The fact is that huge returns are possible with a huge market exposure and the problem with a huge market exposure is that it causes huge wipeouts of capital as the market evolves. So this is analogous to a person who wins the lottery. You get a huge amount of return in one run but if you spent all your lottery money in tickets, you would hardly ever win again or if you do, keeping on doing this will eventually wipe you clean. The market – I believe – has a self-limiting character which makes the systematic exploitation of market inefficiencies to achieve huge profits impossible due to the fact that huge profits require huge exposures, and huge exposures – lead to wipeouts.

The golden question is then what is realistically possible ? Since there is no way in which the “top” possible average profitability can be inferred the best measurement we have of what can be systematically achieved is what the average people in the field are actually doing and have been doing for a long time. I have to stress here that the “long time” part here is very important since long periods of time imply robustness and statistical significance. Anyone can triple an account in 2 months, but doing it for 20 years is something very different. When you have been trading for a long amount of time it means that you have very sound risk and money management tools that guarantee your long term success by limiting your present market exposure.

– –

–

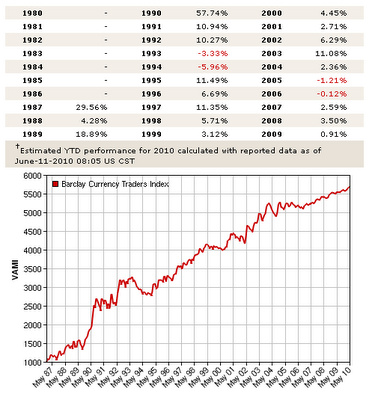

If you check the Barclay Currency Traders Index you will see that the average compounded yearly returns are not to die for. Currency traders average a 7.71% compounded anual return with a worst draw down of 15.26%, certainly traders are in average conservative. However looking at all the profit and draw down figures of the particular traders you will see that average compounded returns and maximum draw down figures are often in a 1:2 to 2:1 ratio, meaning that the average yearly return is actually never better than twice the maximum draw down. If you are thinking that these figures don’t apply to you because these traders don’t have the “flexibility” of small account holders, you are wrong. Many of these traders are NOT trading billions and many of them have access to liquidity you would only dream of so if anything trading conditions for most of these guys are only better than for the average forex trader.

A very important thing about this index is also that it shows that diversification is the key to long term success with the sum of all traders giving a very smooth equity curve over a 20 year long period. So probably a good lesson to learn here is that using several strategies that are all long term profitable will probably help us reduce draw downs as it helps the Barclay Currency Traders Index smooth its performance. As we have seen with the Atinalla project, having a large amount of diversification is very beneficial in the long term for trading strategies.

However the most important thing about these profit and draw down figures is that they show us the true face of market exposure and what you can expect to be realistic. If in the best case your maximum draw down level is likely going to be around one half your average compounded yearly profit then a monthly 100-200% return or a 100% yearly return for that matter are unrealistic or excessively risky for any sound investor. In the end, this currency trader index tells us that for moderate risks, forex investors should aim for a yearly profit of 20-30% if their risk appetite is moderate.

Currently our Atinalla No.1 portfolio would hold a place near the top of the Barclay Index and for this reason I would be tempted to say that it is very profitable. However we must consider here that the portfolio has not been run for 20 years on a live account and only time will tell us what its real profit and draw down targets are. Nonetheless the most important thing about Atinalla project portfolios is that they are traded with a very good profit expectation and a VERY clear worst case equity-loss scenario in mind, which is 36% for the Atinalla No.1 Portfolio.

If you would like to learn more about forex automated trading and how you too can design your automated trading systems based on sound risk and profit targets please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !

Hello Daniel,

It looks like your systems are trade not worse, possibly even better than traders, on whose performance, the Barclay Currency trader index is based on!

If Atinalla project will achieve comparable or better performance, this would mean that automatic trading is a great alternative to a manual one!

Regards

Maxim

Hello Maxim,

Thank you very much for your comment :o) However the Barclay Currency Trader Index does not distinguish traders by tactics so it is probable that some of them use mechanical systems to an important extent.

We'll see where Atinalla portfolios stand with time. As I have always said, the important thing is that we know our risk targets and we understand our systems :o)

Thanks again for the comment and kind words Maxim !

Best Regards,

Daniel

So, what I am seeing is that Atinalla No.1 could be a better suite of trading systems than this Barclay index… :)

So, when do you plan on becoming a fund manager and when will you start accepting deposits. (wink) :)

I think you mentioned that Barclay has 119 different systems. Just in my simple thoughts, it seems that this may be too many systems. I suppose my question is "how many systems are too many systems in a long term strategy portfolio?" Can you actually have too many systems… Does amount of money invested in the portfolio play the big part in this thought…

Anyway, good post I always enjoy reading.

JT

Hello JT,

Thank you for your comment :o) It's always great to have you around.

I was thinking of getting my CTA certification next year to start managing large amounts of money so we'll see what time brings ;o).

Regarding the Barclay Index, it has 119 different "traders" (which are actually hedge funds, individual traders and groups of traders) but many of them may use similar or the same systems. Evidently there are some very bad perfoming contributors and some better perfoming contributors and they form a somewhat "normal" distribution weighted towards the losing side.

Can "too much" diversification happen ? Regarding profit it can certainly reduce overall profitability but the main gain you get is in robustness as your trading becomes more resistant to change. However eventually when you add a certain number of systems they start to correlate and the effect of adding additional trading methods becomes extremely reduced. So how many are too many ? We need more time go get this answer ! :o)

The amount of money plays a role in the sense that it may limit or open up possibilities regarding diversification. For example a small 100-200K account may only trade on retail forex brokers while a 10 million dollar fund will be able to have direct interbank access with its own software solution, giving you the ability to different things, like high frequency trading. However in the end there are systems – like the turtle trading system and such swing systems – that can be used almost with any account size so the role the amount of money plays is only relative to the strategies used.

I hope this answers your question JT. Thank you very much again for your comment :o)

Best Regards,

Daniel

That 2:1 ratio between yearly average profit and max drawdown seems to be a kinda universal rule in trading which supports your market efficiency theory, Daniel. Here's what Paul Tudor Jones says about this in the Market Wizards interviews (By the way, P.T. Jones' first idol in trading was Richard Dennis):

Q: How do you measure your performance?

PTJ:You've got to look at good traders historically. If a trader can on average annually deliver two to three times their worst draw down, then that's a very good track record, and I'd say that that's what I try to do.

And here's a great film about Paul Tudor Jones and what trading was like in the eighties:

http://www.tudou.com/programs/view/XH5W4vffBbY/

Enjoy :)

Excellent article. Unfortunately you have to hunt long and hard to find people speaking the truth like this. The sad fact is that most people don't want to listen.

Hello OrangePotatoe (love the nickname by the way !),

Thank you very much for your comment :o) I am glad you have liked the article. Definitely – as you say – the fact is that people generally simply don't want to listen. In general people who seek knowledge learn from others experience and people who are stubborn need to learn from their own. Thank you very much again for commenting :o)

Best Regards,

Daniel

[…] boys”. You can read the article explaining what the index is and what information it gives us here. Definitely the information provided by the Barclay index is one of easiest and most convenient […]

[…] realizan trading discrecional y sistemático. Podemos comparar sus gráficas de resultados de los índices discrecional y sistemáticos de la fundación Barclay […]

[…] AAR / Maximum drawdown ratio […]