A few days ago I wrote a post where I showed you the first Coatl portfolio I intend to use on a live trading scenario. Although this demonstrates that Coatl – by itself – can breed systems which are profitable around 10 year simulations with out-of-sample testing periods it is also interesting to note that the systems generated by Coatl constitute a useful source of additional strategies for either the improvement or creation of Atinalla portfolios (this is the name of the portfolio creation project within Asirikuy). During this post I will talk about some of the experiments I have done with the pairing of Coatl and other Asirikuy systems, showing you how Coatl based strategies are indeed a valuable source of diversification for our current trading system arsenal.

For those of you who are not familiarized with Coatl, it is a native MQL4 simple and user friendly genetic programming framework which I created to expand our ability to create likely long term profitable systems to trade the forex market. Coatl is able to find profitable simulation trading scenarios for any instrument (at least every instrument I’ve tried it on) increasing our ability to find inefficiencies on currency pairs where this hasn’t been possible in a manual way. As I showed a few days ago Coatl can be used to create portfolios to trade a wide array of different currency pairs, allowing us to greatly diversify our trading in a robust way.

–

After seeing the potential of Coatl for the development of individual systems I became curious about the potential of individual Coatl generated strategies to work with regular Asirikuy trading systems. Obviously the ability to generate likely profitable systems for every pair is very good in the sense that it can allow us to improve the diversification and market exposure of several of our current Atinalla portfolios or create new ones with better overall characteristics.

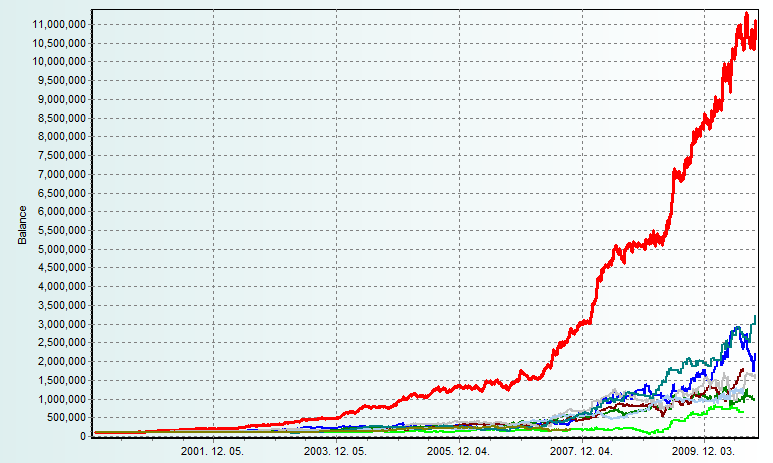

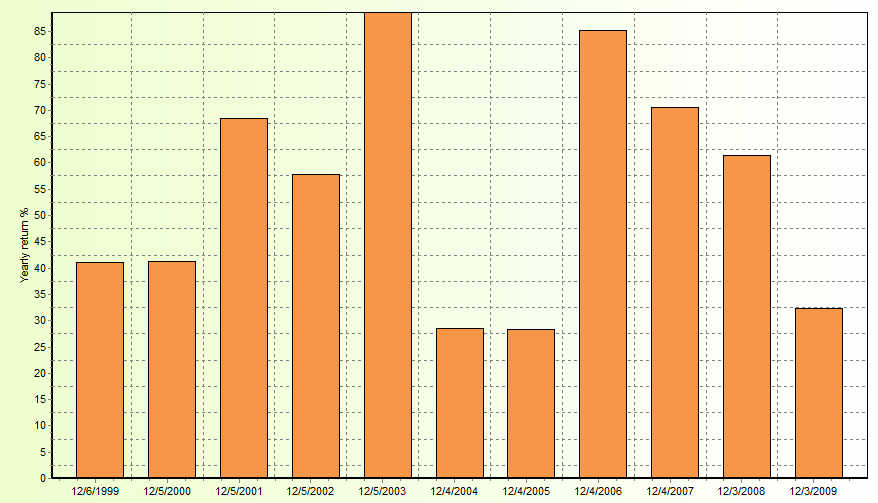

The first experiments I did involved the building of “instrument couple” portfolios in which 3 different instance are used to trade each one of the two pairs within the portfolio. To see if Coatl managed to improve the market exposure of Asirikuy systems I built portfolios using 2 Asirikuy EA instances per symbol and a Coatl generated strategy as a compliment. Doing this experiment for several different symbols revealed that Coatl helped Asirikuy trading systems in most cases, particularly in cases involving symbols where a very limited set of systems is available (like the USD/JPY).

After doing this I also looked at how Coatl worked against other daily systems such as Quimichi and Ayotl. The results showed that Coatl didn’t compliment other daily systems that well when used on main trending pairs (where Coatl attempts to do something alike what these systems do) but when used on pairs which have trends which are less clear the genetically designed systems managed to greatly improve the results of these daily long term trend following strategies. Coatl then compliments trending strategies on symbols where these strategies do not work that well and reinforces the profits from trending on symbols which have this behavior.

Certainly another advantage of Coatl is its ability to “fill holes” on portfolios which need to have more symbols to increase their level of diversification. For example if we have a portfolio using 5 different trading strategies on 4 symbols we might use 3 Coatl systems to increase the number of traded symbols to 7, something which brings an implicit additional robustness and – more often than not – reduces overall market exposure and increases the potential gains attained by the portfolio as a whole.

It is also curious to note here that since Coatl can generate a varied array of strategies it can even generate systems that hedge each other. Although the potential to do this is limited (since Coatl strategies for the same symbol usually share some properties) it is clear that combining several Coatl strategies may be beneficial for robustness. Perhaps the best way to combine Coatl strategies on the same symbol might be to use strategies on different time frames such that daily, 4H and 1H trending inefficiencies are covered.

–

–

Through this analysis I have taken a small glimpse at the large potential of Coatl generated strategies and what can be done with them. Right now I continue my research into these strategies and their pairing amongst themselves and with Asirikuy systems and I hope to start evaluating them in live trading within next month. As you see Coatl has greatly expanded our potential for the creation of likely profitable strategies, hopefully making the replacement of strategies in the future and the building or improvement of portfolios a “walk in the park”.

If you would like to learn more about Coatl and how you too can learn to build your own likely long term profitable strategies based on sound trading tactics please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)