Those of you who have been reading and awaiting the consequence of the new CFTC regulations may be aware that part of this new law forces brokers to share certain account information, including the number of accounts they have and which percentage is profitable vs which percentage is unprofitable. These numbers have already been released by a large majority of NFA brokers – missing perhaps only FXDD – showing us what many perceive as surprising results regarding retail trader profitability. On today’s post I will talk about why these numbers are probably too “optimistic” what they are hiding and why certain brokers – especially Oanda – show a very high trader profitability when compared to others.

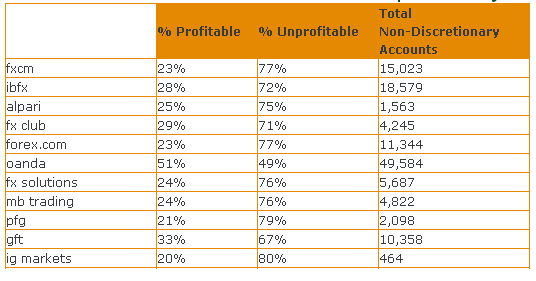

The first thing we need to understand here is which data the government has forced brokers to reveal and what this data actually means. The new law makes brokers show you the total number of active accounts and their profit or unprofitable status during each quarter. However the brokers are NOT required to show how many accounts were closed, how many are new or how many “changed status” from one period to another. (image below taken from forexmagnates.com)

–

Most NFA brokers have profitabilities between 20-25%, showing that retail trader profitability is above the mythical 95% that has been preached to new traders world-wide. However these figures are probably overoptimistic as they are just a mere representation of short term profitability. Suppose a broker has 50 accounts from which 10 are profitable and 40 are unprofitable, the next quarter 48 out of those 50 accounts become losers, 38 are closed and 38 new accounts are opened. In the end of the next quarter just 10 are profitable and 40 are unprofitable (just like in the first quarter) but in reality most people lost their accounts and only 2 out of 50 remained profitable through the whole two quarter period.

The fact is that forex retail trading might look more like this scenario since the number of account turn-over (closed and opened accounts) is extremely large so what you are looking at is a mixture of those who achieve to “get lucky” and those who are profitable in reality (in the long term). This is misleading since you tend to think that many people are profitable – which in the short term is true – but you lack the account durability and account turn-over information which is necessary to know in reality how many are truly profitable.

However an interesting fact here is that Oanda has the highest profitability amongst all brokers (50%) probably because it already had restricted leverage to low levels a long time ago. The fact that traders are unable to over-leverage their accounts makes account death slower (however it will remain a certainty for those without a long term statistical edge) reason why the figures of short term profitability are higher. Certainly I believe we will see a decrease in the death-speed of accounts on other brokers but I do not think this will change real figures of success in the long term.

To sum it up, I believe that current broker information given through the new CFTC is just misleading, incomplete and probably almost useless since there is a complete lack of knowledge about the actual time in which profitable accounts have been opened and the actual opening and closing of accounts which can mask profitability information to give unrealistic numbers of overall profitability as I showed in the above example. Nonetheless, it is better than having no information and it will be interesting to see as these numbers evolve during the following quarters (especially regarding account numbers).

If you would like to learn more about my journey in trading and how you to can learn how to have a higher like hood of achieving success with mechanical trading strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general. I hope you enjoyed this article! :o)

Interesting article Daniel, pretty much sums up the way statistics are used to mislead and mis-inform in so many areas, hospital/doctor waiting lists, school exam results, speed cameras vs road safety etc. As soon as government agencies and regulators want to show with statistics how they are improving things, manipulation is used by those feeding the data to show the desired results rather than the reality, by exploiting the poorly drafted specifications laid down.

Hello Dave,

Thank you very much for your comment :o) This is very true and the reason why every statistic needs to be taken with a great deal of caution until all the information can be factored in. This reminds me a little bit about unemployment statistics which can be changed dramatically depending on how you calculate the figures. For example the unemployment rate on most Latin American countries is just above 10% but it really is above 30% in some cases if you calculate it by European or US standards. In the case of forex brokers they only want to show what the CFTC forces them to since they are not interested in revealing any unnecessary information to their counterparts. Thanks again for commenting,

Best regards,

Daniel