During December 2010 I was very happy to release the first counter-trending Asirikuy stategy within the Watukushay Project. This strategy – named Sapaq – is a counter-trending system used to trade during the European sessions after an average-like Asian session develops in tune with the previous day’s trading progression. This system was the first Asirikuy counter-trending strategy, showing that likely long term profitable systems can also be developed through the use of non-trending techniques if they are based on adequate analysis and observation. One of the best consequences of getting this trading technique was the powerful hedging power it has while trading with other Asirikuy systems, reason why it was only logical to attempt to include it within Atinalla portfolios. On today’s post I will share with you some of the results I obtained when adding this powerful system to some of the currently available Atinalla setups.

As you may have learned through the past few months of blog posts, the Atinalla Project was developed in Asirikuy as a way to encourage the creation of portfolios using Asirikuy trading systems. The project quickly sprout five different portfolios (No1-4 and FE) which show the power of system diversification and the amazing hedging of draw down that happens when different trading strategies are combined. However, due to the nature of Asirikuy systems Atinalla portoflios had – up until now – only used trending techniques to profit from the market.

–

Certainly you might think that the mere inclusion of a counter-trending system would hugely improve any trending portfolio but the truth is that the use of a different trading technique does not necessarily guarantee that the systems will hedge each other’s draw down periods any better than two trending techniques. The important thing when you consider the joining of trading systems in a portfolio is not that much the nature of how they trade but the practical hedging of draw down they show. Different trending techniques can hedge each other extremely well while a counter-trending/trending pair can show almost no hedging.

However I was pleased to discover that Sapaq had one of the biggest negative correlations regarding the location of draw down periods against some of the most importantly traded trending strategies, especially against the God’s Gift ATR and Atipaq (Watukushay No.5). For this reason it became an obvious objective to try to diversify all Atinalla portfolios with the inclusion of Sapaq, something that gave good results in all cases and especially for the Atinalla No.3 and No.4 portfolios. The first two portfolios didn’t have a very big improvement since they do not use Atipaq and only use the GG ATR slightly, since Sapaq doesn’t hedge Teyacanani very well (because Teyacanani can change trading direction with amazing plasticity) the results only show a moderate improvement.

–

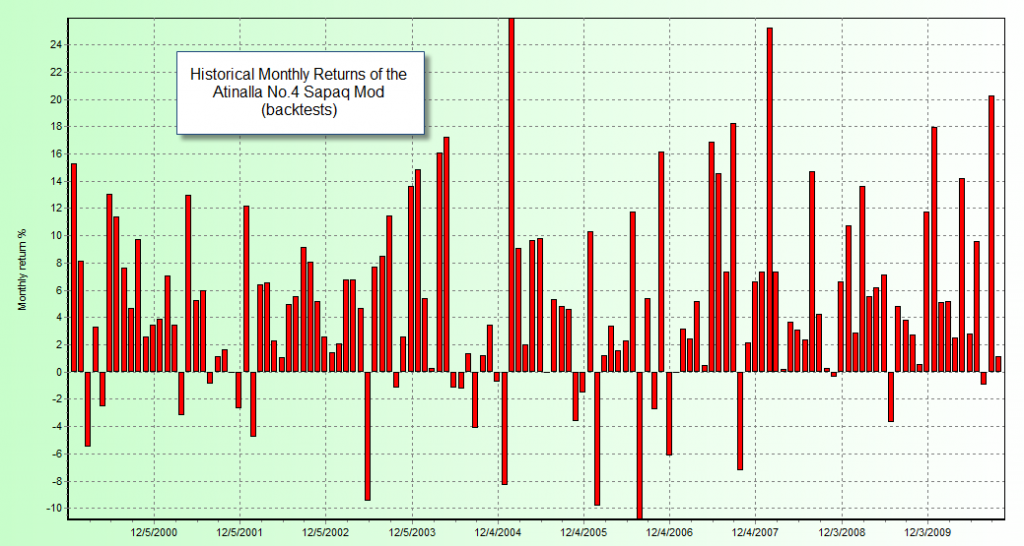

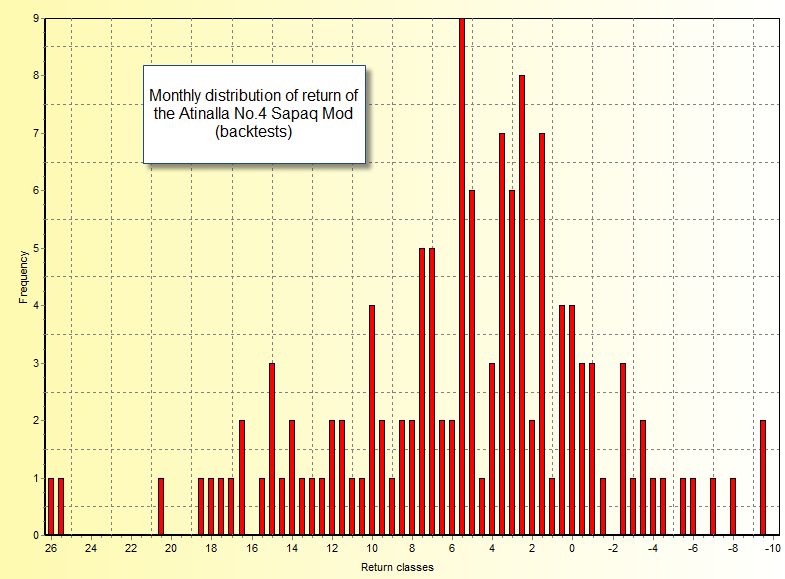

However for Atinalla No.3 and No.4 the results are nothing short of amazing. The inclusion of Sapaq on the portfolios causes a great increase in profitability and a very important reduction in draw down bringing the historical average compounded yearly profit to maximum draw down ratio above 4 for both portfolios and almost above 5 for Atinalla No.3. The results of the distribution of monthly returns also change quite dramatically improving by a very large degree when compared with the non-Sapaq modified portfolios. For example Atinalla No.4 shows a probability have a winning month above 80% something that makes it potentially much easier to trade.

Overall the inclusion of Sapaq on both portfolios shows an increase in profitability, a decrease in draw down and an improvement on the distribution of monthly return. The kurtosis risk of Atinalla No.4 also diminishes while the kurtosis of Atinalla No.3 decreases below that of a normal distribution (making the risk of getting extremely low/high returns much lower than before).

Certainly the very positive effect achieved by Sapaq on these portfolios is caused by the very good negative correlation seen between this system and Atipaq and the GG ATR which cause the improvement to be quite big. This can be explained by the lack of flexibility of these two systems as they take significant amount of time to change their directionality causing Sapaq’s entering of counter-trending movements to hedge their open draw downs when they go into losing periods and vice versa. Certainly this shows that although counter strategy techniques do not offer better hedging by definition (compare Sapaq with Teyacanani for example) but when trading strategies have similar flexibilities and the counter-effect is more pronounced very strong improvements do arise.

Information about these modifications : the Sapaq instances used, the risk parameters implemented, etc will become available to Asirikuy members within a few hours (along with this week’s videos and newsletter). If you would like to learn more about Asirikuy trading systems and how you too can develop reliable trading strategies through the use of sound trading tactics and analysis please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Daniel-

Congratulations, these results are amazing!

They may even be life-changing in the sense that if I have a reasonably good chance of making 50% per year, it changes from just earning a decent return to actually being able to live comfortably off of forex trading – and have a life at the same time!

The lack of NFA compliance poses some challenges, but we have FXDD as one solution. Also, I should be able to acheive the same affect by trading the original portfolios in one account, and the Sapaq instances in another account. Let me know if you can think of any reason why that wouldn’t work.

Thanks again and keep up the great work!

Chris

Daniel-

Those results from Watukushay #4 are even better, close to 75% average return, amazing!

Regarding my comment above, I understand that running the Sapaq instances in a different account is not quite the same thing since they don’t share the capital with the other systems like when you run them together. So I retract the question.

Thanks again, great work,

Chris