If you asked me what the most popular topic in forex and trading books is, I would definitely go with psychology. There are perhaps thousands of different authors and approaches to this problem but most of them put it in very simple words : psychological problems are the main cause of your failure in trading and learning to control your emotions will ensure your trading success. This couldn’t be further from the truth. Although psychological problems can affect a traders performance they have absolutely nothing to do with profitability or a trader’s ability to achieve long term gains in forex trading. Through the following paragraphs I will show you why psychological problems are generated in trading, why solving them not necessarily brings profitability and what the true BIG problem most traders have actually is that makes them fail miserably in the longer term.

What are the psychological problems in trading ? These are the obstacles presented by a person’s inability to look at the market clearly, without having any emotions come into play when making trading decisions. This ability is obviously important as failing to take positions without fear or greed is vital for the withstanding of draw down periods and the achievement of long term profitability. Looking at the market in an objective cold-headed fashion is one of the most important skills of successful traders, something at which new traders fail miserably.

–

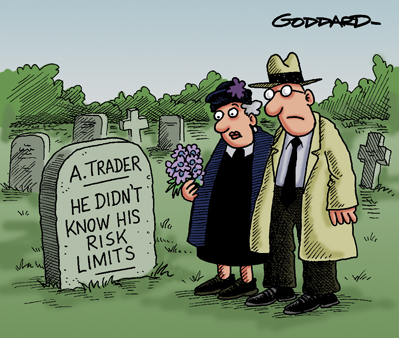

However in order to understand why psychology in itself is not the main problem we need to understand what causes psychological issues to begin with. When you are sitting in front of your screen and you take a trade without measuring risk at an opportunity which was clearly not present or when you move your stops against a clearly losing position you are acting in a very emotional manner. When you are taking 5 times more trades because you are over-confident and when you keep on switching systems because of short term draw downs you are also being emotional. The cause of these emotions is your lack of understanding. Yes, ignorance breeds emotions. There is a saying around some professional trading rooms saying that “psychology is the crutch of those who ignore what is going on”. Nothing could be more true.

What you need to understand here is that psychology may appear to be the cause of all your trading problems but in reality the underlying cause is not psychology but understanding. There are many traders who attempt to attack this issue from a mere psychological point of view, attempting to over-come their emotions through will-power and books on trading psychology. An approach that sadly fails practically all the time. Most new traders have an almost total ignorance regarding what they trade, not even knowing if the system they are using even has a positive statistical edge to begin with. All the psychological training will not make someone trading an unprofitable system profitable, no amount of emotional suppression will make a trader without an edge achieve long term profitability.

In the end the cause of psychological problems is ignorance so there should not be thousands of books on psychology and how to “defeat” this monster but there should be even more books on how to reach an understanding, how to evaluate strategies and how to determine their long term statistical characteristics. Blaming psychology is blaming an effect of the primordial cause, when you think you fail because you are emotional, you truly fail because you are ignorant. No amount of “emotional training” will help you unless you reach an understanding of what you are doing and why your system or discretionary rules will have a high like hood of working in the long term. Most new traders start by using a system they found in a blog or forum without ever wondering if it even has a positive statistical edge, such traders usually blame psychology for their problems when in fact it is their ignorance that does not enable them to succeed.

As I have said many times within videos in Asirikuy, the key to ridding yourself of psychological problems and achieving long term success is simply to understand what you are doing. Build a complete understanding of the trading tactic you are using, learn to evaluate strategies, find long term statistical edges, etc. Once you build an understanding psychology won’t be a problem anymore because it will become irrelevant. The more you understand the easier it will be to trade and the less you understand the more difficult it will be to control your emotions or even know if what you are doing in trading – the strategies you are implementing- are bound to succeed in the longer term.

If you would like to learn more about how to build a true education around mechanical trading and the building of automated trading systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)