However tick volume – which simply measures the volume of ticks during a certain amount of time – has been shown to be proportional to true volume in systems where this data is available for comparison. In forex we have tick volume and this allows us to think about the building of systems based on this information. However a big problem is that each broker has different liquidity providers and for this reason the number of ticks as an absolute value becomes useless as each system would need to be tailor made to the data feed of each broker and this is just impossible to do since forex brokers do not let you access their 10 year data (or they haven’t even been on the market for this long).

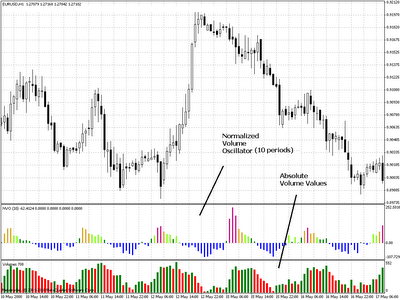

The best solution to the above problem is to use an NVO or normalized volume oscillator that portrays tick volume as a percentage of the tick volume values for the past X market periods. There are already several NVO indicators available for free for metatrader 4 and the one I like the most is available here. This indicators shows us volume in a -100 to 100 range where 0 represents the median volume value and -100 and 100 represent the lowest and highest volume values during the past X periods. Below you can see an image of the NVO together with the volume indicator (which just shows absolute tick volume values as a histogram).

– –

–

After we have this information it now becomes quite simple to design a strategy based on this NVO indicator. But how do we use volume ? The traditional way to use volume is to distinguish between different “reasons” for different “events” to happen in trading. Usually price action patterns, indicator signals, etc, can happen due to reasons that are not related to actual changes in market behavior. For example, you can have a shooting star candlestick pattern develop because of lack of liquidity and not because of an imminent reversal. What volume allows you to do is to eliminate all these “false” signals, since you are only entering positions after a signal that is meaningful happens. Meaningful in this case, means that it happens on high market volume (which we assume to be proportional to tick volume which is what we actually have).

– –

–

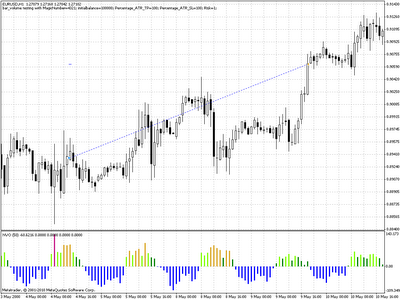

I designed a very simple system using a very simple candlestick pattern and the above mentioned NVO indicator. The results in simulations (Jan 2000 – Jan 2010, EUR/USD) were quite good with a system with an average yearly profit to maximum draw down ratio of 0.5:1 without any optimization or additional exit logic besides a simple SL and TP. What this strategy shows is simply that entries with very good mathematical expectancy values can be designed when using an NVO as a way to measure the meaningfulness of certain market signals (of course a strategy has to be designed with the use of volume in mind from the beginning, strategies like the ones used by Watukushay No.2 or Teyacanani don’t actually benefit from an additional NVO based filter).

– –

–

Bear in mind that this does not mean that you should add an NVO filter to “every system” to attempt to improve its entries. This will most likely not work since anNVO is only useful as a way to aid in entry selection when the price pattern we are looking for benefits from this type of criteria. When a pattern is valid regardless of volume, the NVO becomes a problem and NOT a solution. Also most indicator signals do not get any improvements from the use of an NVO since their signals represent the conjunction of complex calculations done over price through significant periods of time. In the end if you want to design a system using an NVO you should plan this from the beginning, adding such a filter as an after thought is NOT going to work in the large majority of cases.

After a few weeks of hard work and development using normalized volume oscillators I can say that I have developed at least a couple of strategies that show long term profitable results on a basket of currency pairs. However we will see in time if such strategies are in fact able to avoid broker dependency due to the NVO implementation and therefore succeed in the long term. Tomorrow I will be releasing a few videos in Asirikuy dealing with volume as well as the actual logic and coding implementation of the above mentioned NVO strategy.

As always if you would like to learn more about automated trading and gain a true education in the development and understanding of these trading systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to trading systems. I hope you enjoyed this article ! :o)

Daniel,

It is the first volume-based strategy I've ever seen,-my congratulations!

I've put attention that half of the trades (I don't know if they correspond to half of the time), from trade 1 to 120, the EA didn't achieve meaningful results. Most of the profits came from trades 132to 172.

As far as I understand from the equity curve, one would wait for a very long while to new equity high appearance,-is this the case?

Maxim

Hello Maxim,

Thank you for your comment and support :o) As a matter of fact you are right in that the period you mentioned (132-172) was the most profitable. However equity highs are reached somewhat frequently (at least every two years). It is also worth remembering that this system hasn't been optimized or fully developed and it is just a proof of concept that likely long term profitable systems can be developed using NVOs.

Of course the Asirikuy videos on volume which will be released tomorrow will help you much better understand the system and the use of this indicator.

Thank you very much again for your comment :o)

Best Regards,

Daniel