–

–

–The problem to those experienced in trading should now become more evident. New traders fail to understand that systems trade in profit and draw down cycles and that the only way in which a system can remain profitable in the long term is if those profitable periods are greater in magnitude than the draw down periods. However, they fail to grasp the fact that a system can still have very profitable periods and then strong draw down periods that wipe accounts. A general lack of focus on the reliability of simulations and the need to have long term reliable back testing results ends up with inexperienced traders only paying attention to very short term live tests that are statistically meaningless and only portray very short term trading results.

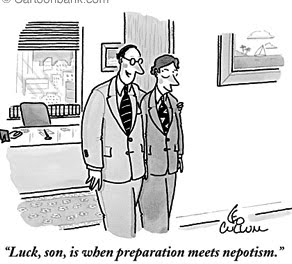

Additionaly- despite the actual long term profitability of a system- the existance of long consistently profitable periods makes the entering into draw down periods more likely since the market is waiting to cash on the system’s exposure. So the more attractive the equity curve seems to new traders, the more likely it is to show a venture into draw down territory. In the end inexperienced traders will systematically select systems that have a high like hood to enter draw down periods and this will lead – in the bast majority of cases – to the above mentioned result. Every time you get a system, it seems to start losing money. Oh my bad luck.

However the solution is not to do the opposite and get into systems that are losing money (new traders tend to simplify things this way), the solution is to know the extent of the draw downs a trading system will get into, to have reliable long term trading simulations that can show us precisely what we should expect from the system. As always it is lack of understanding what makes new traders so bad at picking systems and even worse at being able to live through extensive and deep draw down periods (something that is bound to happen with any system). If you look for a system that consistenly makes profits and “seldomly loses” you are getting yourself into this game of picking losing systems and even worse, you are most likely to use systems with very unsound trading tactics and risk to reward ratios.

In the end, the “luck effect” – as I like to call it – has an important effect in trader psychology , ending up with traders losing all their “faith” in automated trading. People who time after time use systems with very nice equity curves only to find strong draw down periods sometime after will most of the time say “automated trading doesn’t work” and they will completely quit the quest to achieve profitable trading using this type of systems. However it is important here to understand that what generates this “luck effect” is merely the general lack of in-depth analysis and the desperate search for a holy grail of automated trading. When new traders acquire some experience and they begin to see that the analysis and understanding of a trading system is vital for success, the luck effect immediately starts to vanish since draw down periods become a part of the business and not an undesirable evil.

Of course if you would like to gain a true education in automated trading and learn to design and use systems you can understand and have confidence in please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to trading systems. I hope you enjoyed this article ! :o)