If you just skim through the Forex automated trading system development forums you will find one or two people interested in finding the “worst” possible system. The idea – which seems to be based on “common sense” – is that if you find a system which simply losses a big percentage of the time you’ll be able to reverse its logic to come up with a system that produces at least a profitable outcome. People who think this idea “might work” usually lack an understand about what makes a system fail and what makes a profitable system profitable. On today’s post I am going to share with you my experience on this subject and why reversing strategies simply does NOT yield any useful results.

Picture this, you’re becoming frustrated with system development – as you fail to produce anything with an edge – and you start to feel that what you need is precisely the opposite thing. If you find a system which simply has lost money most of the time you’ll be able to “turn it around” so that it becomes a very profitable strategy. Not only does this seem to have a lot of future but people will – without a doubt – easily give away systems that lose money very quickly and you – in a very clever way – will simply turn them around to make your money. What could go wrong in this perfect strategy? The problem comes when you consider the true reasons why strategies and traders fail.

–

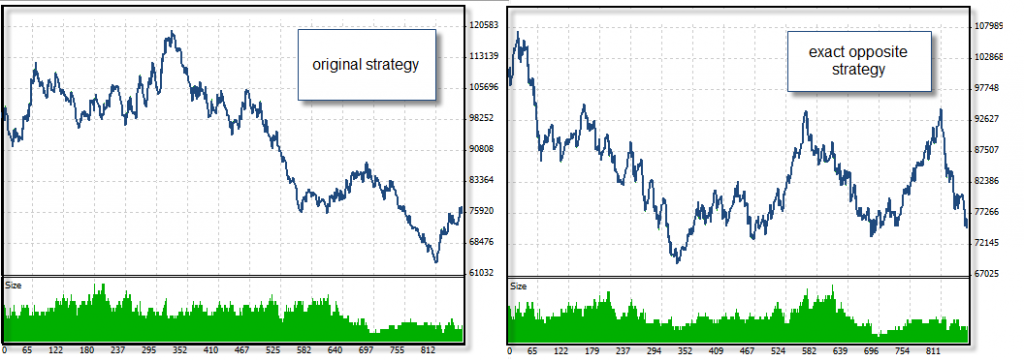

What makes a trader or strategy lose money in the long term? The supposition that reversing a losing strategy produces a profitable one comes from the assumption that a losing strategy has a “negative edge”. This supposes that a strategy behaves like an individual trade (if you had entered that losing trade the other way around you would’ve made money, right ?) which means that reversion implies the opposite outcome. However when viewing strategies we need to consider that systems and traders lose money NOT because they have a negative edge but simply because they have absolutely no edge, meaning that they will lose money as a consequence of their trading volume and the paying of the spread. Traders and systems without an edge which trade more will lose money faster while traders and systems who trade less often will take longer to lose money. However the reversion of losing strategies only produces another losing strategy because – in most cases – there is simply no edge to begin with. Of course, reversing any profitable strategy produces a losing one but the opposite is NOT true, this arises because profitability requires an edge while losing merely requires you to have none or to have a negative one.

Perhaps this is best illustrated with a simple experiment I carried out a few months ago. I told two aspiring traders that new traders almost always wipe their trading accounts so in order to find out the reason why I told each one to mirror the other trader’s trades. If both beginners had a “negative edge” due to some reason then both of them would in the end make money since they would follow the other’s trades. Each trader had two accounts, their personal account and the account they used to mirror the other person’s trades. In the end the inevitable happened, both traders lost all their money on their 2 accounts (only paper money). Why ? The reason is that beginners lose money because they have NO EDGE not because they have a negative one.

In the end a negative edge is just as rare as a positive one as it implies the finding of an inefficiency which can make you lose money faster than the spread. Definitely finding a losing strategy with a negative edge and reversing it will produce a profitable system but doing this is quite stupid since you will have to do twice the testing to know if the losing system is losing money because it has no edge or because it has a negative one. It just makes more sense to develop strategies seeking for profitability (a positive long term statistical edge) rather than trying to find a negative edge amongst losing systems where almost all losing systems you’ll find simply have no edge whatsoever.

It is also important to make it clear that systems that seem to “lose money all the time” not necessarily have a negative edge as they may simply had no edge but trade too frequently. Any system that has no edge – as I mentioned before – losses money as a function of trading frequency so the more the system trades the quicker and “smoother” its losing of money will become. So next time you think about this idea of “turning a system around” remember that systems lose money because they have NO EDGE and – on the vast majority of cases – not because they have a negative edge. It is much simpler and in fact much more rewarding from a system production point of view to develop systems searching for long term positive statistical edges, what profitable system development is – in the end – all about.

If you would like to learn more about my work in automated trading and how you too can earn a true education in algorithmic trading and likely long term profitable system development please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Good article. I totally agree with Daniel. Like going to Casino, you bet alone or followed a really “bad luck” guy but betting the opposite way, the result probably would be the same, lose money.

Develop an edge before you approaching the market is the key I think.

Wilson

Hi Daniel,

while I think you are right in what you are saying about “having an edge” your proof is not correct.

By looking at the charts one can see, that trade sizes seem not to be identical and the nr of trades seems to differ slightly, too. For an “exact opposite strategy” it would be necessary to do all trades identical except the order type. It is something different than only toggling order type in OrderSend statements. If a strategy has a negative outcome over time and returns are a multiple of the spread, an “exact opposite strategy” will always have a positive outcome.

Regards,

fd

Hi Fd,

Thank you for your comment :o) Well, you’re right about differences in the lot size. This are caused by the adaptation against account balance which of course is different between the strategy and its mirror. However perfectly mirror strategies with fixed lot sizes also yield losing mirror images. You also need to take into account that a strategy will NEVER be a perfect mirror of another because when you enter a buy you enter at the ask and when you enter a sell you enter at the bid. This difference will make exits, profits and losses different from what you would expect from an “exact” mirror. It can therefore happen that you can have a strategy that seems to “lose faster than the spread” which when inverted yields another unprofitable strategy. There are many many reasons why the strategy of reversing losers doesn’t work, the above was just a small synopsis of what I consider most important. Thank you very much again for your comment,

Best Regards,

Daniel

Hey guys,

I just stopped by and read your comments and a thought or two popped into my mind. I have tried reversing a loosing strategy before on several occasions only to get Daniel’s results he mentioned in this post. In reading, I thought about how the stop loss and take profit seem to come into play in reversing a strategy as well as some of the factors already mentioned. If I have a strategy where I just flip the buy and the sell on the OrderSend and my TP is 50 pips and my SL is 50 pips (1:1), give or take some pips in the spread it could quite possibly have a good reverse effect. If I had a TP of 25 pips and a SL of 50 pips the story starts to become unclear if a reverse strategy would even be possible(1:2). This is due to the wins on the original strategy could have gone for more pips had you not stopped at 25 pips, which means in reverse those wins can become the deeper 50 pip loss. I think a similar problem comes up when you were going for 50 pips on TP and 25 pips SL (2:1). You don’t know if those orders in reverse are going to grab 50 pips. They may have stopped out at 25 pips but how do you know they would TP at 50 pips in reverse.

So in light of all this I think maybe there is some possibility of reverse strategy success if you were at a 1:1 flipping only the buy and sell on the OrderSend. But I would not hold my breath, and I suppose running a test would always prove to you if it worked or not. If you created a system with set variables and lot size, set 1:1 TP and SL, and came up with a 30% accuracy in a 10 year back test, sure why not?, you might want to consider a reverse look at the strategy.

[…] came across this blog post (link here) yesterday, which reminded me of the same point made by Andrea Unger during one of his talks: you […]

I just read this article and if you have been in the markets around for some time you will know that what Daniel tells is true. Is different to have a negative edge than to have no edge at all.

However, if you have a consistently loser strategy, where fixed TP/SL are 40 pips, and spread/commisions are not taken into account, I would think that if you reverse the strategy the outcome obviously should be positive – once again without accounting for spread/commisions.

What do you think?

This is true. However it’s the wrong route because it’s much harder to tell a “negative edge” than a positive edge. If you want to make money it’s simply easier to look for things that make money instead of looking for things that do not and try to separate them from things that lose due to other reasons besides a “negative edge”. Only systems with an edge make money but random chance and negative edges lose money and random chance is MUCH more common.