Mechanical trading must be one of the most misunderstood ways of making a profit on the market. All new traders believe that mechanical trading is the answer to their “prayers” because they believe that making a long term profit from systems with clear rules is easy, trouble-free and worry-less. Without a doubt, inexperienced traders believe that the only thing they need to become successful using mechanical trading is to find a “good” commercial EA and after they achieve this there will be no obstacle between them and long term profitability. Boy, couldn’t they be more wrong. On today’s post I am going to talk about the cycle of a profitable algorithmic traders, what needs to be done and why there is no “easy way” towards profitable trading in the use of automated strategies even though the “hype” might say something different.

There are many “common sense” arguments that explain why automated trading should not be an easy task. Things like “if it was this easy we would all be doing it” and “if it was this simple banks would be crazy about expert advisors” are some of the most common arguments you will find against the existence of an “easy way” to become rich or even make a steady income with automated trading systems. However these arguments do not convince inexperienced traders because they fail to see the reasons why the above are true, for most new traders there doesn’t seem to be such a problem. If I can load a system that “works” what would prevent me from getting rich ? New traders wonder.

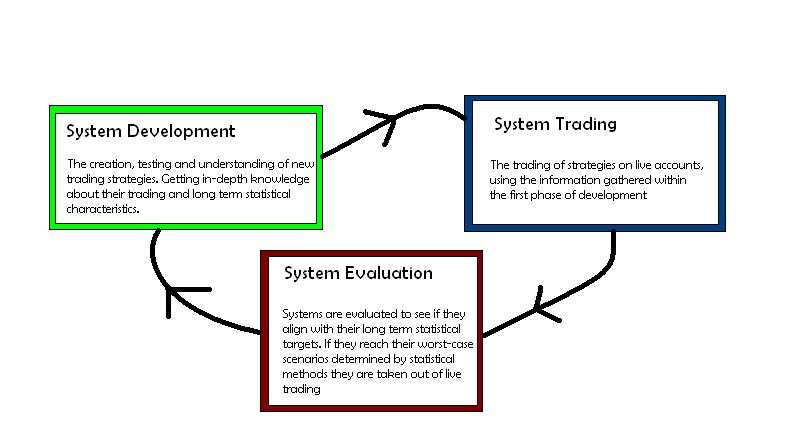

There are several truths about automated trading systems that they ignore, and this ignorance is what leads them to believe that the above “easy riches” are possible. What does it really take to succeed in automated trading ? What do successful algorithmic traders do that allows them to actually make a profit in real life ? I will now explain the steps of the successful “profitable algorithmic trader cycle” so that you can see the huge amount of effort it takes to succeed and why there are no ways to “avoid this cycle” if you want to get success through the use of mechanical trading strategies.

The first step of the cycle is what I call the “development phase” within this phase a trader develops and evaluates a strategy which has a clear long term statistical edge based on realistic simulations. During this phase the trader also uses other statistical tools – such as the Monte Carlo simulations discussed yesterday – to determine the worst-case or “failing threshold” of the strategy, the point where the system will be deemed to risky to be traded. During the development phase the trader deeply analyzes the strategy understanding draw down cycles, draw down depths, profitability periods, etc.

The next phase is the trading phase. For experienced algorithmic profitable traders there is no such thing as a demo test, small live test, large live test sequence as it has become popular with retail traders. If a system was developed with all precautions in mind a small demo test to confirm coding execution will be followed by the large scale loading of the system on a portfolio.

A very important thing that distinguishes profitable algorithmic traders from retail traders is the fact that the first group has a variety of trading systems THEY coded to satisfy their needs, a group of systems that continuously works as a portfolio in which many systems which are perfectly understood (all went through the first phase) are used to achieve success.

The last phase – and probably the most important – is the evaluation phase. During this phase a trader looks at the statistical results of the systems over a given period and evalutes whether or not these results fall into the expected profit and draw down scenarios forcasted by the extensive initial analysis. If this is true then the trader removes the system from the portfolio and enters a new development phase to create a new system to fill its place.

Truth be told, from the few retail algorithmic profitable traders I know, none fall out of this cycle and none use commercial trading systems. All of them develop their own systems and evaluate them in such a way that they understand them better than the palm of their hand. The concept of trading a “black box” (as in a commercial system) is foreign to all successful automated traders and the focus lies on developing systems to build portfolios, continuously evaluation those portfolios and systems to change them when they fall out of their statistically predicted performance regarding draw down, consecutive losses, draw down period lengths, etc. All trading systems can eventually fail (this is a reality) and the only thing that guarantees success is the continuous effort to develop new systems and evaluate current ones.

It is easy to see why there is no such thing as “easy mechanical trading” when you look at the reality of the field. Success with automated trading systems requires hard work and a lot of commitment. I personally spend 40-60 hours every week only creating and researching the strategies I currently trade, for the successful algorithmic trader, trading is only the tip of the iceberg as system development and evaluation takes a lot of time.

Definitely I believe anyone can be successful with automated trading if enough time, dedication and effort is put towards it. Like with everything else in life, success is not achieved by “sleeping” and watching the money “roll”, success is achieved by committing to the development of profitable systems and – most importantly – to the understanding of EVERYTHING that is being done. The in-depth understanding of the trading systems and portfolios used is what finally allows traders to “breach” the psychological and ignorance barriers between them and long term success in trading.

If you would like to get a true education in automated trading to learn how you too can develop your own systems and portfolios based on sound trading tactics and realistic profit and draw down targets please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)

This is back from 2010.

I wonder what the author would have to say about sites such as Quantopian that offer backtesting platforms for free.