As I wrote on one of my recent posts, building systems using trailing stops helped me achieve a higher degree of mathematical expectancy and linearity on strategies generated on EUR/USD 1H charts. These initial system experiments used a trailing stop that allowed for limited dynamic retracing of the SL towards unfavorable territory after the TL was triggered (though not further than break-even) in order to allow for volatility expansions upon trade evolution. This means that after the TL was trigger the SL would be moved to break-even and it could subsequently move with some freedom above this level at the expectation of further favorable movements. Today I am going to share with you the next part of this story, as I further developed additional TL notions within Kantu and tested their effect on generated strategies. Within the following paragraphs I am going to talk about a simpler form of non-retracing TL that was able to achieve good results as well, without the need for additional parameters.

–

If you remember my last post about trailing stops, the whole idea of introducing trailing stops in the Kantu system generation process is to be able to fit systems within a framework that allows for the natural creation of strategies that are easier to trade and easier to discard upon failure. By using a trailing stop you are forcing Kantu to find systems that are profitable under the assumption that this trailing stop mechanism is active. Depending on your trailing stop this can lead to different types of trading strategies or it can lead to strategies that completely avoid the use of the trailing stop by setting its triggering to a very high number. Thinking about this idea, I decided to try a type of TL that wouldn’t introduce any additional parameters (such as a TL triggering level) and would serve the purpose of generating strategies with a high level of mathematical expectancy.

How do you introduce a trailing stop that doesn’t require any additional parameter definitions? The easiest mechanism to do this is what I call a “simple non-retracing trailing stop”. This trailing stop mechanism simply moves the SL as any favorable bars develop in the direction of the trade. If your stop-loss was set at 100% of the daily 20-ATR then the SL will be moved 100% of the 20-ATR below the open of any new bar that is above (for longs) or below (for shorts) the trade opening price. For example if a long order was opened at 1.3150, the SL is set to 50 pips and the next bar open is at 1.3160, the SL would be moved from 1.3100 (its initial value) to 1.3110 (50 pips below the last order close) at the start of the next bar. The trailing stop is also non-retracing as we won’t move it towards unfavorable territory from this set point.

–

–

This trailing stop is in effect moving the SL dynamically in your favor without any retracing. The TL will always trail favorable movements of any dimension and will allow you to take advantage of “lucky” moves in your favor that are not anticipated within the trading strategy’s logic. Contrary to the most popular trailing-stop mechanisms this TL also preserves a level of dynamic management as the ATR definition changes as the market evolves towards more or less volatile scenarios. In the end what you get is a mechanism to lock on-going gains, without the need of any additional parameters as the trailing-stop is actually of the same dimension as the initial stop-loss and only affects position management by moving this value towards the most favorable candle opening value after trade entry.

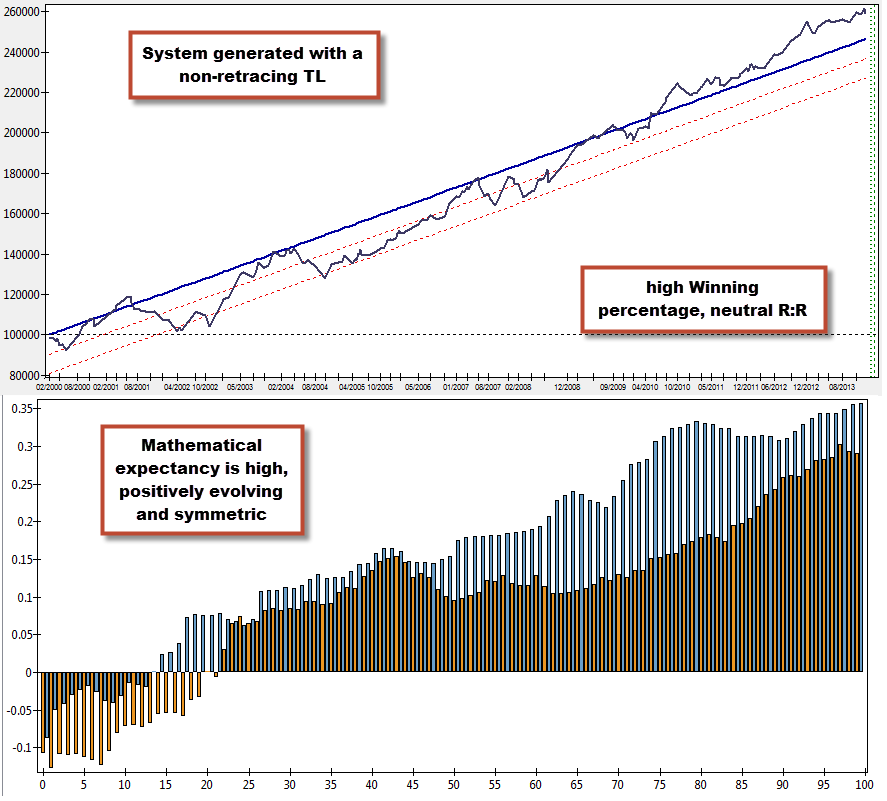

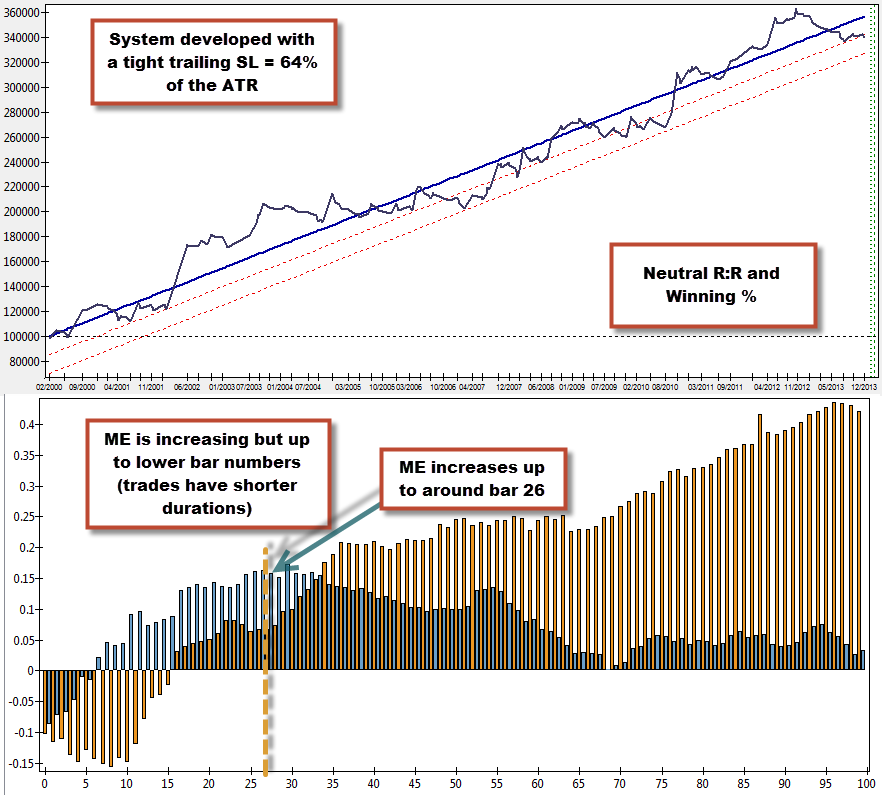

This non-retracing trailing-stop with no additional parameters leads to some interesting system results. The fact that we always move the SL on favorable moves implies that a big and positively evolving mathematical expectancy is needed to achieve good results. By generating systems in the framework of this TL mechanism we are able to generate systems that have symmetric ME curves with increasing values as a function of bar number (especially true for systems with high winning percentages). Interestingly some systems develop with nearly neutral Risk to Reward and Winning Percentage characteristics (R:R near 1 and W% near 50%) and these systems regularly have very tight SL values (60% of the ATR).

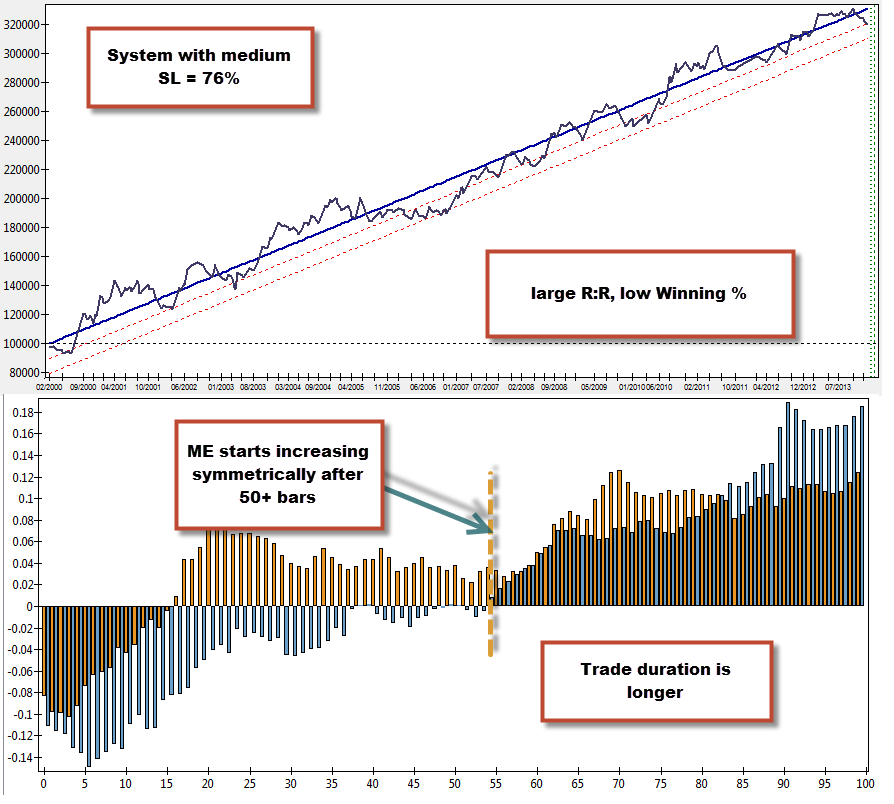

There are also systems with low winning percentages and high Reward to Risk Ratios, which also have larger SL values but longer term trade duration. These systems have signals that usually put entries within periods of consolidation that require a given time for a breakout to materialize. Once this happens the ME increases rapidly for both longs and shorts, allowing the system to achieve an overall high Reward to Risk Ratio. This type of systems makes use of the trailing SL at a later point within a trade, as favorable movements to do not materialize until the trade is much older. However it is worth noting that the TL is activated and the SL is not that big (70-150% of the ATR).

–

–

As you can see the non-retracing TL mechanism gives rise to at least 3 different system types that employ the trailing stop in a different manner. There are both systems that use a larger trailing stop and show a later rise of the ME with low winning percentages and high Reward to Risk ratio and systems with small trailing stop values and short trade duration with a fast but limited rise in ME values. Khada The development of trailing stop techniques within Kantu allows us to determine what type of strategy we want to build and construct system types that wouldn’t be possible without their use.

If you would like to learn more about Kantu and how you can use it to develop trading strategies for yourself please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Interesting results indeed.

Thanks for the article.

Daniel, do these methodology move the stop loss even if price movement on a specific bar was unfavorable? i.e, you are in a long position, you have been moving your trailing stop up for a while. The next bar closes lower than it opened but just a little lower, but in the process the ATR(20) decreased. So when you calculate Current price – ATR(20) the result is a StopLoss at a higher level than it currently is. Would the stop loss be moved up?

Thanks again. Good work.

Henrik

Hi Henrik,

Thanks for your comment :o) The SL price won’t be moved if the resulting SL is more unfavorable than the last set one (that’s why I called it a non-retrace TL). If price moves unfavorably or the ATR changes and the new SL would be more unfavorable then no SL change takes place. I hope this answers your question (let me know if it doesn’t). Thanks again for reading and commenting!

Best Regards,

Daniel

Thanks for your answer Daniel.

I know it is a non-retrace Stop loss, so I understand you don’t move it to a more unfavorable one. Which means in a Long trade you don’t move the SL down to a lower price than where it already is. So, I understand that part.

What I’m saying is that a new calculated Stop Loss value after a bar closes might be higher than where the current Stop Loss is, just because ATR(20) may have decreased and not necessarily because price went up in the most recent bar.

So what happens in this scenario: You’re in a long position. The most recently closed bar was negative (Close[1] < Open[1]). The ATR(20) decreased but Current Price minus ATR(20) is higher than where the SL is situated. Would you still move the SL up in this scenario even though price didnt go up in the last bar?

Regards,

Henrik

Hi Henrik,

Thank you for your reply :o) Yes! you would move it up because the contracting volatility means that the expectation of an unfavorable movement should be smaller. Therefore if price stays constant but volatility contracts you would trail the SL towards the current price. This makes sense, as contracting volatility implies that the most unfavorable excursion from a random walk should be smaller. I am sorry I misunderstood your question before! Thanks a lot again for commenting,

Best Regards,

Daniel