Yesterday I was talking with a friend about forex trading and how difficult it is to achieve success trading in this market. My friend attempted to become a successful forex trader with me when we started – actually he started before and introduced me to this journey – and we both hit practically the same barriers when we opened our first live accounts. My first live account – although this story is worth its own post – had grown from 200 USD to almost 500 USD by the end of my first trading week and there was simply nothing I thought could stop me from making a killing on this market. On the other hand my friend started with 100 USD and grew his account to 900 USD within the first two months of trading. However after this initial success our accounts were both wiped out after two months. My friend then completely quit forex trading and I continued to slowly learn about it and eventually made it my career. What is so different about both of us that turned me into a successful trader and him into a losing one ?

On today’s post I will be making a very interesting exercise which is attempting to detail the qualities that are necessary to succeed as a trader as percentages of importance. Everybody has heard for example that a genius is 99% effort and 1% inspiration (or a similar variation of this theme). What are the percentage qualities – defined by their importance – necessary to be successful in forex trading ? Yesterday when I was talking with my friend I started to realize that although we first had similar goals, the different way in which we have always approached problems and challenges in life led us into two very different paths around forex trading.

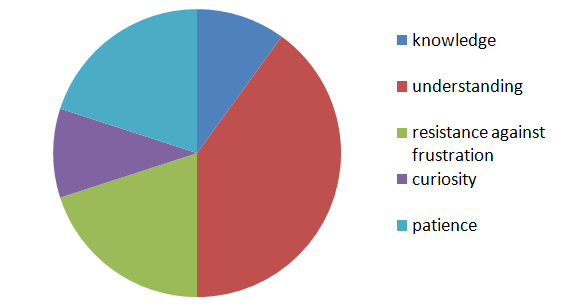

Above you can see a chart of what I consider the most important aspects for someone to succeed in forex trading. I didn’t want this post to fall into all the general knowledge given to new traders over the internet (e.i success in trading depends highly on psychology) but I wanted to make this a little bit more useful by going into a lot more detail. For me success in trading is mainly divided into 5 different fields each one having an important role in the final achievement of profitability. I will now go through each one explaining what it means for me and I why I consider it important.

http://uslanka.net/2013/10/page/2 Understanding 40%. This is the most important aspect for me since it is what eventually allows a trader to get rid of the influence of emotions. Understanding is simply the ability to know the reasons why certain phenomena happen and how these observations can be applied to new circumstances. In trading this means that you will know exactly the inefficiency you want to exploit, what this inefficiency means, why it is present, how it can be made into a system, what the characteristics of the systems are, why they are bound to be successful, what risk level you are expecting, etc. People fail to understand because understanding requires a huge amount of effort and a “deep digging” that people are unwilling or don’t have the time to do. They then search for “turn-key” solutions that eventually lead them to failure since they lack the most important aspect of a successful trader, understanding.

Cuauhtémoc Knowledge 10%. Another important aspect for success in trading is the acquisition of knowledge. Knowledge does not pertain to how information is applied but merely to the information itself. In order to succeed in trading you must have a certain degree of knowledge. For example you need to know basic stuff, like how to calculate lot sizes and control your risk, but you also need to have more advanced knowledge like how the market changes when it evolves and how a trading strategy can be reliably evaluated. Knowledge is simply information which allows you to build a deeper understanding. We can think of knowledge as the tool and understanding as its application.

Resistance against frustration 20%. This is very important and I believe that this is the main psychological point were people fail when they attempt to become successful traders. Traders usually start with a lot of hope which is commonly shattered when they start to use unsound trading techniques (like martingales) or when they take excessive risk. Then new traders feel an urge to quit due to the fact that they are frustrated with trading. People then start to think things such as “nothing works”, “everything is a scam”, “there is no profitable system”, etc. The problem here is that understanding is not being built and resistance to frustration is low. People who have a higher tolerance for frustration and continue to build understanding and knowledge often have a higher chance of succeeding because they will be able to get to the point where their understanding eliminates their frustration while other people who lack this skill will not be able to get there.

Patience 20%. This is a very necessary and rare skill in today’s modern world. The large majority of people who start trading want profits and they want them now and in big numbers. Patience – the ability to wait for a favorable outcome – is a very important quality since the lack of patience leads to unsound decisions, account wipeouts and the triumph of emotions over reason. People who are patient are favored to become successful traders because they will be able to wait for profitable periods and live through the draw downs, they will be able to resists frustration before reaching understanding, etc. Patience is a BIG part of successful trading, a common characteristic of most profitable forex traders.

Curiosity 10%. I believe that a high degree of my success – and the success of another few traders I know – is based on the fact that we are simply curious by nature. The advantage of being curious is that it automatically leads to the seeking of understanding since curious people are not comfortable “swallowing” what marketers try to sell them. When I started looking into commercial systems I was very curious and this eventually lead me to a very in-depth understanding (although I still have a lot of way to go !) of trading systems. It wasn’t enough for me for some guy to say “make 100% per month” I demanded statistically valid proof, to know the logic ,etc. Eventually this lead me to the development of my own systems, success in trading and Asirikuy :o).

Well, this is my view of what is necessary for a new trader to succeed. A trader needs to have understanding, knowledge, patience, a natural resistance to frustration and curiosity. I believe that people who fall into this category are bound to be successful since they have the “natural tools” required to get the job done in the long term. Lack of understanding, lack of knowledge and weak emotional intelligence are the main factors that lead people to failure, from what I have seen in my experience and they are the main reason why after many years I achieved success from trading while my friend is working a 9 to 5 job.

If you would like to learn more about the understanding of trading systems and gain a true education around automated trading strategies and how to use them successfully please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach automated trading in general . I hope you enjoyed this article ! :o)