When you ask a new trader what it means to diversify in Forex trading they immediately run to some answers that seem satisfactory but which in reality yield no relationship which what we formally consider to diversify. Many traders will tell you that to diversify you need several type of strategies, a strategy for “ranging markets”, a strategy for “trends” and perhaps a “scalper” or a “counter-trending” strategy. It is obvious that a large majority of traders believe that diversification comes from the use of trading strategies that seem to follow different “basic principles” but in the end this has very little – if anything – to do with true diversification. On this post I am going to tell you what you should look for when diversifying and why the simple definition of what a strategy does is NOT enough to really know if you’re really diversifying your trading.

What does it mean to diversify? In trading this term implies that you will reduce your risk through the use of different trading setups. Note here that diversification has NOTHING to do with the types of strategies being traded but with RISK. If we interpret risk as the down side of a strategy combination (its maximum draw down), diversification only appears when joining two different strategies generates a reduction in the draw down WITHOUT sacrificing profitability. This means that when there is an increase in the average compounded yearly profit to maximum draw down ratio when you combine two strategies you are effectively diversifying your trading.

–

–

It is critical here – to effectively diversify – to separate the statistical and relevant notion of diversification from the simple use of “different setups” as using different setups on its own may NOT be diversifying your trading if the joint compounded yearly profit to maximum draw down ratio is NOT increasing. So if you’re trading two strategies, one trending and one counter trending but their profit and draw down periods are VERY directly correlated you are NOT doing anything as you’re effectively NOT diminishing risk even if you’re in fact using two strategies which seem to operate under very different inefficiencies. Diversification arises from the inverse correlation between the profit and draw down periods of different strategies NOT from the superficial differences in what they attempt to do (i.e what you define as how they trade).

Many people think that the simple difference in strategies implies an inverse correlation (for example trending and counter-trending strategies) but this can be shown to not be the case under many different circumstances. For example a counter trending strategy may have success as the same times as a trending strategy if the inefficiencies both of them exploit are in sync. For example the counter trending strategy may exploit pullbacks on strong momentum while the trending strategy may trade the breakouts that follow such pullbacks in the direction of the trend. In the end both systems get good profits and losses around the same periods. Diversification is therefore NOT so simple and obvious and it requires strong statistical analysis to ensure that two strategies can indeed reduce risk when used together.

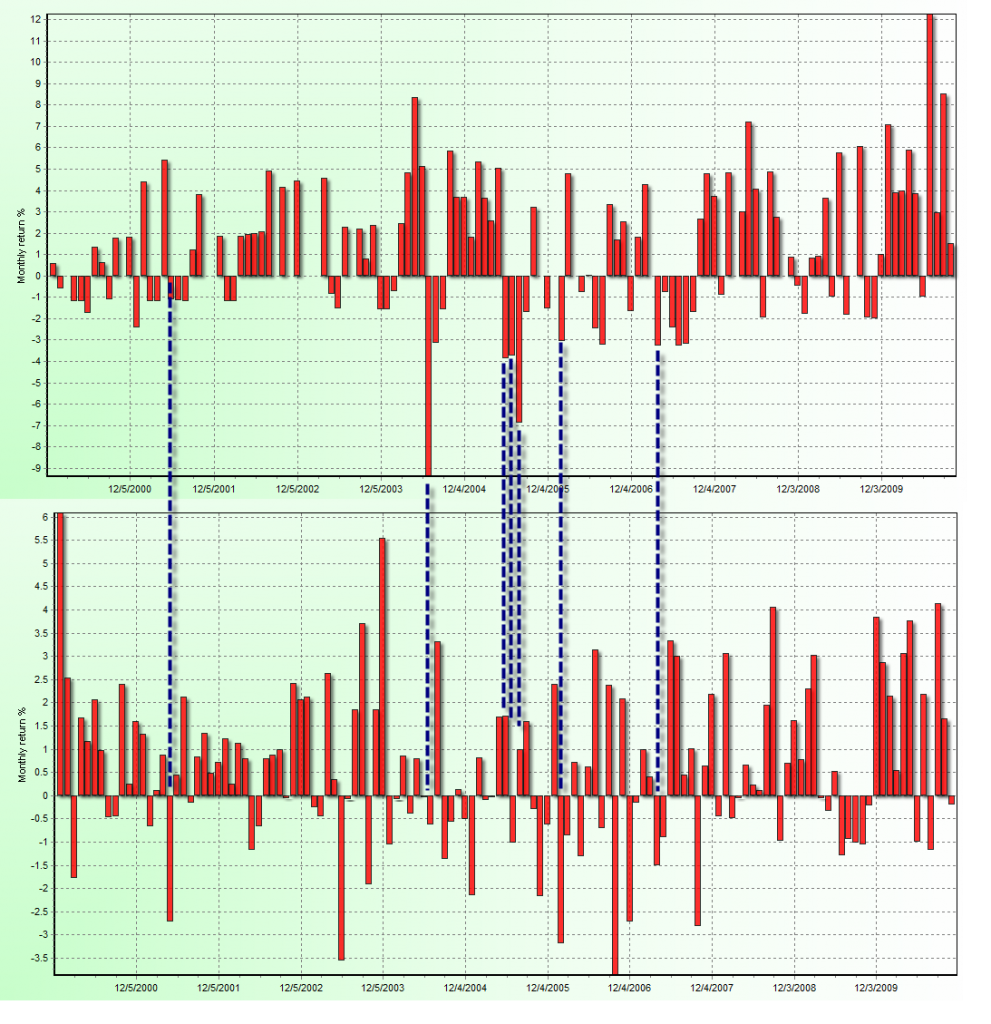

One of the best ways to truly assess diversification is through the use of the monthly distribution of returns. This provides a very easy way to compare profitable and draw down periods and draw quick conclusions regarding what strategies might be useful together. By adding the results of both strategies on all months through a 10-20 year backtest we can indeed see if there is a net reduction in risk compared to profit or simply an escalation of risk and profit which gives us the same effect as doubling risk on each one of the single strategies. Correlation is something which cannot be deduced from the way in which a strategy trades as often different types of inefficiencies may arise during similar periods when the market does display characteristic crowd behavior.

So if you truly want to know whether or not you’re diversifying your trading it becomes key to perform adequate long term statistical analysis of both strategies and the merged portfolio in order to know what the end result might be. Sometimes people just “trust” the they are diversifying and find out that they are only escalating risks when they look at a properly done long term analysis. Often you will find surprising and seemingly unintuitive results, for example that two trending strategies can effectively diversify each other as their inefficiencies get exploited successfully under very different market circumstances. As I have said before the nature of the strategy being used tells you nothing about whether or not your effectively reducing risk relative to profit and statistical analysis cannot simply be neglected.

If you would like to learn more about proper diversification analysis and how you too can learn how to analyze systems together in portfolios accurately please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)