The finding of trading systems through the use of our simple – and yet effective – new genetic framework in Asirikuy has been my objective for the past few weeks. Although I had previously done some experimentation with the framework and found a lot of likely profitable systems for the Asirikuy community to use as examples, I had yet to use the full power of the framework to arrive at systems which showed its true potential. Now after more than a week of continuous optimization I will be revealing to you some of the results I have obtained with Coatl and why I believe systems generated with this framework are bound to be robust and powerful strategies for the years to come.

For those of you who may not be familiarized with Coatl, it is a simple genetic framework I develop in MT4 to aid us in the development of trading strategies and -particularly – for the finding of inefficiencies on pairs in which the task of finding them manually is personally difficult for me due to my lack of familiarity with certain pairs (like JPY crosses, USD/CAD and some others). Coatl uses reliable control point simulations to build reliable trading systems on time frames on or above the one hour and uses very coarse 5-10% optimization steps and a simple one-entry-logic one-exit-logic approach which reduces the possibility of curve fitting to a large degree.

+

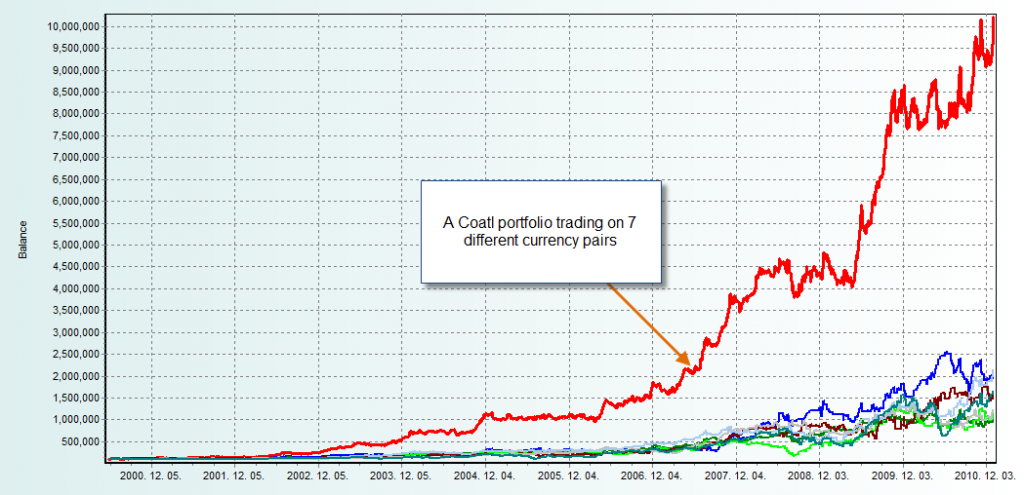

Two weeks ago – right after releasing the framework – I started to use the released version to come up with a profitable portfolio based on 11 year EOD (End of Day) data for at least 7 different forex currency pairs. The reason why I chose the daily data to start with is that systems developed within daily data are less broker dependent, technically more robust (as daily behavior is more “fundamental to human psychology”) and much less prone to be affected by spread or slippage issues.

In order to create the systems I ran Coatl from June 2000 till January 2010 and after the creation process was done I chose the systems with the best average compounded yearly profit to maximum draw down ratios. After this was done I then performed a full test from June 2000 till January 2011 to confirm the ability of the systems to survive to one year of “out of sample” testing. I also performed 5% parameter variations in order to confirm that the systems were robust and did not lose a significant portion of their profitability when their logic got “jiggled” a little bit. I also repeated all final simulations using the “every tick” mode to ensure that no underestimations of profitability had been done by the control points method and I even used our “equity logging” functions to ensure that no open draw down underestimations were present.

–

After this I analyzed the entry and exit logic of all the different strategies to see if they made any sense from a rational trading point of view and I took the time to build a chart showing all the different ways in which the systems had achieved their profitable simulations results on the different pairs. This was a great exercise which allowed me to both understand better what to expect from each of the different instances and to understand better what inefficiencies are exploitable amongst different currency pairs. Doing this also showed me which pairs are similar and which pairs are different from each other, enhancing my understanding of the overall forex panorama.

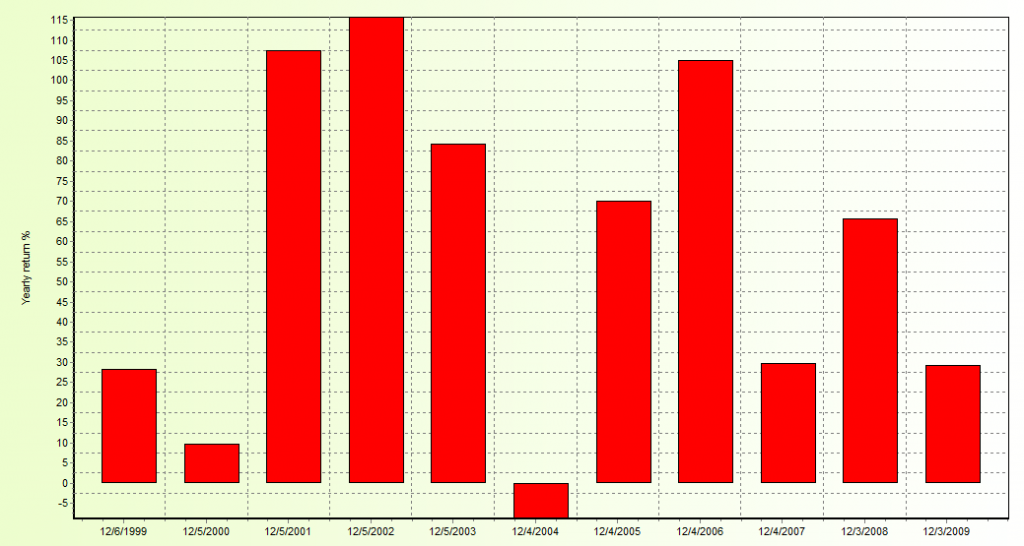

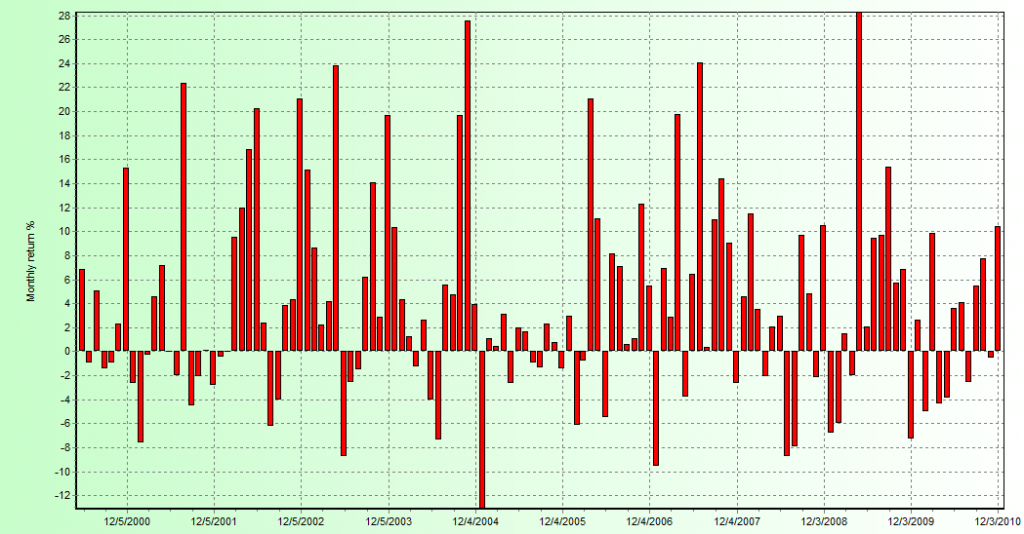

The results of the portfolio Coatl finally came up with are actually very good with an average compounded yearly profit to maximum draw down ratio of 3 and a 64% probability of achieving a profitable month. Although the results do show a losing year through the whole 11 year period, this is only slightly losing while profitable years are much more favorable. Monthly yields also show a surprising accumulation and frequency of profitable outcomes, something that is quite rare for a portfolio trading on the daily time frames. The first Coatl bred portfolio therefore achieves very good and robust results on over 7 different currency pairs, taking our system trading towards the next level.

–

This is going to be the first portfolio I will be officially releasing in Asirikuy designed fully by the Coatl genetic framework, a portfolio which will start trading in live accounts within next week. During the following weeks I will be focusing on the building of a daily minor and a 4H major portfolio, additional portfolios which will certainly provide us with an added degree of diversification and robustness. Along this and next week I will also share with you some additional insights – which I learned from the analysis of this portfolio – which gave me a much clearer perspective about the forex market plus some interesting findings I made when grouping Coatl based systems with traditional Asirikuy strategies.

If you would like to learn more about my work in automated trading and the simple but effective and user friendly genetic framework I have developed for MT4 please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Dear Daniel, thank you for giving us a so powerful and at the same time user friendly tool as Coatl is. I have some question about this portfolio. Did you try to run it starting from 1990, taking the years from 1990 to 2000 as an out of sample test period? Which result did you have?

Did you make a second step optimisation including stop losses and take profits or the closings are just logic dependent? Thank you.

Kind regards.

Maurizio

Hello Maurizio,

Thank you for your comment :o) I am glad you like Coatl and that you consider it user-friendly, I definitely wanted all Asirikuy members to be able to use it so I made it as easy to use (and yet as powerful) as I could :o) Regarding the portfolio, only a few of the instruments have EOD data back to 1990 so only a few could be tested in the way you suggest. As I said on the article for this system I followed the regular 2000-2009 and 2010 out-of-sample procedure so currently I do not know how some of these systems might have performed before 2000. I plan to run this portfolio and develop another one which is developed with 1990-2000 as an optimization period and out-of-sample tested from 2000 to 2010. About the optimization steps I did a single fully correlated run where everything was taken into account. I hope this answers your questions :o)

Best Regards,

Daniel