The great opportunities around trading and the long and steep learning curve are the main factors why most people who want to become successful traders tend to look for shortcuts. The idea of “not reinventing the wheel” and letting someone else do “all the work” prompts people to search for quick and easy profit solutions which they can simply benefit from with the “push” of a button. The idea to search for easy trading success is so widely spread and common that some people even becomes experts in this area, learning the latest and greatest ways to use a certain “turn-key” trading solution to achieve “maximum profits”. On today’s post I want to talk a little bit about the very important issue of trader responsibility, I will share with you my opinion about why no one will be able to achieve profitability for you and why you need to take full responsibility for your investments and ride that steep learning curve towards long term profitability.

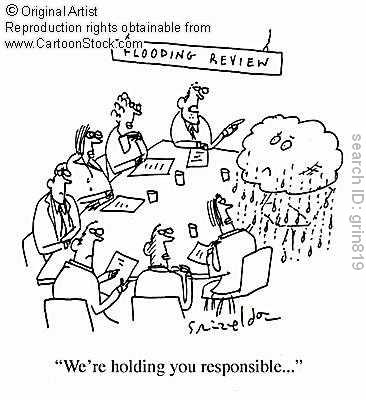

There seems to be no reason why everyone has to do the “hard work” to becomes successful traders. If many people have already done this then what in the world would prevent you from sharing their success? From expert advisors to trading signal providers, many different sources of this “magic touch” have sprouted within the past few years with the promise to let you benefit from the large experience and gains attained by this so called “good traders”. Now there are many problems with this approach and several reasons why it does not lead to a successful long term outcome. In the end whenever you try to lean the responsibility for long term profitability on something or someone else you’re effectively cutting your own chances of success.

–

Why is delegating responsibility in trading a bad thing? The first problem comes from the fact that people who do not understand trading do not understand who might be in capacity to be delegated this responsibility. As a simple example we have the typical case of new traders who put their money on cheap automated trading systems with the promise of huge gains. In this case delegating responsibility was a huge mistake since the trader had no idea of how to measure the quality of the entity he was delegating this responsibility to. In the end the trader is left with an empty or heavily crippled account and no lessons on how to attain profit. A price has paid in market tuition but the lesson was skipped, a very bad outcome.

The second reason why delegating responsibility over your trading is not a good idea has to do with your level of confidence in the entity which is trading your account. When people are ignorant about how trading works and how profitable strategies develop in time it will be almost impossible for them to take the burden of running a likely long term profitable strategy. Psychological pressure will be too great in periods of loss and the lack of knowledge about statistics will make the person very uneasy about what to expect and when the “responsible partner” should be stopped. Delegation in ignorance breeds lack of confidence which – in the end – leads to terrible results, even if the trusted entity was in fact doing its job as it was supposed to.

Does this mean we should use no tools? No, I am obviously not saying here that you should not use any algorithmic trading strategies. What I am saying here is that their usage should not imply a delegation of trading responsibility. You should understand that any lack of understanding or knowledge you have will make a dent in your ability to achieve long term profitability and trading tools which you do not perfectly understand will just make you fail in the long term. Automated trading strategies are tools which must be used as a way to exert your trading ideas onto an account NOT a way in which you delegate trading responsibility. What I mean is that the systems you use should be trading strategies you fully understand and therefore the responsibility of trading actions will be on you even though execution will be delegated in the hands of a trusted “automated entity”.

If you have started trading with the hopes of getting some kind of automated trading system to do all your work and your journey being limited to learning how to load a program and a script then you are in for a very big surprise. The path towards success in trading requires you to take responsibility for your trading actions so that you can learn the lessons you pay the market for and benefit from your experiences. In the end if you just look to load something that will “work like an ATM” you will find that – even if the technique you use is profitable in the long term – your lack of knowledge, understanding and evaluation capacity will make you fail before the potential of the technique you’re using is realized.

In the end the truth is simple: there are no shortcuts in trading. Either you take the time to climb the steep curve, learn about the market, system development, statistics and evaluation or you just will not achieve long term profitability. Automated trading systems are invaluable tools to help you achieve your goals but they will only work if you do not use them as ways of delegating responsibility. When using automated trading systems you should first build a strong knowledge and understanding base about statistics, the trading tactics being used and the programming techniques behind your system. Knowing all of this will not only help you have great confidence in your development but they will make any failure you have a truly rich learning experience.

If you would like to start your learning process in automated trading and learn how you too can gain a deep understanding about the creation, use and evaluation of algorithmic trading strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)