During this past week I have written several posts about trading robustness and the use of minor currency pairs in forex trading. I talked about how – in order to have accurate simulations on minors in Metatrader 4 – we needed to develop daily systems which were able to arrive at accurate control point simulations in which the accurate well known daily charts could be used and the lower time frames (less accurate for these spreads due to historical spread variations) could be avoided. On today’st post I will be sharing with you my efforts to develop systems with minors using my genetic programming framework (you can read more about it here, here and here) and what preliminary results I have been able to achieve. I will talk about the different pairs I used, the profitability of the results I achieved and why these results are bound to be robust, non-curve-fitted and a good startup point for the development of a minor-based portfolio.

Minors constitute an important part of forex trading because they constitute the majority of instruments we can trade. Aside from the 6-8 major highly-liquid currency pairs, minors form the rest of the foreign exchange over-the-counter market. It is therefore important for us to consider the trading of minor currency pairs if we want to achieve a higher degree of diversification and less exposure to the USD than with the main major currency pairs (which are almost entirely based on the USD).

–

This leads us to find minor based strategies which are profitable on each one of the different instruments available. When I was confronted with this problem, I immediately thought that my genetic framework might be the best way to develop sound and reliable systems to trade the minors, obtaining reliable simulations and generating transparent systems we could analyze to determine what sort of inefficiencies are bound to work on the different less liquid pairs. The systems developed worked on the daily charts and provided accurate control point simulations. The building of the systems was performed from 2003 to 2009 while 2010 was left as an out-of-sample year to further avoid any curve fitting that might have happened due to the inclusion of the whole trading period. It is also worth remembering that the framework is very restricted to only build systems with simple entry and exit criteria that are symmetrical in short/long entries/exits.

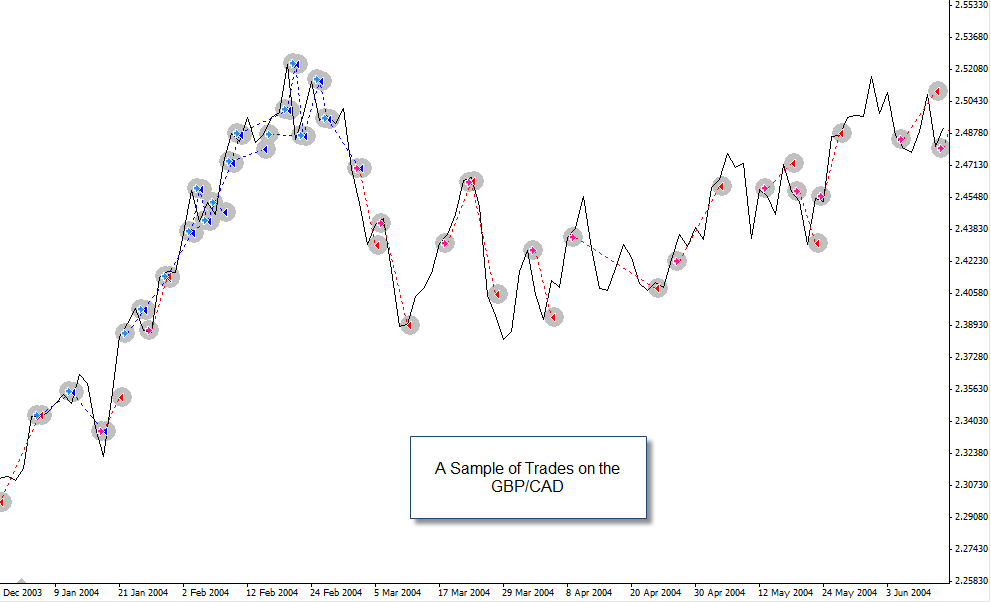

Perhaps the most interesting part of this was to analyze the results obtained for the different minors and what the “framework” came up with as a solution to achieve long term profitability on these pairs. Interestingly enough the solution depended on how much each different currency pair “trended” and how volatile its movements were. On the more volatile pairs the system opted to use only range-trading or trend-following-on-retracement techniques (buying low, selling high) while on more trendy pairs the system decided to use trend following techniques. It is interesting to note however that the system found an “equilibrium” on each pair, using a combination of both of these techniques depending on the actual character of the pair being traded. On pairs like the GBP/CAD – shown above – the system decided to use both techniques, following the trend using long term indicators (only very established trends) while fading trends that are just “weak” in nature.

–

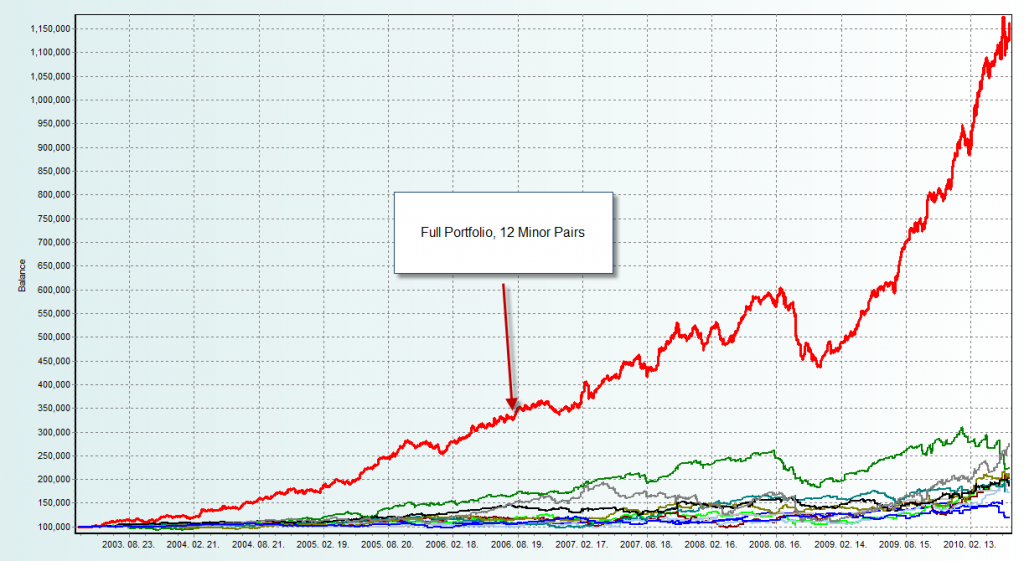

This way of developing systems allows us to easily develop sound trading tactics for a whole portfolio of minors in an almost automated fashion. By following this procedure on most minors I was able to obtain a trading portfolio which contains a lot “new instruments” we have never traded in Asirikuy. With an average compounded yearly profit of 38% and a maximum draw down of 28%, the portfolio achieves a good average compounded yearly profit to maximum draw down ratio of 1.38, in line with many good portfolios obtained using current Asirikuy systems on majors. The fact that the portfolio also relies on a wide variety of non USD pairs also makes it a perfect diversification against this currency and a good portfolio to trade under non-USD denominated accounts. Of course, we can make portfolios using all JPY, EUR, or CAD pairs (for example), something I will talk about within a future post.

As you see, this genetic framework is an extremely powerful tool for the development of trading strategies, allowing us to obtain results for any instrument we want with the certainty that the trading system obtained will be transparent (easy to understand) and the possibility of curve fitting will be minimal. Most importantly, the systems have adequate worst case draw down values that would allow us to stop trading them shall their statistical characteristics deviate from the long term values determined in testing. I am currently continuing my work on this genetic programming mechanism, expecting to release it in January 2011.

If you would like to learn more about automated trading and how you too can develop your own likely long term profitable mechanical trading strategies based on sound trading tactics please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)

Daniel,

I would like to know whether 1 year out of 7 is enough for forward testing.

Shouldn’t this period be longer?

Maxim

Hello Maxim,

Thank you for your comment :o) I consider one year out of seven enough here to “prove the point” that the system preserves its statistical characteristics in an out-of-sample basis. However from a practical point there is no “long enough” walk forward period and there is never the certainty of future positive results. From the perspective of curve-fitting, the fact that the system performs well outside of the first sample talks about the “robustness” of the strategy. Increasing this period would sadly reduce the amount of optimization “space” significantly and therefore the system would lack enough previous data on which to get optimized. I believe however that one year is enough to prove the above point although continuous running under live conditions is necessary to see where this eventually gets us. Thank you very much again for your comment,

Best Regards,

Daniel

Hello Daniel,

as I understand from the preliminary informations about your genetic programming framework, it will allows to find for a currency pair or for a system portfolio the best inefficiency to exploit, and consequently the best trading strategy with the best settings. So in theory this will make it possible to code the “ultimate” trading system, as no human brain could do better than a computer in analysing a very big amount of data and find out the best ones. So should we imagine that after the releasing of such systems, nothing better could come and this could be considered the ultimate point in Asirikuy systems development?

Thank you.

Kind regards.

Maurizio

Hello Maurizio,

Thank you for your comment :o) Well, what you are saying is probably an exaggeration regarding what the framework can do. I developed this programming framework in order to allow us to find inefficiencies on different currency pairs in a small amount of time but many restrictions were made in order to make this a possibility in MT4 as well as to ensure that the framework does not simply generate curve-fitted solutions which are sure to fail in the near future. The genetic framework does NOT create the “ultimate system” it merely finds inefficiencies within a given pair, doing this in a way which guarantees both system transparency and future robustness to some extent. Certainly the results of the framework will be improvable through manual reanalysis and modification and the strategies it “generates” will not be considered – by any means – “the best possible”. Probably you will understand this a lot better when the framework is released to the Asirikuy community in January but for the time being it is important to understand that the systems created are mainly simple transparent robust strategies (at least through my perception) but they do NOT constitute the “best possible strategies” or anything close to that definition. I hope this answers your questions :o) Thank you very much again for your comments,

Best Regards,

Daniel

PS : System development, never ends :o)

Thank you Daniel. In fact it is difficult to completely understand the characteristics and the potential of this tool, and how it works in details. So we just have to be patients and wait a little more…

Thank you very much for all your news.

Kind regards

this is a very interesting concept for sure, have you ever heard of a program called http://www.tradingsystemlab.com it seems to do along the same lines of what you have spoken about in these four post. -Matt