The first tools a person comes into contact with when they start to trade the forex market are technical indicators. These pieces of code which are merely ways of doing calculations on price data and displaying the results on the screen are our main way of interpreting the market and getting a clearer vision of what is going on with price action. However people get very disappointed after a small while because they realize that indicators get them “late” into trades and generate them loses instead of profits as they always arrive to the party when everyone is already going out the door. This leads people to say that indicator “lag” and “do not work” and that only price action gives them a reliable and prompt way in which to act while indicators do not. On today’s post I will share with you why indicators do not and actually never “lag” and why the problems with indicator use and the achievement of profitable strategies with them is not a problem of the indicators but an understanding and interpretation problem which is the fault of traders and not the fault of the tools being used.

First of all we need to understand what an indicator is and what it is supposed to do. Indicators are merely the display of a certain calculation done over price action that allows us to get a clearer picture of what is going on within a certain instrument. There are at least 10 or 20 indicators which are largely used, amongst them Moving Averages and Oscillators take the biggest role. Moving averages simply display the average value of a certain price level (close, open, high, low, typical, median, etc) through the past X periods while oscillators display the normalized value of a certain price property like what percentage of the movement during the past X periods can be attributed to up or down movements (RSI) or where price is relative to the past X periods high and low (stochastic).

Indicators never lag because they always display these calculations to the latest possible tick. Saying that indicators “lag” is very imprecise and misleading since this supposes that the information they display is “out of sync” with the market to a certain extent when in fact the information displayed is always as up-to-date as possible. The value of any indicator always displays the requested calculation on the same bars displayed on the screen as would be used for a price action analysis so if anyone says that indicators “lag” then price action would do the same, something which is simply absurd.

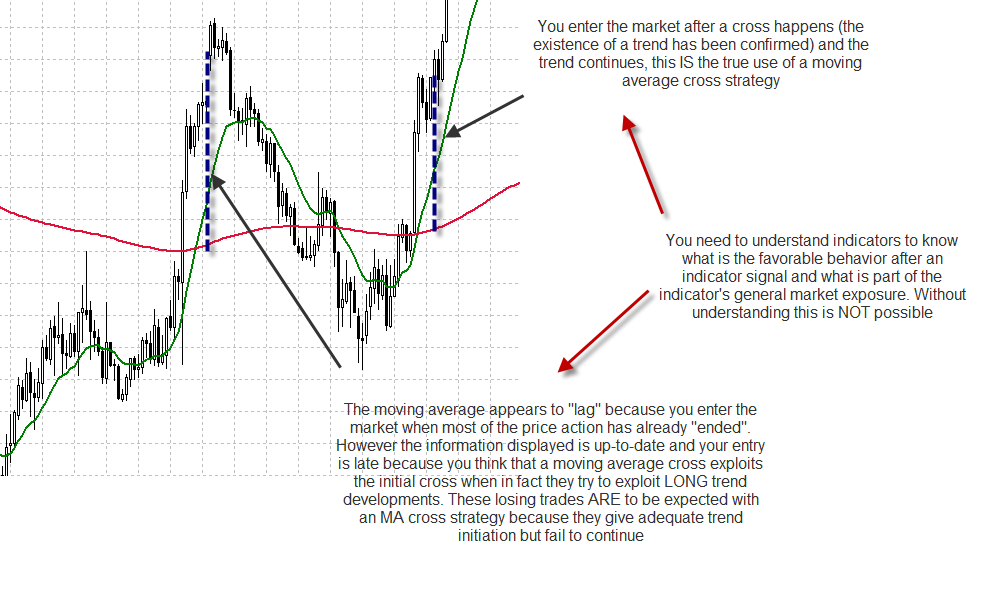

Why do people say that indicators lag ? People say this because when they act according to indicator signals they do not achieve profitable outcomes and price already has “exhausted the movement” when they get into the market. The problem here is not a problem of lagging but a problem of deficient interpretation of what an indicator is saying. For example traders may want to get into the market on a Moving Average cross but in order for a cross to happen a significant trend needs to develop. If you understand the way averages are calculated then it becomes obvious that for a short term average to become larger than a long term one a fast increase in price is first necessary. So what you are doing when you do this is expecting future price to continue this trend, if it doesn’t then you encounter a loss and the indicator appears to “lag” because you weren’t able to get any profit but you would have got a profit if you would have entered the trade earlier. http://thehistoryhacker.com/2013/01/22/marylands-identity-crisis/?replytocom=312 The perception of “indicator lag” comes from a misunderstanding of what the expected outcome of an indicator’s signal is and what the losing trades consequence of the market exposure of the strategy look like.

What you need to understand here is that you need to know what indicators are saying if you want to be successful through their use. Most people who call indicators “garbage” and “lagging” do not understand the way in which they are calculated nor do they know how to turn this knowledge into the exploitation of an inefficiency. Of course, in order to follow a trend a trend must develop first and in order to follow a trend reversal or some other behavior some previous price action must happen first. It is impossible to get into positions with a positive mathematical expectancy out of nowhere since some action is needed to indicate a future possible outcome with a high probability. The key to the development of profitable strategies using indicators is to understand exactly what indicators are saying and when an indicator signals a certain behavior which can lead to a positive outcome with a high probability.

If you do not understand how indicators work, what they mean and how their values relate to price action you will most likely never be able to succeed with them since this understanding is absolutely necessary for the creation of adequate trading strategies. Failing to understand the math behind the indicators and the actual meaning of an indicator’s values and actions will lead to unsuccessful trading and the constant frustration consequence of the apparent “lagging” of indicators. When you understand what indicators say they do not “lag” but they display an updated piece of information which is useful for the development of your trading strategy.

Several systems I have developed show how indicators can be used successfully for the development of trading strategies when their function is interpreted correctly. Watukushay FE achieves 10 year profitable backtests and profitable live trading through the use of a simple RSI based technique which adequately interprets trend directions and retracements, getting the EA into good positions to grab possible trend continuations. If I had attempted to develop a system based on traditional RSI analysis I would have failed and it was only through my in-depth analysis of the RSI and the meaning of this calculation that I was able to develop this strategy.

In the future, when you start the development of a trading strategy based on indicators it will be KEY to understand how the indicators you are using are calculated, what they mean and why does entering the market when certain indicator values change makes sense. An in-depth analysis of these entries, their mathematical expectancy and what price action tends to do after them is going to be primordial to your success. However keep in mind that indicators never “lag” they always display information on your screen based on the SAME bars you use for the development of your price action analysis. http://icrapoport.com/wp-json/oembed/1.0/embed?url=https://icrapoport.com/fateful-introduction-to-sports-illustrated/ The faulty thing here is your analysis and not the indicators themselves.

If you would like to learn more about developing long term profitable strategies and adequately interpreting indicators please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach automated trading in general . I hope you enjoyed this article ! :o)

Wow!!!I was really impressed with your article.Sincerely,I have never seen such insightful analysis of a commonly held myth.

You really ‘killed’ it.

Thanks a lot for sharing your knowledge,I really appreciate your article.

More power to your elbow.

Hello James,

I am glad you liked the article :o) Thank you very much for your comment, I hope you continue to visit my blog !

Best Regards,

Daniel

your site simply irresistible for anyone who can see the future.

Thanks again for the comment James :o)

Daniel