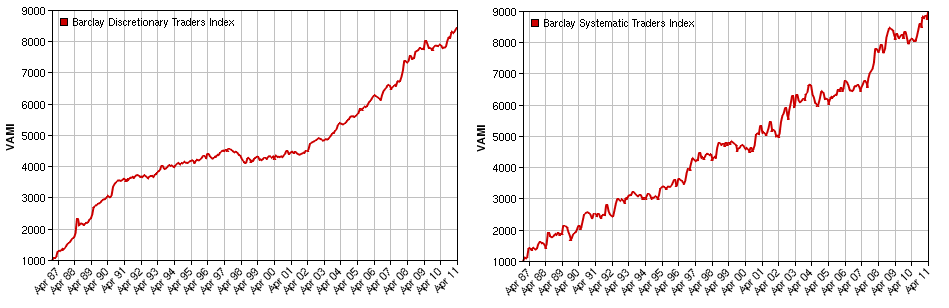

I bet most of you have had a very simple question on your minds since you started your journey in trading. Is discretionary trading better than systematic trading? Do traders who “get it” have an edge over those who simply use statistically sound systems? Does algorithmic trading even “work” at all? The answer to these questions is not very easy since there are simply few well-known sources of evidence where we can truly see what the long term success of both ways of approaching the markets are. On today’s post I will talk about the discretionary Vs algorithmic trader indexes of the Barclay Hedge group where you will see that discretionary traders have no advantage over algorithmic traders. In the end both ways of trading get very similar returns although they both have specific differences which we will discuss within the next few paragraphs.

How do we know if algorithmic trading is better than discretionary trading? Easy, find a source of information which has collected information from more than 100+ firms and individuals trading the markets and compare performance during the past 20+ years. Is there such a source of information? Yes! The Barclay Hedge group has collected this data over the past 20 years with both a discretionary and a systematic index with the hope of showing which approach is better. The discretionary index currently features 150 contributors (between individual traders and firms) which take their decisions in a discretionary way in at least 65% of cases while the algorithmic trader index features more than 400 contributors which make their decision using automated systems in at least 95% of cases.

–

–

When we compare both graphs the results are obvious to the naked eye. The end result of both indexes after 24 years of following has been VERY similar and – from a profit point of view – both algorithmic and discretionary trading contributors have had an overall similar return. This proves the point that discretionary and algorithmic trading are – at their top levels – quite similar regarding their overall profit capabilities. This makes sense as – after all – both types of traders are after the same markets and therefore the characteristics they can exploit in the long term are fundamentally the same. If a discretionary trader profits from long term trends so can a manual trader and while an automated system can profit from 24/5 trading and lightning fast execution this seems to be compensated by the higher level of “understanding” inherent to the human brain through discretionary trading. In the end results regarding profits are VERY similar.

From a draw down perspective the maximum draw down depth of the systematic trader index is more than double that of the discretionary trader index although the maximum draw down period length of this index is at least two times longer than the first one. Overall – when considering both factors – the systematic trader index actually has a lower Ulcer index than the discretionary trader index. So to speak we would have to say here that the systematic traders tend to go into deeper but shorter draw downs than the discretionary traders while the discretionary traders tend to go into smaller but much longer draw down periods. In the end the systematic index has a much more linear equity curve while the discretionary index has a much “less linear” look.

Another important factor here is the statistical significance of the results. Systematic traders are almost 3 times more abundant than discretionary traders and therefore the systematic index has more statistical value as it represents a higher percentage of the active trading population. While discretionary traders are just 150, systematic traders are 457, this higher number should imply that the systematic trader index covers more “extremes” from that same population while the discretionary index is more constrained.

Overall these indexes give us very important information about the markets, they show that systematic trading WORKS that draw down period lengths are overall smaller than for discretionary traders and that draw down depths tend to be in average greater than for discretionary systems. Do discretionary systems achieve a ton more profit than algorithmic traders? No! Both types of trading have – at their top levels – the same profit capabilities. It will be extremely interesting to keep an eye on these indexes as computers evolve as we will see how this affects the performance of one type of trading Vs the other. My prediction would be that the effect will be bigger and bigger as systems gain much higher capabilities (when they start approaching the human brain’s processing power). Note how during 1987-1995 the discretionary traders performed better but during the last few years (2008-2011), systematic traders have started to get ahead in terms of profitability.

Next time someone asks you if algorithmic trading works, just point them to the Barclay systematic trader index! If you would like to learn more about my journey in automated trading and how you too can learn and get a true education on this field please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

You won’t believe how much this topic was thrown down my thoat. People kept telling me automated trading is impossible, but I moved on and ignored them, very happy I did that :)

Thanks for the evidence!

Hi Franco,

Can you advise which EA you use?

kind regards,

Dave

So systematic traders made money, discretionary traders made money – but as we all know trading is a minus zero sum game (brokers / market makers made money) – so who the heck lost money then hmm???

The devil is in the detail or if you want there are small lies, big lies and then there is statistics. I doubt the value of these numbers unless I know the methodology. I would like to know where those earned money came from…

Hi Nelo,

Thank you for posting :o) Bear in mind that the Barclay trader index only covers a small fraction of market performers but all of them are audited perfomers who have traded for the past 10-20 years using either dicretionary or automated trading strategies. Who lost money so that these traders could make money? Well some of other traders out there :o) The index is just a sample of audited perfomers but certainly it doesn’t cover a large percentage of the market (remember that a majority of market participants lose money, evidence points to +90-99% in retail Forex). The important thing is that these results show that in the long term serious audited performers make roughly similar amounts of money whether they trade in a 100% mechanical or discretionary fashion. I hope this clears it up :o)

Best Regards,

Daniel

You cleared it up, thanks Daniel.