Our Asirikuy MQL4 genetic framework – Coatl – has the ability to produce trading systems without any prior knowledge about the inefficiencies found within a currency pair. The genetic framework has already proved it can generate results which offer profitable outcomes even across 20 year periods on any currency pair which it is presented with. Now that I have generated successful 10 year strategies for all majors and minor available it is time to put those together in portfolios which are meaningful and have a high probability to remain profitable under future market conditions. On today’s post I will share with you my idea of “single currency centered portfolios” which allows anyone who uses Coatl to choose a given trading setup which satisfies both their deposit currency and investment desires.

Certainly the subject of portfolio building has always been quite controversial and difficult since there are many ways in which portfolios can be built and it becomes difficult to avoid having a selection bias since strategies are usually cherry picked by their profitability therefore pre-selected to yield very high expected profits and as low expected draw downs as possible. Since Coatl offers a wide array of systems on all different currency pairs I wanted to test another logic for portfolio building which excludes a selection bias by trading given “set groups” of currency pairs without any selection inherent to the profitability of the particular systems used.

–

My idea was to build portfolios centered around single currencies such that they could be traded with low margin and capital requirements, something which could never be done on an “all instrument” Coatl portfolio. The selection bias of profitable systems is avoided by picking all instruments which contain a certain pair, regardless of how profitable those systems or their combination is. For example to build a EUR single currency centered portfolio I used all EUR containing pairs such that the portfolio would trade the EUR/USD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/AUD and EUR/NZD. This selection method does not choose particular systems due to their profitability but is simply concerned with having one system on each instrument (systems which are generated by Coatl according to our development guidelines).

Repeating the above procedure for the GBP, USD, JPY, AUD, NZD and CHF I was able to build many single currency centered portfolios which lack any selection bias and are therefore more robust regarding possible “curve fitting” introduced through portfolio system selection. The portfolios also offer a very attractive way of investing for non-USD investors as for a person holding a EUR account it would seem more attractive to hold all investments in EUR rather than in USD.

Another very interesting characteristic of the above portfolios is that they create the possibility to trade many different accounts, each one centered around a different currency pair. In total you would be trading more than 20 different instruments across 7 different accounts, something which will offer protection from unexpected market events. Certainly all portfolios share at least one instrument and therefore their performance is somewhat correlated but the use of many different pairs on each portfolio ensures that risk is diversified along a wide range of different types of strategies.

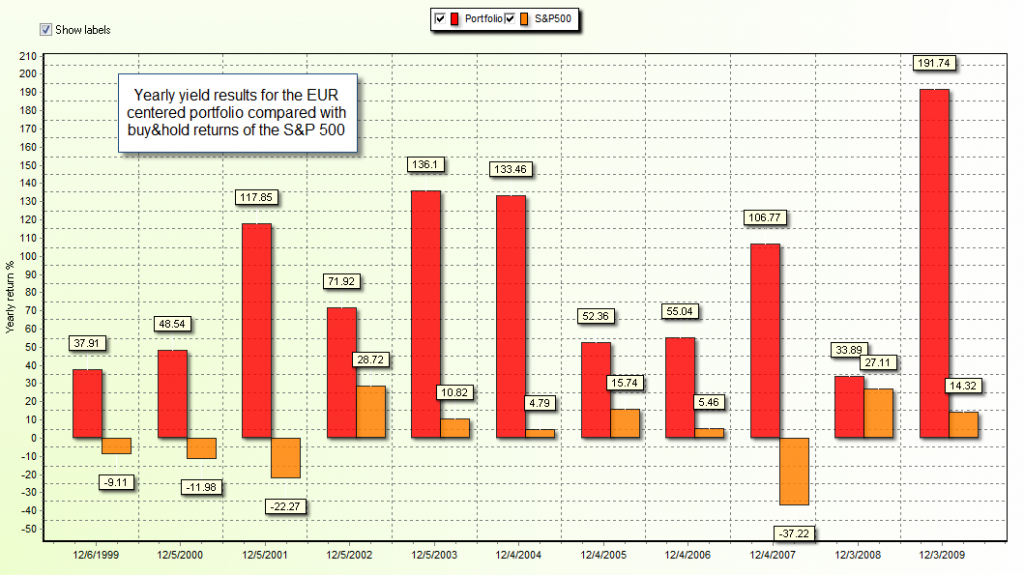

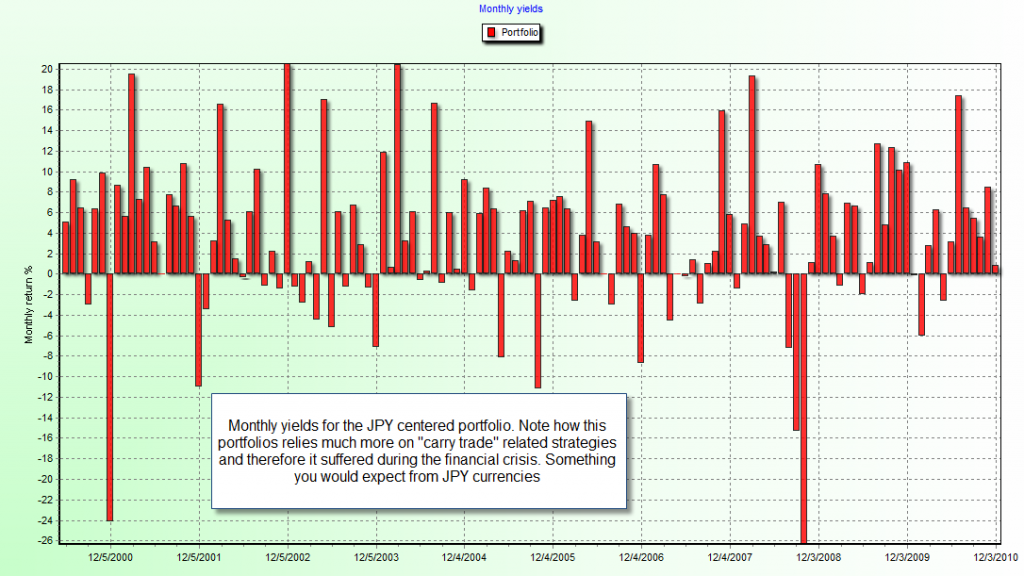

The performance of the single centered currency portfolios is also quite good. The USD and EUR portfolios are perhaps the best performing with AMR to Max DD ratios above 3 while the CHF portfolios goes next with a ratio closer to 2 and the AUD and JPY portfolios follow with a ratio closer to 1.5. The worse performing of the single currency portfolios is the NZD, most likely because its pairs have the least liquidity from all the above mentioned different single currency sets. It was however very surprising for me to see that a portfolio such as the EUR centered one, containing very illiquid instruments – when compared with the EUR/USD – such as the EUR/CHF, EUR/CAD and EUR/GBP was able to achieve such profitable results (in line with the USD centered portfolio). It is however very satisfying to see that the strategies resulting from Coatl and their application in non-biased portfolios still yields very favorable results.

Another important thing is that the portfolios hedge each other very well from a fundamental perspective. For example while the EUR and USD portfolios had one of their best years in 2008 the JPY portfolio got hit because the systems generated on JPY pairs rely significantly on strategies which exploit the dynamics of the carry trade. It is however good to note that the JPY portfolio recovered during the next few years and the EUR and USD portfolios still showed very solid performance. Overall most single currency centered portfolios have 1 or 2 losing years during the 11 year testing period while some (like the EUR centered one) have none.

–

This weekend I will share the settings and backtests for these portfolios within Asirikuy, giving members the opportunity to implement the portfolio they consider more in line with their interests or even to implement portfolios across different accounts to diversify risk and improve the potential for long term market survival. However it will also be important for anyone considering to use these portfolios to adequately evaluate and understand the strategies of all the different instruments used in order to trade Coatl successfully. It is important to remember that understanding is VITAL for success.

If you would like to learn more about my work in automated trading and how Coatl can bring significant insight into the inefficiencies within different currency pairs please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hi Daniel-

Looks great, and i’m looking forward to getting a look at the new portfolios. There’s a whole world of opportunity outside the “big six” pairs I haven’t considered up to now.

The only potential downside I can think of is that the spreads get a lot wider once once we get away from the big six. But more systems and more pairs increases diversity which could add the confidence need to scale up to every large account sizes.

Keep up the great work!

Chris

http://fx-mon.blogspot.com

Hi Chris,

Thanks a lot for your comment :o) I am glad you like the idea of using these portfolios ! Definitely this brings us out of the “big six” and gives us the opportunity to explore and profit from a wide array of different inefficiencies. Certainly the spread does get wider but since these portfolios trade daily charts with average profits in the +200% of the daily ATR mark they will not suffer tremendously due to this fact. As you say however the big advantage here is added diversification which gives us more confidence for larger account sizes. Right now I am also exploring Coatl for the trading of metals, indexes and CFDs (which are offered on some MT4 brokers) this would also add a larger degree of market diversification :o) Thanks again for your comment !

Best regards,

Daniel

Very impressive returns – how are the draw-downs?

Hello Ekreitzer,

Thank you for your comment :o) The AMR to Max DD ratios are mentioned within the articles. Anyway you will be able to see all the portfolio statistics this weekend within Asirikuy. Thanks again for your comment,

Best Regards,

Daniel