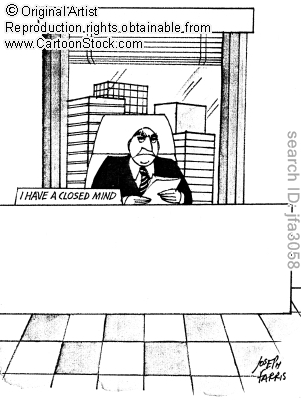

So why do people view conservative traders as being “close minded” ? The answer to this questions is actually not that complex and goes into the way in which new and experienced traders view trading and how they differ in the way in which they approach their trading accounts and the way in which they trade this money. For new traders there seems to be an urge to gain high returns with small amounts of money, something which is very understandable and aligns perfectly with all the hype and risk taking that can go on with small amounts of money. Since the amounts of money risked by new traders are usually small the sense that the potential reward is much higher than the potential risk is very important.

You will see that new traders will be very easily convinced to use any trading tactic that promises large returns, merely due to the fact that the balance of possible benefit and loss is heavily tilted towards the rewarding side. New traders are therefore much more likely to try new trading tactics which don’t have proved long term profitability in order to face the potential and very tempting reward. On the other hand, experienced traders are very reluctant to trade anything that has yet not shown long term profitability because the stakes are – in most cases – much higher (in absolute money terms).

Experienced traders also have an advantage here regarding the number of systems they have seen in the past and which ones they have seen succeed and fail as the years have gone by. Most professional traders will know that certain systems are – by experience – very bad ideas while others are more sound approaches. The answer of new traders to this argument is generally that the fact that no one has done it doesn’t mean it cannot be done, which is a valid, yet dangerous argument.

– –

–

Professional traders are more focused in the long term ability of their systems to succeed while new traders are more comfortable in using new systems which have a very high probability of failing. In the end it is not that professional traders are unable to embrace new ideas, it is simply that they require these ideas to be put to the test rigorously since every time they have been used they have shown to fail in the long term. This is analogous to the people who attempt to build perpetual motions machines, which would violate the laws of thermodynamics. Since these laws are based on vast amounts of observational data for which an exception to the rules has never been found, there must be an overwhelming and convincing amount of experimental evidence to disprove any of them. In the end the people who do not attempt to build perpetual motion machines are not “close minded” they just know that the laws of thermodynamics work on all the observations of our universe that have been made and therefore such an endeavor is most likely a waste of time.

In trading things work the same way. Conservative traders do not develop martingales and scalpers with very bad risk to reward ratios because they know that these systems have always failed in the long term, even if there is no absolute proof saying that a very profitable scalper or martingale cannot be made, professionals know that this is most likely a complete waste of time since from a very large amount of attempts, none have succeeded. It is not that conservative traders are “close minded” since they will eagerly test new ideas which have not proved to fail so dramatically during the past, it is merely that they are being careful and applying the experience most traders have had in order to trade only systems that can reward them in the long term.

So in the end it is not a matter of traders being “close minded” when they do not embrace ideas that seem to put extreme amounts of risk on equity, it is merely that these same ideas have already shown to fail time and time again in the past. It is therefore not a matter of being “close minded” but a matter of being cautious aiming to put your money in the hands of trading systems that are likely going to work for you in the long term. Where would you rather put your money, in a new company that promises you 100% returns each month (knowing that all of these companies in the past have turned out to be ponzies) or into an investment fund that has given its customers an average 15% compounded yearly profit during the past twenty years ? The same applies to choosing trading systems for your forex account.

If you would like to learn more about how you too can build and design your own trading systems with sound trading tactics that are likely to work in the long term please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach automated trading in general . I hope you enjoyed this article ! :o)

How about thinking of probability ?

For example if i have dangerous system that give 25% return per winning, and backtest said win:loose ratio is more than 4:1, is this acceptable ?

I am agree about small or big money aspect. It is easier to accept loosing 100% of $100 compare to 20% of $10,000 and on the other hand, winning 100% of $100 is small if compare to winning 20% of $10,000.

I don’t like scammer HYIP, but from mathematic view: on 100% monthly return, i just need 1 month to enter safety zone.. am i wrong with this point of view ?

Regards,

Primadi

Hi Primadi,

Thank you for your comment :o) You are entering a no win game here. Even if you managed to make 100% for a while using very high risk, you would eventually wipe out and eventually you would face a series of wipeouts in which you would lose all your winning and then everything else. You cannot beat long term statistics, if there is a very high risk setup you can be lucky a few times but if you do it enough times you will eventually get all your capital killed. If you want to try your luck, then you’re talking about gambling, which I am not interested in. If you want to gamble then it is better to go to Vegas, at least the drinks are free ;o)

Regarding HYIP, there is no doubt that you can make money in the initial phases of any ponzi scheme. But you should bear in mind that laws make you LIABLE in case you are making money being aware that this may turn out to be a scam. When you invest in a fund acting in a way which assumes you think there is a high chance of other people being ripped off, the profits you make are the proceeds of criminal activity as well. When you participate in the HYIP with the intend to make money knowing that others might be defrauded, you are committing fraud as well. It is not only about your profits and you being on the “safe zone”. Besides this being highly unethical it IS illegal, consult a lawyer to find out what the case is in your particular legislation.

I hope this answers your questions :o)

Best Regards,

Daniel