A few days ago – on the post about my November 2012 Currency Trader Magazine article – a visitor commented on how time filtering was a “very bad idea” since the best thing one could do was to look for something that would simply work on everything. I replied by saying that this is one of the fronts we work on at Asirikuy but that there was a price to pay for trading something that would be tremendously robust (work on almost anything). On today’s post I want to go a little bit deeper into the price of trading a universal inefficiency and what the disadvantages and advantages of doing so might be. I will talk about some of the efforts we have made in the past at Asirikuy and I will go through some of our latest developments on this matter (in which we have made great progress thanks to Fd).

Let us begin by defining what a universal trading system actually is. A universal algorithmic strategy is a trading system that you can load on all available symbols – therefore no selection bias – with the exact same parameter settings and logic in order to obtain long term profitable results. In a universal system you will have extremely limited degrees of freedom – as close to none as possible would be best – and you will trade in the exact same way no matter if it’s the EUR/JPY, the USD/CHF or the GBP/CHF. The idea is that you have one “master key” that you can use on everything that will always give you some sort of profitable result, the market aspect exploited by this key is so absolutely fundamental that turning this strategy into an unprofitable one would require a direct change of human nature.

–

–

The idea to develop such a trading system is not new and most initial research on this comes from the 60s and 70s when traders wanted to have simple tools they could use to trade all instruments in the futures market. Computational power was limited (almost none) back then so strategies on upper timeframes had limited trades and therefore large portfolios were also needed to have statistically significant simulation results (which were obtained manually). The idea was that instruments didn’t always behave in the same way but they always behaved like some other instrument had in the past. The assumption was that in a basket of 20 currency instruments number 1 might behave for 5 years like number 2 did the 5 previous years and then number 2 would behave like number 4, etc. If you have a system that can trade the whole basket profitably then your long term profit is almost guaranteed because the natural behavior that brings profit to the strategy will always exist – in one form or another – inside the traded basket. The only assumption is that a currency pair in the future will behave like some other currency did in the past, and this covers a lot of ground.

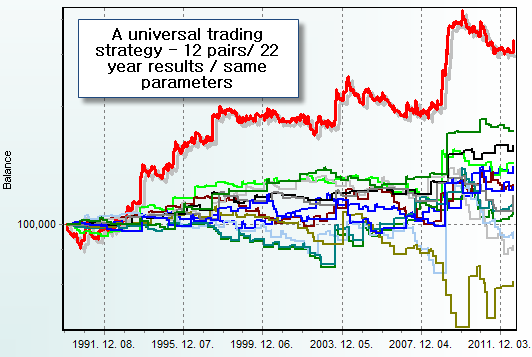

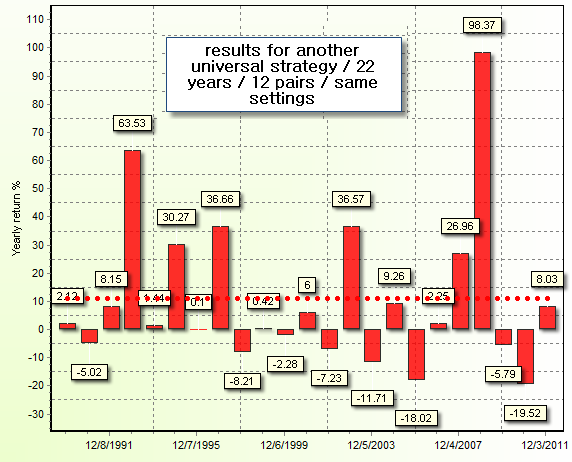

Contrary to what many would believe, achieving such a system is not tremendously difficult, particularly if you take into account the teachings of the 60s and 70s traders. What they learned was mainly that trending was the foremost important market behavior and therefore a wide variety of trend following methods lend themselves to become exploiters of universal market inefficiencies. We have developed several of this in the past at Asirikuy with Comitl and Quimichi being the foremost examples of this type of trading technique. These systems have limited degrees of freedom and trade many pairs with the exact same parameters, their only assumption is that the baskets they trade will behave in a similar way (as a whole) in the future. Clearly if such systems were super successful the problem of trading would be solved :o) but as a matter of fact there are many problems that make the practical application of universal trading strategies quite difficult.

Let me start by saying that the core concept is part of what makes these strategies problematic. Since you are exploiting something so universal, it so happens that such inefficiencies tend to be very correlated among the different pairs. If you are profiting from strong trends, trends in currencies will happen in very correlated manners, especially strong directionality involving the daily time frame. This means that drawdown periods will correlate as well because it is quite unlikely to have strong trends on one currency while another is simply moving in a range. Perhaps the only diversifying factor in this sense is the carry trade which does develop long term trends on some instruments while others lag. This is the main reason why the results of some currency pairs such as the USD/JPY or the EUR/JPY do not correlate very well with those of others like the EUR/GBP or the EUR/USD in which carry trading has been much more limited. This correlation would still exist in the future if the roles reversed, a big advantage of the universal trading approach.

–

–

The above correlations also generate problems with drawdown period lengths, especially since such universal systems usually have very strong and yet rare winning trades that only happen once every few years. Tolerating periods of losses in the order of 1000-2000 days is something very difficult to do and quite unacceptable according to many modern portfolio management standards. In a world where most hedge funds are chasing quarter to yearly bonuses, the idea of holding drawdown periods for such long amounts of time seems very odd. Definitely few managers would be happy with such a prospect, except those whose view is the most long term.

With all this in mind it soon becomes easy to understand why such systems are so hard to trade and why they are no “holy grail” to the algorithmic trading problem. They are obviously good for many reasons but just a piece of the puzzle on how to develop trading strategies. Certainly we haven’t given up in Asirikuy in ways to improve the above idea and we are certainly moving towards this with a new strategy being developed in conjunction with Fd (using momentum to evaluate trending movements). This strategy has hardly any degrees of freedom and the idea is to make this value as close to zero as possible. Results are yet to be beyond what we already know but we certainly hope they can be improved going forward (as more analytic concepts are implemented in the project). This strategy also works better on some pairs where Comitl and Quimichi had also failed to give good results, perhaps forecasting some of the strengths of this new trading methodology against previously developed ones.

If you have any ideas on how to develop universal strategies or if you would like to learn more about our ideas please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

thanks for trying to respond to me. i don’t like trend following at least not in the turtle traders trade. those systems in my view depend on megatrends which you never know if they will happen. if you break down the movement into minitrends then the market is almost always trending. if you identify the minitrend, take a small portion of that then you will have a very good trading system with high winrate. i really do think that the best way is to find a universal trading system which has worked since the begining of the stock market. i have charts of dow from the 30’s and my systems work on that . i also have random generated charts where i found the same logic aplies. in my view you are not trading market inefficiencies you’re trading random processes . the argument will be that random processes cannot be predicted. well i think it’s possible and that could be an interesting experiment. simple price action and candlestick patterns but in a systematic way will be the tools of prediction.

i forgot to mention that your experience with universals is different than mine but i can say that there is a thing that i hate. correlations. there can be times when i take 5 trades in the same day at the same hour which in the near past were not corelated but that can change. so if i’m in those 5 transactions it’s like i’m in one with 5 times the risk.with 2% risk that is a beautiful 10% drawdown if it’s a loss.

your systems are higher timeframe and a big basket of instruments for months or years. my systems trade 4h timeframe with holding period of 4h-24h. your systems are low winrate and dependant of big trends and my systems are design to catch portions of minitrends and reversals for a 1.1*atr(14) with high winrate 70-80%. i don’t know how many trades are there in a classical trend following but i think there are very few. if a system does not have many trades the profit is significantly lower than a system which has many. a day trading system which is able to pay the spread gives many more trades and the profit potential is amplified .

my systems are based on classical indicators but with new usages and with elements of price action. they are non automated but conceived with objective rules.