Earlier this week I published a rather controversial post where I talked about my research on the generation of price action based patterns that are profitable across 2 different currency pairs. The post concludes that strategies built on multiple pairs are both less likely to be profitable and more likely to be less profitable than strategies created using a single pair. Although only data for strategies created to be profitable on EU+GU was showed and compared with individual EU and GU results the general conclusions held when looking at 6 different two pair combinations (EU+GU, EU+UJ, UJ+GU, UC+GU, EU+UC, UC+UJ). The conclusions were based on in-sample periods of 15 years and pseudo out of sample periods (p-OS) of the same length, largely eliminating the possibility that this is just an observation made by chance. Today I want to further expand on this research by showing you the results of this experiment when searching for strategies that are profitable across 4 FX symbols.

–

–

One of the main criticisms I received from last week’s study was the general lack of more symbols in the analysis. Although there is a reduction in the expected amount of profitable systems and their magnitude when going from results on one pair to results on two pairs a few people told me that this effect might not be present when looking at more than 2 pairs. Given that the “general market characteristics” that are targeted when doing multiple-symbol testing might only exceed the noise when much more data is present it could be the case that this effect is only substantial when a significant number of symbols is used to create the multiple pair strategies. To find out whether this might be the case I generated 1000 systems that were profitable on either the EURUSD, USDJPY, GBPUSD or the USDCHF and an equal number of systems that were profitable on the 4 symbols at the same time. Systems generated had an R² > 0.8 and a frequency larger than 10 trades per year and the in-sample generation period went from 1986 to 2001. The systems were then pseudo out of sample tested from 2001 to 2016.

As you might notice I reduced the R² requirement as systems that are profitable on 4 symbols are much harder to obtain than systems that are profitable on only two and mining systems that are profitable on the 4 at a much higher R² would have taken a substantially longer amount of time. It is also important to notice that the two pair experiments give the same results when the R² is reduced as well, so this change in the filter does not change the general conclusions from my earlier recent post about two symbol strategies.

–

–

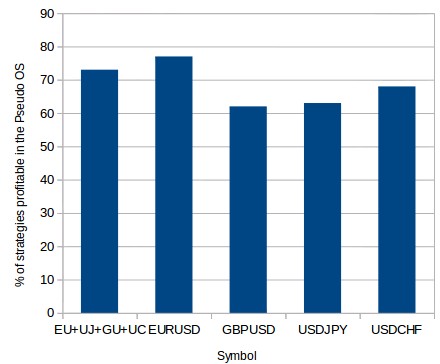

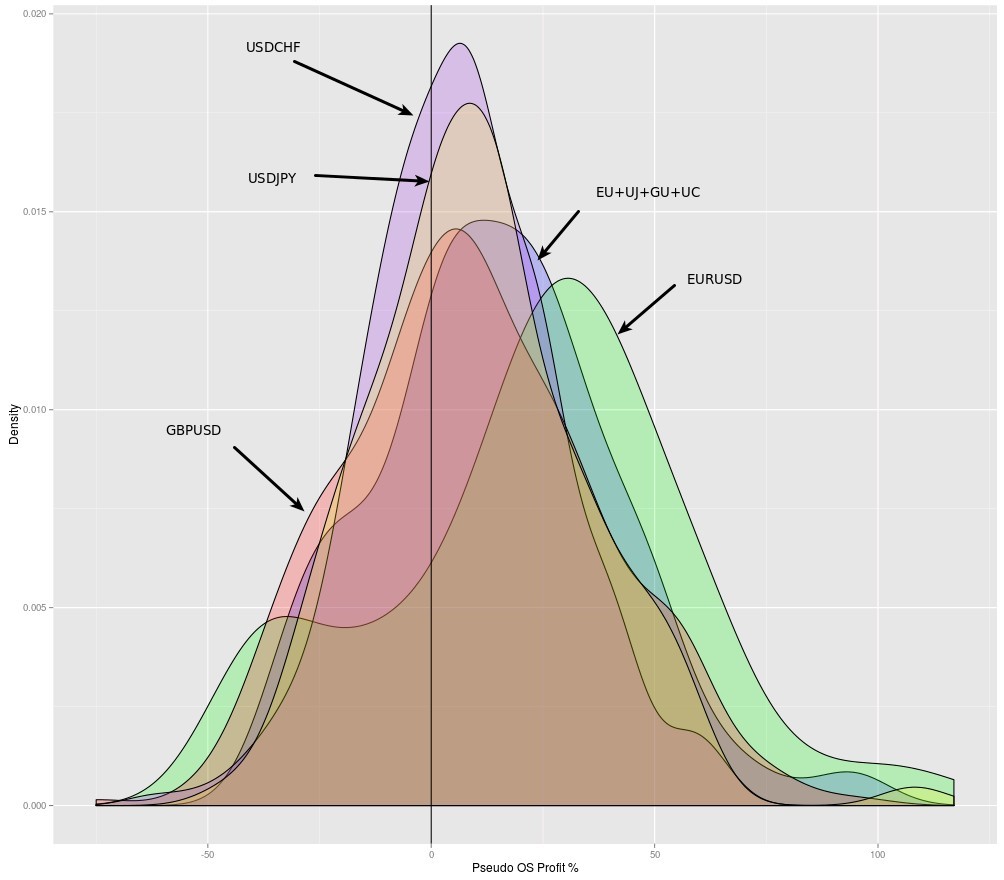

Contrary to the results when using 2 pairs – where the number of profitable systems in the pseudo OS is always less for the multiple pair strategies – when using 4 different pairs this ceases to be the case. As you can see in the image above the percentage of p-OS profitable results in the EU+GU+UJ+UC case is 73% which is lower only when compared with the EU where the percentage of p-OS profitable strategies is 77%. For all other symbols the 4 symbol multiple pair strategy represents a substantial improvement over the single symbol results, at least at this R² filter level. The mean p-OS profit also increases substantially in all cases except in the case of the EUR/USD, something that you can see on both the distribution of systems and the last graph within this post.

Interestingly the results are above what would be the average for results from the 4 symbols. The average percentage of profitable systems in the p-OS for the four symbols is 67.5% and the average profit is 12.47% while the values for the 4 symbol systems are 73% and 14.6% which are higher in both cases. This could also imply that the number of systems that are profitable from symbols with higher profitability is higher, which is actually the case. When looking at the profitable p-OS results discriminated by symbol for the 4 symbol systems we see that the number of systems that were profitable in the EUR/USD was 88%, on the GBP/USD 62%, on the USD/JPY 52% and on the USD/CHF 88%. This means that when discriminated by symbol we actually get better results than in almost all individual symbols, except for the USD/JPY were both the average profit and percentage of profitable p-OS systems is much lower.

–

–

http://kirstincronn-mills.com/?feed=rss2 These results show that the issue of multiple symbol trading is complex and cannot be resolved with simple 2-pair strategy results. Although pertaining to the specific case of price action based 2 pair strategies it is safe to say that results could be in general expected to be worse when compared with single symbol strategies this does not seem to hold up when going into strategies constructed for more than 2 symbols. In this particular case the use of 4 pair strategies starts to yield results that are better when compared with most individual symbol results, showing that there does seem to be some grasping of a more general level of market inefficiency. I will gather more statistically solid results within the next few weeks – as these tests take a long time to gather data – and will post when I have some further results, perhaps even going into the 5 symbol region. If you would like to learn more about trading system construction and how you too can build your own strategies using powerful data-mining methods please consider joining Asirikuy.com, a website fiAsirikuy.comlled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.