When you’ve been designing trading systems for a while it becomes evident that one of the most fundamental aspects of successful systems is their ability to adapt to various market conditions through the use of different measures of market volatility. The most popular way to do this – and what Asirikuy systems have used up until now by large – is the Average True Range which is a simple indicator that tells us the average of the maximum distance between a certain number of candles’ OHLC values. The concept of the true range was developed to take into account gaps as part of the volatility on daily charts and greatly improves on the measurement of volatility achieved by a simple daily candle High/Low measurement. However the ATR has some significant problems which I will discuss within the following paragraphs. On this article I will also propose an alternative measurement of volatility – Asirikuy volatility – which improves on the ATR concept.

The ATR is a great tool to measure volatility on financial instruments but it suffers from a few important problems. The first and perhaps most important problem is that dependency of the ATR on the way in which daily candles are built. If you just shifted daily data by an hour you would get extremely different ATR values as the OHLC values of daily candles would become altered. Since Forex brokers do not have a universal daily candle open/close time it becomes important to eliminate daily candle time stamp dependency in order to ensure that our measurement of volatility does not vary amongst brokers. Certainly we could construct offline charts to eliminate this problem but there are other short comings which would encourage us to change the indicator in itself.

–

–

The second problem with the ATR is its reaction to short term volatility changes. The ATR – as a daily indicator – reacts very slowly to changes of volatility along a single daily candle. This can be positive or negative depending on the strategy used but for the most part the ATR reacts too slowly to changes in volatility for strategies in the 4H and 1H time frames. Some strategies would certainly benefit from a volatility criteria which reacted faster and which depended on a larger set of values. Since a fast reacting ATR (like a 4 period one) reacts to changes in only a few values broker dependency increases significantly.

In essence what we would ideally have is a volatility indicator whose reaction speed we can control carefully without diminishing the number of bars used for its calculations tremendously and we would also like the indicator to be independent of daily charts BUT at the same time give us some notion about daily volatility. In order to tackle these problems I have created Asirikuy volatility which is an indicator used on the 1H charts which attempts to solve all these problems by using a new concept based on the fact that volatility is directly proportional to absolute ranges on long periods on the 1H charts.

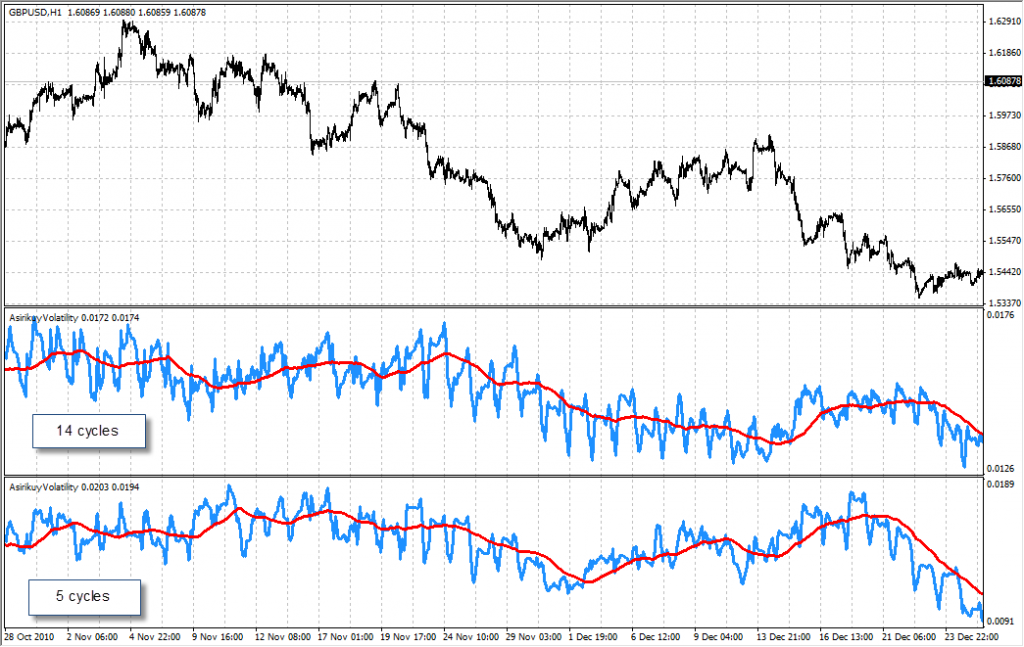

The indicator uses a set cycle length and a given number of cycles. For example the indicator with a 24 period cycle length and a 10 cycle number will calculate the high-low distance between hours 0-24, 24-48, 48-72, etc (until ten cycles are done) and then these values are averaged to obtain a notion of what the high-low distance has been within a past given number of cycles with a certain length. The result of doing this is a measurement of volatility that is constantly updating every hour which has some strong oscillations due to the fact that the shifting of cycles on each hour causes the high-low distances to oscillate (the magnitude of this oscillation is also useful as it is a measurement of the variability of volatility). A much better measurement of volatility is obtained when we create an average of this first volatility obtaining a smooth line which resembles the daily ATR in behavior.

This new indicator measures daily volatility without depending on the daily charts, its changing speed is easily controlled through the cycle length, cycle number and averaging period and it provides us with a clearer perspective of how volatility changes through time. I believe that Asirikuy Volatility – or some concepts derived from it – could be used as a much better alternative to the ATR within our trading systems as it constitutes a much more comprehensive measurement of how ranges vary within the market and possibly gives us a better possibility at having more successful adaptations to variations in market conditions. I will be testing this measurement on Asirikuy systems during the next few weeks to see if we can obtain similar or better results compared with the ATR.

If you would like to learn more about my work in automated trading and how you too can learn to build and design your own automated strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hi Daniel,

there are 2 things that came to my mind regarding your volatility indicator:

– volatility is driven by volume. When you average volume or HL ranges over the same hours of a number of trading days you will get a very similar characteristic pattern with arround 5 peaks. Thus there is a periodic component in volatility which is mainly dependend on the hour of day. One could look at it as a baseline and measure current deviations against this. Averaging over different hours from the same day ignors this fact.

– in order to make volatility comparable between different instruments some sort of normalization (e.g. using standard deviation) could be desirable. As high market returns in a short time are tight to high volatility one could try to maximize an investment into instrument whose normalized volatility is highest. Obviously, this will not help you if you want to use a volatility measure for sizing purposes.

These 2 approaches can be used to try to forecast volatility and to give additional hints whether to invest into an instrument at a given time or not, too.

Looking forward to hear about your experiences and new ideas you will come up with!

Best regards,

Fd

Hi Fd,

Thank you for your comment :o) The idea of normalizing volatility for all pairs is a very interesting one which could be useful to compare how relative volatility is increasing or decreasing, I’ll definitely take into account for future development projects. Regarding the periodicity of volatility, I am not that interested in this but more in the variation of daily volatility which falls more in line with changes in market conditions. Thanks again for your comments!

Best Regards,

Daniel

Hey Daniel,

When will this indicator be available? I also want to test it out on a new system that I’m developing.

Hi Franco,

Thank you for your comment :o) The indicator will be available in a few weeks to Asirikuy members!

Best Regards,

Daniel