When you start your journey in the building of algorithmic trading strategies you quickly find out that strategy robustness is usually evaluated as a function of the topology of the parameter space of the strategies. Systems for which small parameter variations cause huge changes in profitability are discarded while systems that have large regions of profitable spaces are considered more robust. Today I want to talk about this notion and why it can be a fundamentally wrong way to look at trading strategies. I will give some examples of when it makes sense to use this criteria, when it may lead to wrong decisions and why always applying this rationality inevitably leads to trading systems that belong to a single category.

–

–

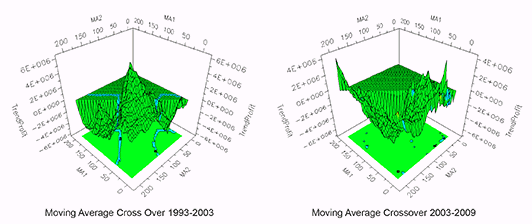

Suppose you have a trading system that implements a moving average cross. You need to decide which parameters to use for your moving average periods and you therefore build some sort of map that shows you how parameter variations affect the profitability of your trading system (or some other statistic). After performing the optimization you then end up with figures like those showed above (which I borrowed from this fxtradermagazine article). The above results may appear robust because a significant portion of the results across the parameter variations are profitable – meaning that variations do not have such a big effect on market results – so a large majority of traders would be happy to call systems like these good for trading. As a matter of fact systems that behave in this manner are often of this type, systems that use things like moving averages or indicators that perform some type of averaging operation.

Traders however are extremely adverse to strategies that show the opposite behavior. Imagine a system that has an hour parameter which when changed completely changes the characteristics of the trading strategy. The strategy may be very profitable at 9 AM US EST but then completely fail if it is traded at 8 or 10 AM. The system should then be discarded because it’s definitely not robust, right? Well, no. The system probably works only at 9 AM because something special happens at that hour – for example the US market open – that simply does not happen at 8 or 10 AM. The strategy is not “less robust” when it fails at 8 or 10, what happens is mainly that the strategy does not apply at those hours because the strategy only applies to the events that happen at 9 AM.

–

–

It is easy to see how not all parameters are the same. A moving average is not the same as an hour because each hour is fundamentally different while each subsequent moving average value contains within it the data for all values before it. Things like single candle values and hours are unique parameters – their variations do not contain information from any other value – which makes them fundamentally different from something like an indicator period parameter which contains information from other values. Of course if an RSI trading strategy using a 20 period gave great results but at 21 gave terrible results the strategy would be terrible, because 21 contains basically all the information that 20 contained plus only a small additional piece of information.

A strategy that is based on parameters that have no relationship with one another is therefore expected to show peaks, simply because each value forms a fundamentally new trading strategy, not variations of the same trading strategy. If a strategy takes a long trade because there is a known expectation for price to increase 20 hours after a one hour bullish movement then making that value 21 or 19 may completely invalidate the strategy because the strategy might demand that this happens exactly 20 hours after the movement is detected (perhaps a company does a very large transaction 20 hours after a parent company received another one). After 19 or 21 hours the market is different, the market return 20 hours after is completely uncorrelated with the market return at hours 19 or 21. The lack of auto correlation in financial time series returns implies that price pattern based strategies are each unique to the selected values. Changing values means you’re completely changing strategies — it’s not like changing the period of a moving average where values contain shared information. Yoshii If values of inputs upon parameter variations are not auto-correlated then they are just different strategies not simply variations of a single system.

–

–

If you establish an “island of profitability” criteria for the selection of trading strategies then you’re automatically removing from the realm of possibility all the systems I mentioned above – which are not in any way more likely to fail than “island based” strategies – meaning that you’re removing lots of possibilities just because you want to only trade strategies for which inputs on parameter variations are auto-correlated. If you follow this philosophy you’ll end up with strategies that are all of the same group, which will probably hurt you in terms of diversification if you could also be trading strategies which have no auto-correlation of inputs on parameter variations. If you would like to learn more about trading strategies and how you too can create highly diversified trading strategy portfolios please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies