Perhaps the only thing which I have done constantly since I started trading is attempting to gain a deeper understanding about the field. If you have read my blog I incessantly talk about the need to develop an in-depth understanding of the market and trading and how this is the only efficient remedy against problems such as unprofitable trading, account wiping, use of unsound trading techniques, psychological issues, etc. But how do you gain an understanding? What does it mean to “understand” trading? How does someone go from learning that Forex exists to trading it profitably? On today’s post I want to talk to you about the building of an understanding in Forex trading and how by devoting time and effort to this you’ll be able to achieve success, or at least have a much higher probability to do so.

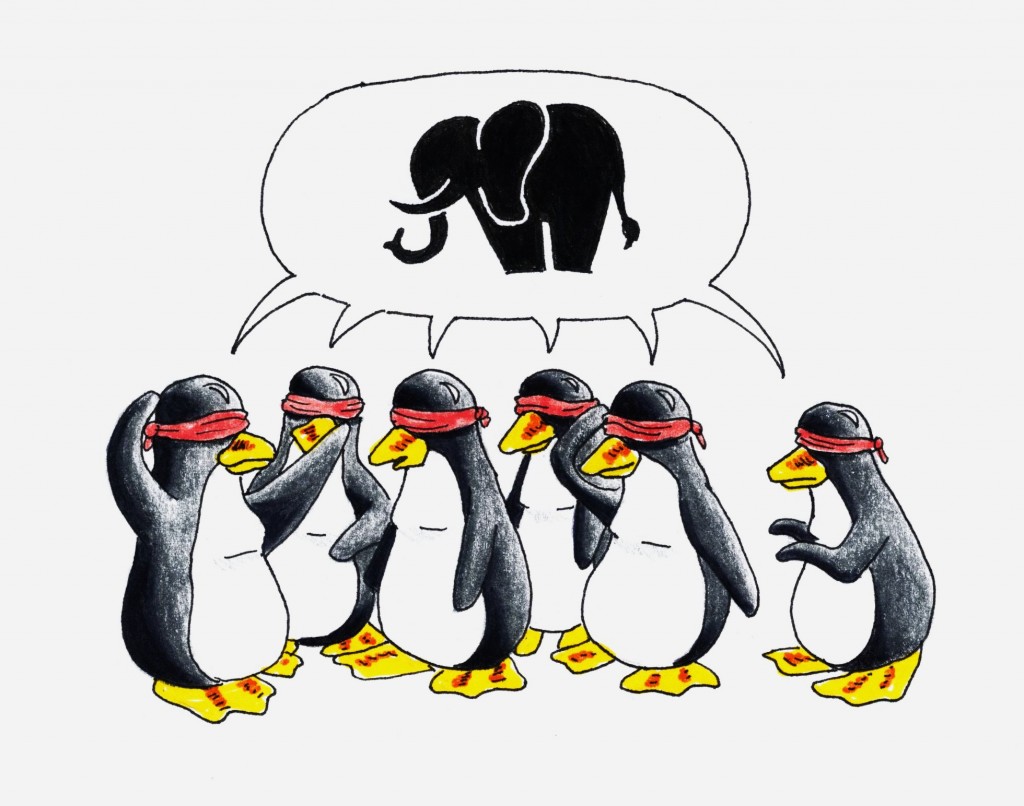

What is to “understand” ? Many people confuse knowing with understanding but the fact is that both are too completely different things. Knowledge is simply gained by acquiring information — whenever you learn something new in Forex, like what is leverage or what is a contract size you’re indeed increasing your knowledge about trading. However understanding is different because it involves a comprehensive view about a subject which involves both knowledge about “cause and effect” relationships and the ability to deduce new information from old one. You could therefore say that someone who “understands” trading is able to develop new trading systems, profit from the markets and be void of psychological hardship. Understanding is effectively the consequence of applying in-depth knowledge about cause and effect relationships.

–

–

There are probably many approaches to gaining an understanding about trading but I will talk to you about what has worked for me and why I believe this way of gaining an understanding can be quite universal. As a scientist I tend to be very curious and I also tend to think through the scientific method when I approach an area of knowledge I am not familiarized with. In trading it was the exact same thing. In order to build an understanding in trading you should approach the problem assuming that you do not know anything, that all sources of information are wrong and that all cause-and-effect relationships are to be explored.

For me this meant that I needed to have evidence for absolutely all the information I would use through my trading career. What does it mean to have evidence? It means that I needed to carry out “experiments” which answered the questions I had without taking anyone’s word or believing anything I read about cause-and-effect relationships in Forex trading. For example at some point during my trading career I wanted to know if the simulations obtained in trading programs are reliable when compared with what the systems really traded like on the past. In order to evaluate this I performed many demo/live testing runs and then performed back-tests of these same periods. Through this analysis I found that I could sometimes obtain good reproduction and sometimes I didn’t something which generated a cause-effect understanding for me regarding what types of strategies could be evaluated most accurately.

Building a causal relationship structure in your brain around trading is perhaps the most important thing you can do to make yourself a good and profitable trader. As in science in trading the gaining of understanding is all about generating hypothesis and then testing them against some experiments you design to answer the questions you might have. Can a Martingale be traded profitably? Does the probability of a system losing increases as it accumulates profitable trades? Do draw down and profit periods have some fixed cyclic correlation? Is there any limit to accurate simulation? All of these are questions you can ask and for which you can devise tests which can give you causal relationship information. Understanding in trading – again as in science – comes from ordered and reproducible experimentation. If anyone could do the same experiments and come to the same conclusions then you have a valid answer to a specific question.

In trading it is not about reading books or taking people’s advice but it is entirely about building an understanding. When you have a strong causal structure in your mind you won’t get “fear” or “greed” as you will be able to understand the reasons behind the things that are happening. The bigger your understanding is the larger amount of phenomena you will understand and the less anxiety and problems you’ll get into when faced with the challenge of managing a live account. When faced with the challenge of understanding something new (a causal relationship you haven’t studied before) you’ll have the necessary tools to study it and yield valuable conclusions.

When you approach trading like this, relying on evidence and experimentation to answer questions, you stop relying on the things other people tell you and you have a natural tendency to avoid being “married” to any idea. If there is any new evidence that challenges some of your previous observations then you consider them, re-experiment and reassess your conclusions. Many times through my trading career I have reached conclusions that weren’t valid in the “big picture” as I was ignoring something in my experiments but as others pointed them out and suggested new experiments we were able to reach a “broader view” that includes a much better understanding of what is going on. Trading though understanding is the wisest and most important thing you can do if you truly want to succeed on this field. It wont’ be fast and it won’t be easy and you will probably need to build a lot of knowledge in programming and statistics to answer all your questions but in the end you will reach a Zen-like stance at trading that will be the envy of all the “traders on the block”.

If you would like to learn more about my journey in trading and how you too can gain a true education in this field please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)