Joe looks with anger at his computer monitor as his account – which was up almost 200% after 18 months- suddenly faces a margin call due to his trading system’s tactics. He knew from the beginning that the strategy he was using put his account at a very significant risk of a wipe-out but he used it nonetheless because the potential – if he avoided that wipe-out – seemed tremendous. Joe – as most new traders out there – had an “all or nothing mentality” a sense that the potential reward was very high for the very small risk taken. Certainly many of you may have traded – or continue trading – this way with the idea that you can take a very high risk on a small amount of money with the idea that if it “works out” the potential reward will be huge. On today’s post I will talk about why this is an absolutely unsound approach to trading and why it is bound to cause a lot of financial loss and peril with little – if any – long term rewards.

The arguments for the “all or nothing mentality” are actually pretty simple and almost entirely the same in every case. There is a system which has some very unsound trading tactics that gives some profitable long term simulations or some limited live trading results (these can be even 12 to 18 months long). Then traders start to use the system with the hopes to achieve the results of the simulations within a few years, with the hope of becoming millionaires if the system works or simple losing a few hundred or thousand bucks if it doesn’t work.

–

The problem here is that traders have never considered the actual success rate of such an approach. What is the real probability that this will work without the account being wiped out ? What is the possibility to “beat the odds” and get the unlikely but extremely profitable outcome before getting a margin call ? The answer – sadly – seems to be that the probability of using a very unsafe trading tactic to gain enormous richness is – if not zero – extremely unlikely. This means that someone doing this is bound to wipe their account with an extremely high probability. The decision is fueled by the potential gains – just like in a casino – so the trader decides to risk initial investment capital without actually considering the odds.

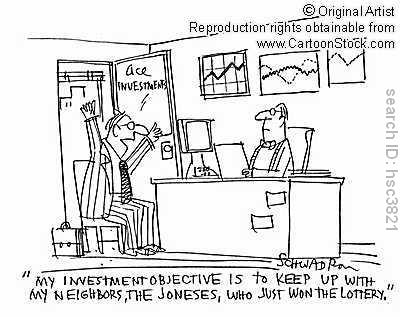

If you consider the potential reward, the money spent and the possibility to get from a small investment (1-10K USD) to one million dollars in a short amount of time (one to three years) , it becomes evident that a much less risky approach -were the odds are in fact clear – is simply to win the lottery. If you are willing to risk losing your money against a very risky system with a clear possibility to wipe your account clean, then it is much easier, less complicated and more straightforward to use that money to buy lottery tickets. You get a very high potential gain from a very small investment, you also have a high probability of losing and the stakes are – as an advantage against unsound trading – quite clear.

Approaching trading like a lottery game is a very dangerous tactic that leads to -apparently- only one final situation. The main outcome is a high level of frustration with several consecutive “small” financial losses and a huge waste of time as people spend months or even years attempting to “hit the jackpot” as they continue to wipe small investments. New traders then delude themselves to thinking that these accounts were small and therefore meaningless but the fact is that every day of trading you lose where you could be potentially making and compounding money with a sound investment plan takes away from your potential long term gain.

The fact is that a person can spend 5 years attempting to achieve profit with high risk unsound trading strategies without knowing that if those several 1-5K USD investments had been put to work on a sound realistic compounding trading tactic, the returns right now could be on their way to becoming at least 100-200K USD. New traders are often very short-sighted and this leads them to ignore what they could have achieved with a sound trading plan from the beginning. In the end a trader that spends time like this for 10 years will have only a very large number of small wipe outs (with probably a few times where very large returns (100-300%) were made (and then lost)) while a trader that spends 10 years with sound trading tactics will be on his or her way to a 1 million dollars and a very wealthy living achieved from trading.

William Eckhardt said once that in order to succeed in trading you just need to do “anything right” for a long amount of time. Meaning that if the strategy you use works just a little bit, the long term effects of the exploitation of this inefficiency will lead to huge returns from compounding. The problem here is that people are looking for high returns and “hitting the jackpot” with a complete disregard for the inherent risk to their capital. People often don’t realize that the time they are wasting in unsound trading is time that could be used in sound investments and realistic compounding. Of course, there is a popular saying in trading that all new people in this field should take into account : “the return of your money is more important than the return on your money”.

If you would like to learn more about mechanical trading strategies and how you too can learn to use, design and program systems which use sound trading tactics please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)