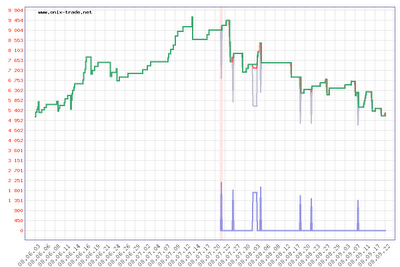

What I like about this company is that it is a perfect example of how this type of expert advisors completely fail to perform on the real market. The profit you see on the backtestng resports is absolutely based on the one minute interpolation erros of the metatrader strategy tester program. The proof of this ? Their own forward testing results ! When you look at the forward testing results for the ultra expert advisor you will find out that the ea does not perform as it does in backtesting, it had huge loses which it wasn’t unable to recover from because of it’s high risk to reward ratio. The picture below was taken from their forward testing which was for some reason stopped in November 2009 (I bet you can guess why !).

–

–Compare that to the backtesting chart shown below. The ea clearly changes a lot between forward and backtesting because the one minute interpolation errors have huge impacts when you have low take profit values and very high risk to reward ratios. It is also very worth noting that the forward testing for the Diamond expert advisor have been completely removed ! (pretty strange, right ?).

This expert advisors are definetely not worth buying but they are a very good example of how the profitability of an expert advisor can change in a very dramatic way between back testing and forward testing and how strategies with high risk to reward ratios are not profitable in the long run because their profitability is based on market randomness which changes amongst different market conditions. If you would like to learn more about other free and commercial expert advisors I have tested and reviewed as well as how to chose and evaluate automated trading systems please consider buying my ebook on automated trading or subscribing to my weekly newsletter to receive updates and check the live and demo accounts I am running with several expert advisors. I hope you enjoyed the article !