want to hold a currency with a very low borrowing rate against a currency with a very high lending rate, the higher the spread between these two values the more profitable your swap credits will be.

The forward premium is often explained by economists as a consequence of “picking pennies in front of a steam roller”. You are making a bet that makes small but sustained gains with little volatility through a significant period of time but you are expected to give back a very large percentage of these gains across some odd yet possible market crash events that will completely unwind the carry trade (meaning that the high interest rate currencies will depreciate very rapidly). In 2008 we saw a scenario of this nature where the leveraged G10 carry trade strategy – which had a Sharpe ratio of more than 0.8 from 1990 to 2008 – faced a drawdown of 20% and a drop of its Sharpe ratio towards the 0.5 region (see here). Even more the 2008 event did not account for the entire forward premium anomaly and therefore several economists speculate that the forward premium anomaly is still compensating for a yet to come market event.

–

–

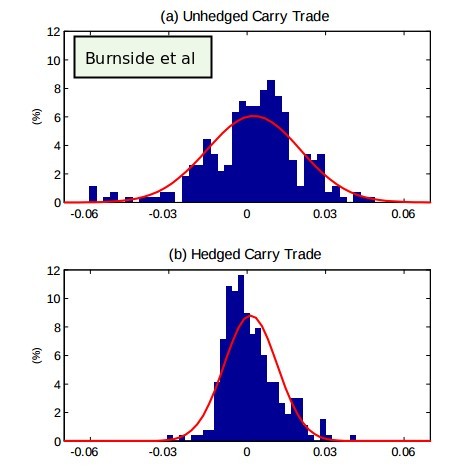

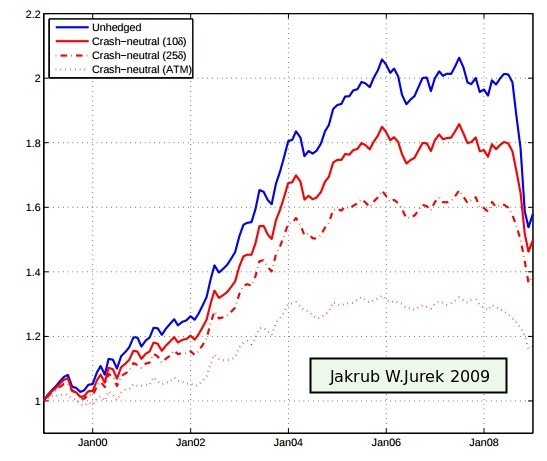

All this said if there is a substantial sensitivity to market crashes it is interesting to consider strategies where the crash risk is reduced or completely eliminated. In his 2009 paper Jakub W.Jurek explores the use of crash-neutral currency carry trade strategies and how they compare with the regular unhedged carry trade. He uses either delta neutral or cash neutral options to hedge the crash risk of a carry trade portfolio either partially or totally. On the image below from his paper you can see his results for a G10, USD based carry trade strategy using different hedging strategies up to December 2008. You can see how the option hedging introduces large additional costs into the carry trade strategy with the premiums being higher as you move to more protection. The drop in the drawdown and return is almost entirely proportional, meaning that the Sharpe is fairly constant. Burnside et al also explore hedging in their 2010 paper on the peso problem and the return of the carry trade. They show how options hedging strongly narrows the distribution of returns of the carry trade and eliminates the fat tail risk.

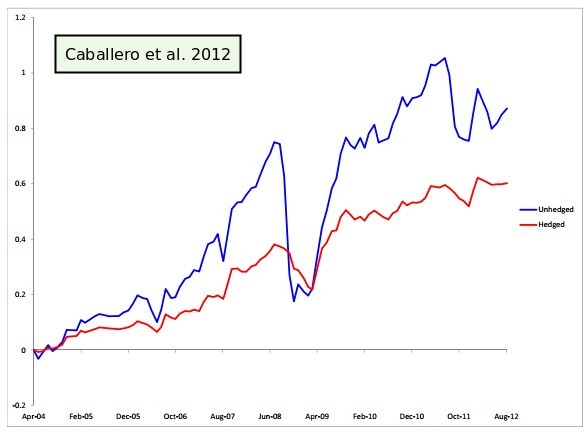

Ricardo J. Caballero and Joseph B. Doyle expanded on the concept of option hedged carry trade strategies on their 2012 paper. In this paper they use simple at the money (ATM) monthly options to hedge the risk of different carry trade portfolios. In the end they find that incredibly good results are obtained when you use a quintile composed of only the highest carry trade yielding currencies. In this portfolio the dramatic reduction in the drawdown in 2008 justifies the additional costs in option premiums to hedge the portfolio results. This is possible because option pricing does not work when there are deviations from the Black-Scholes model. In this model option prices are based on expected future volatility but these estimations of volatility are the wrongest just before market crisis events which are – by their very nature – unforeseen. This results in the fact that option based carry trade hedging is in fact the cheapest when you need it the most, especially for the highest interest yielding pairs. The observation that options are mispriced in the Forex market is actually not new. A recent study in the symmetries between put and call options in FX shows that the symmetry between the two is not perfect, something that stems from the existence of the forward rate.

–

–

The carry trade has some other special properties that we can exploit. While markowitz balancing of traditional FX trading strategies does not work due to the estimation error in future system correlations the future estimation error in carry trade setups is much less prominent due to the fact that future interest rate differentials are predictable to a significant degree. This means that mean variance optimization of carry trade portfolios actually yields consistently better out of sample results than naive optimizations. Pedro Barroso and Pedro Santa-Clara show this phenomenon very clearly in their 2013 paper on optimal currency portfolios.

The carry trade is a very interesting strategy that can provide a significant source of diversification against traditional stock and bond investments. It has a lower volatility and a higher historical Sharpe than the US stock market. By using options to hedge risk and properly choosing the basket of currencies to trade one can obtain even better results that can even totally eliminate the fat-tail risk associated with market crashes even if this comes at the cost of some accumulated return (which can be recovered by using a higher leverage in most cases). Although the traditional carry trade is far from perfect recent research suggestions make it an extremely attractive strategy. That said, you need a proper broker that sells real low cost options – sorry this won’t work with the FX “binary options” retail traders are so into right now – and you need to properly construct your portfolio. The good news is that you don’t want or need large leverage so it is a rather safe strategy from this point of view.

If you would like to learn more about Forex trading strategies and how you too can automatically find new trading strategies using powerful mining technologies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general.