In Asirikuy we are always looking to increase our earning potential to achieve portfolios which have bigger profits and smaller draw downs. Within the past few weeks one of the most important discussions that has emerged in this regard deals with the use of very large system portfolios and how the use of many different trading systems seems to greatly improve the results which can be achieved overall. Certainly there are many things which need to be evaluated before we consider if such results are indeed realistically obtained, something which I intend to do within this post. Within the next few paragraphs I will explain to you why the addition of systems increases profitability exponentially and what things need to be taken into account to run very large system portfolios.

When I started to build portfolios for Asirikuy (perhaps near May 2010) one of the first things I noticed was that the combinations of more systems seemed to greatly improve the results of the overall portfolios. Whenever you add more systems to a portfolio the draw down periods seem to decrease while profitability just increases in an exponential way. The reason why this happens is because – when you use a portfolio where all systems are profitable – the draw down periods are always hedged in some part while profits are compounded in the long term. So while the profitable periods of the different systems “better cover” draw down when more and more systems are added, profits become exponentially additive as each system uses the gains made by its counterparts to achieve even higher profitabilities.

At first I thought that such splendid results where perhaps only caused by the massive neglect of floating losses (as we had no way to evaluate this at the time) but after we implemented adequate equity tracking within our profit and draw down analysis tool it became obvious that equity issues were only minimal and the very large profits and draw down values were indeed achieved without any neglect of open draw down values. It is here when things become more interesting because the prospect of extremely profitable portfolios becomes closer.

The most important deterrent for the use of large portfolios – and the most important thing anyone who uses them must take into account – is without a doubt margin requirements. When leverage is quite high (about 1:100) there is no problem with the usage of such large portfolios (even 20-30 systems can be used comfortably) but as account sizes grow the leverage becomes smaller and therefore larger capital becomes necessary to trade portfolios with large numbers of systems. It is quite true that after a 100K account size the use of such portfolios may become impractical at the required risk levels to achieve very high profits and evidently a lowering in risk would therefore need to happen to allow the trading of the portfolios at a 1:10 leverage, or perhaps less.

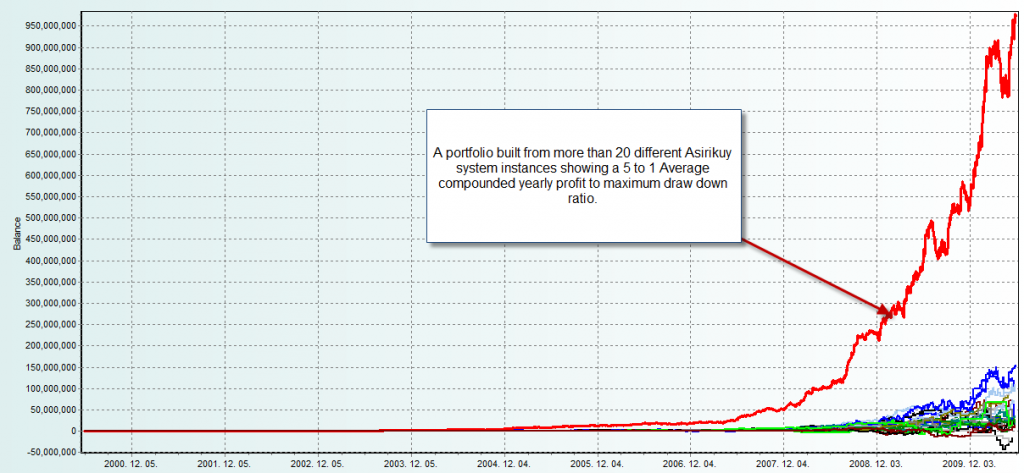

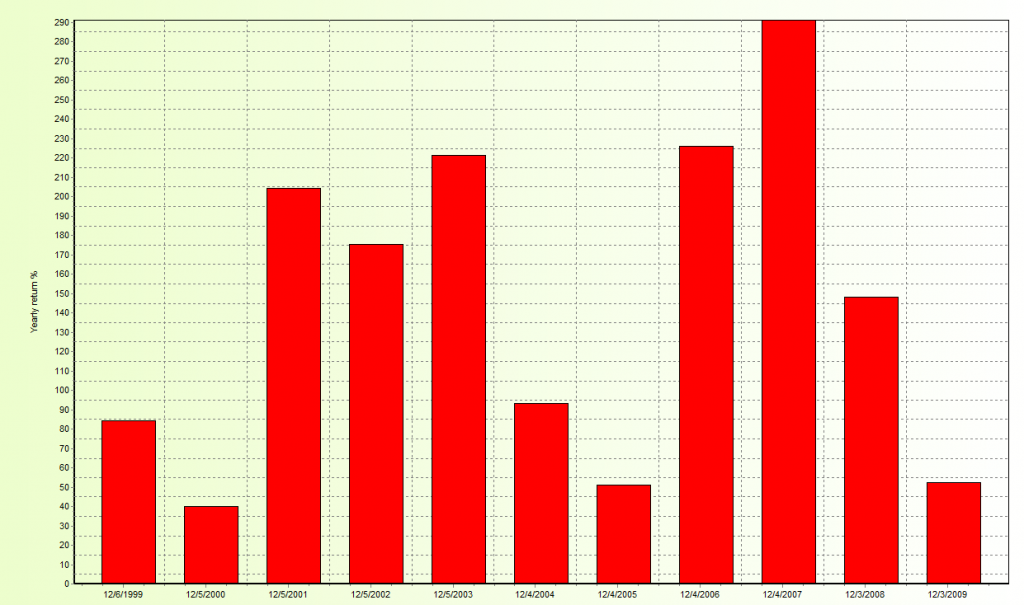

This means that although high profits might be possible under small account conditions – due to the ability to use a larger number of systems – in the long term results might be capped by the amount of money which the user can put into the market and therefore the portfolio may offer a regular sized return, although such return would be offered with a potentially much lower risk. Another thing – which is an obvious cap of all portfolios – is the fact that some losses made by systems which start to “fail” will remove part of the profitability of the account, potentially reducing its profit by a significant amount under unknown future market conditions (when some systems are inevitably bound to fail). Below a yearly profit chart of a 26 instance portfolio.

–

Overall the prospect of the “big system portfolios” points to a very interesting journey where it might certainly be possible to achieve great overall results in small accounts for rapid account growth. When using Asirikuy systems very high average compounded yearly profits to maximum draw down ratios might be achievable which may allow the rapid growth of small amounts of money (3-5K USD) to larger amounts in a smaller period of time. The simulations present up until now do suggest that equity draw downs should not be a problem (with systems rarely having more than 1 to 5 trades opened at the time) and average compounded yearly profits of 80-100% might be achievable with a reduced risk according to the simulations, although taking into account potential system failures in the future that number might be reduced to some extent.

Of course, other practical limitations also need to be taken into account and an adequate division of the systems amongst several MT4 platforms or VP servers must be carried out to ensure that everything is executed without lag and within the required system parameters. Although it would be wrong to assume that the results shown in such profitable simulations can be achieved as a fact, the evidence gathered through very careful evaluation and simulation of big system portfolios suggests that such a possibility – at least for small sized accounts – might exist with the profit potential above 100K being capped to a yearly profit of about 15-30% due to leverage and execution restrictions.

Another very important thing to consider here is that many “big portfolios” do NOT achieve better results than carefully chosen portfolio selections. For example the best results I have ever achieved with a combination of Asirikuy systems (which I will also share amongst the community this weekend) uses only about 8 different instances. This also proves that although the simple “piling up” of systems gives profitable results, careful choosing of portfolios based on their correlations and covariance levels can potentially yield much better results which may even be extrapolated to larger accounts due to the lower margin requirements.

If you would like to learn more about system portfolios and how you too can build your own portfolios with sound trading systems you can design yourself please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Just one more confirmation that I belong to the best forex community on the planet…….. 8^)

Gives me more reason to be CAUTIOUSLY hopeful.

I personally cannot wait for your release of the 8 system combination that you have found, and are you going to start any challenge accounts running this combination?

Would you also give advice this weekend to those of us that may want to run this combination on our own accounts as to needed vps space, amount of mt4’s to be able to run this portfolio, along with all other cautions that you might have?

Hello Josh,

Thank you for your comment :o) Well certainly it makes me very happy that you consider this the best forex community on the planet! I certainly do my best to make it that way :o). Regarding the 8 system portfolio, it is actually more than that, I will be suggesting modifications for all Atinalla portfolios regarding risk balancing, system additions, etc so that all Atinalla challengers can improve their expected results. Obviously this will be accompanied with a video including all relevant aspects of the suggested portfolios, etc and you can definitely adopt them on your challenge account if you wish to do so. Thank you very much again for your comment Josh :o) I hope you continue to enjoy the community for a long time while you achieve all your financial goals !

Best regards,

Daniel