The past few years have been a great learning experience at Asirikuy, with our oldest live accounts now close to 3 trading years, we can say we have experienced the highs and lows of several different trading strategies. Some of our systems have enjoyed success while other experiences have turned out to be sour. However, these bad experiences have been very important – even more than the positive ones – because they have taught us many things about which assumptions are bound to be dangerous in Forex trading. Among the lessons we have learned, things such as large portfolio building, curve fitting, trade chain dependency, start-up point dependency, market efficiency bursts and the like, have played a key role in defining where we are going and what development paths we want to follow. Today I want to share with you what has been the first result coming from many of these experiences, the updated F4 Atinalla portfolios.

The first thing to note here is that F4 systems evolved to include solutions to many of the problems we discovered with F3 strategies, both from a technical and trading perspective . The F4 systems in Asirikuy have been coded to avoid use of MT4 indicators – using only TA-lib implementations – use a very lean C coded NTP DLL solution, carry out all strategy calculations in an external ANSI C coded DLL, include timezone corrections using reference broker and NTP synchronization and include a lean and unified user interface. All these modifications have made the F4 strategies much faster to back-test, easier to port into other platforms and – most importantly – they have opened the door to the use of much more advanced system development and portfolio management techniques (such as game theory and WFA).

–

–

From a trading perspective things have also evolved significantly. In F4 all systems have been coded to give reliable Open Price simulations – removing any intra-bar calculations – properly ensuring that all simulations are as reliable as possible while using the least possible amount of data and computational resources. The F4 strategies have also been modified to react to all trading signals, effectively removing all trade chain and start-up point dependencies. Opened positions have their SL/TP updated on new signals on the same direction while opposite signals generate position closes. This position handling allows us to have very reliable control over risk, ensuring that each system will never be risking a larger amount of the balance as it was intended by the user (within what is possible, slightly higher risk does happen sometimes due to rounding issues). The systems also incorporate an open TP technique (meaning that the TP is internal) effectively allowing us to take advantage of favourable market gaps (that with a fixed TP often generate no additional gain) while allowing for reliable Open price simulations.

With F4 we now have technically improved systems that trade in a much better and reliable way. Systems that have much better controlled risk per trade, constantly receiving feedback from all signals received by the strategies. With these systems – which due to all the above trade differently than F3 versions – the next point was to improve the system evaluation process in order to generate adequate parameter sets for live trading. As a first effort to generate a bridge to migrate from F3 strategies, my first goal has been to replace Atinalla portfolios with F4 equivalent versions. To do this I have followed a stability analysis technique – developed within the last few months at Asirikuy thanks to Fd – which allows us to obtain parameter sets that have the least variability within the parameter space through a 9 year testing period, the variability of the parameters is then out of sample tested to find whether the rank analysis remains constant.

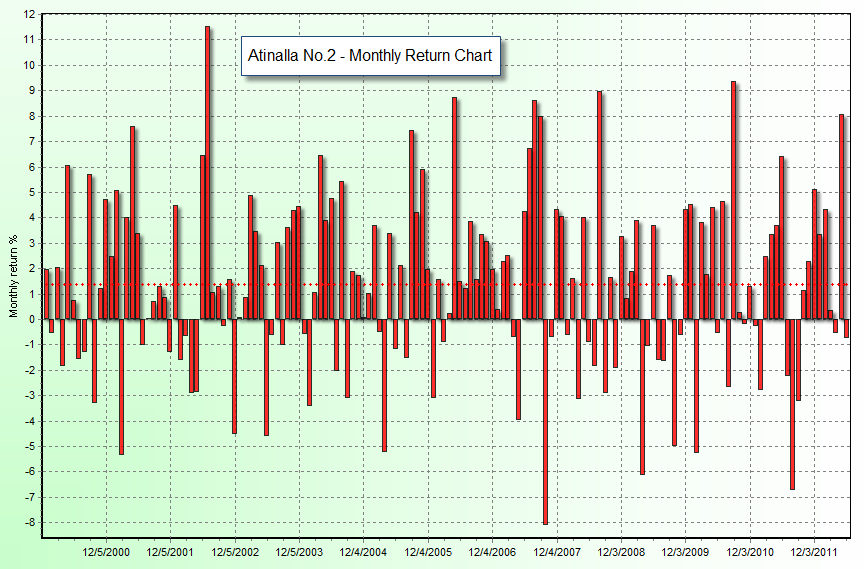

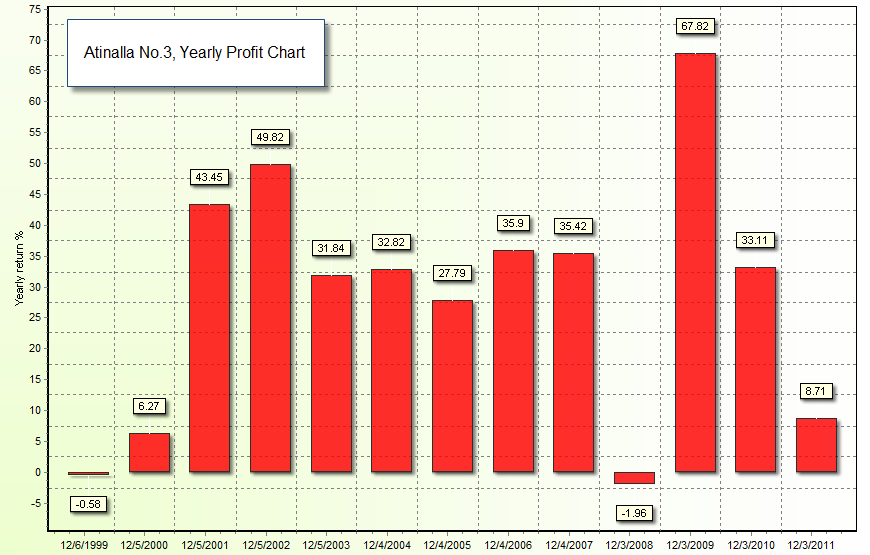

From the above analysis it then became clear that stable parameter results were not easy to obtain, but they did come out nicely for many of our trading systems. With these results I then built portfolios in order to replace the current Atinalla F3 setups, trying to keep the spirit which was behind the creation of each one of the 4 different portfolios we currently use at Asirikuy. Atinalla No.1 was preserved to be a clean trend follower portfolio based on momentum on the EUR/USD, using three different strategies to achieve this goal. Atinalla No.2 was designed to be a multi-strategy trend/counter-trend multi-currency portfolio, Atinalla No.3 was designed to be a breakout/momentum multi-currency portfolio and Atinalla No.4 was designed to be a higher risk/breakout/counter-trending/momentum portfolio with the aim of obtaining higher yearly profit at the expense of an assumption of higher inter-system drawdown correlations. Systems among the portfolios were also equalized to show a similar average risk per trade.

After finishing all the simulations and calculations, it then became clear that these portfolios are much better than the previous ones (at least I think they are!). It is not because they show higher profit in simulations – they clearly do not! – but in fact because of the total opposite. These portfolios show annualized average returns (AAR) to maximum drawdown (MD) ratios in simulations that are between 1.0 and 1.7, far below the ratios of 3-5 showed by their previous counterparts. However the fact that trade chain dependency is non-existent makes me have a higher trust in historical drawdown correlations and the fact that parameters were derived through a rank analysis makes me better trust the stability and actual robustness of the portfolios. Another interesting characteristic is that the market exposure to efficiency bursts statistic (you can search the blog for “efficiency bursts” to learn more) is below the maximum drawdown of the portfolio in all cases, suggesting a more realistic correlation between historical drawdowns.

–

–

It is also good to remember that this is NOT the last step in portfolio design or the “last word” in our Atinalla portfolios. Our solutions continue to evolve as we learn more about trading and develop more advanced tools and theories. For example, our goal right now in the medium term is to develop walk forward analysis techniques (WFA) for all systems, allowing us to have a much better chance to adapt to changing market conditions. The development of our game theory portfolio module is also absolutely key to our advancement in the area of portfolio management and the improvement of our trading results. There are still a ton of things to learn and we would be fools to believe we have everything figured out! Now that I am back to full-time trading, we will hopefully reach all these goals more rapidly :o) Updating of live accounts to the new Atinalla portfolios will hopefully be carried out within the next 2-3 weeks.

Last – but not least – I would like to thank Morgan for all his effort and help in the development of the above mentioned F4 framework, Asirikuy members are a pivotal part of what we achieve as a trading community. If you would like to learn more about algorithmic trading and how to build better trading systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hi Daniel,

Glad that you are continuing your posting on this blog, I really missed the posts!

I would also like to thank Morgan and Fd for their hard work and pushing Asirikuy to the next level of trading

Hi Franco,

Thank you for your comment :o) I’m really glad to be posting too, It’s great to see that I can still count with my all-time loyal readers :o) Thanks again for the comment and keep on posting them!

Best Regards,

Daniel