Why do so many people have unrealistic expectations in Forex trading while so few people have these same expectations when trading stocks or futures? The unique combination of minimum capital requirements and the very real possibility to massively multiply a rather small deposit into a large amount of money have this effect. On today’s post I will take you on a journey to explore the possible random outcome of Forex trading at several different risk levels and time intervals under certain constraints. Through this we will see how massive gains are a real possibility but why such outcomes are so rare and may almost always represent streaks of luck instead of a real trading edge. We will see what random trading can achieve and why – given the law of large numbers – we in fact expect to see these outcomes being achieved by some percentage of the overall Forex trader population.

–

–

Most retail Forex traders – profitable and unprofitable – lack any real trading edge. The most important reason why this happens is that most traders do not have any set of statistical data to justify entering a trade instead of staying on the sidelines – there is no measured expectation that the trade will perform better than random chance – and by definition this means that these traders have no edge. However having no edge does not mean that a trader cannot be profitable. The fact that random walks with negative bias – which is what you do when you trade without an edge in Forex – can temporarily go into profitable territory implies that there is a chance that a trader will be profitable even without having any real edge.

We can take a look into some of the expected scenarios for such traders by randomly entering trades within a Forex trading instrument and looking at the distribution of potential outcomes we can achieve. For this I have performed simulations on the EUR/USD where a trader has the same probability to enter a long, enter a short or remain on the sidelines on each 1H bar. Trades are entered with a symmetric stop loss and take profit where both values are set at 100% of the 20 period daily Average True Range. If a trader has a trade open and decides to enter a trade in the same direction the SL and TP are adjusted as if the trade was new and if the trader decides to enter a trade in the opposite direction trades are stopped and reversed. For all cases I performed 1500 simulations.

Outcomes are specially interesting when we look at high risk levels which is what many of the traders who want to amass big fortunes from small deposits typically use. If we look at the above mentioned simulations for 2015 data using a 50% risk per trade we can see that the amount of traders who reach a full account blow out is not 100% of traders. Although by any standard there is no way to trade with an edge at a 50% level – because random fluctuations on a real edge always ensure you’ll have more than two or three consecutive losses – we can see that indeed some traders are expected to “make it” after a year of risking 50% of their accounts on every trade. The above graph shows the frequency distribution of profit as a percentage of the initial deposit for these traders, although most traders in fact lose the entire account there are some with amazing results, with gains in the +4000% region. Calculating the probabilities using the frequency distribution obtained we can in fact expect a 0.06% probability to achieve such a result and we would in fact expect a profitability of 10,000%+ to show at a large enough sample size (at a 10,000 trader sample we would already expect at least one to make it to this level by chance).

–

–

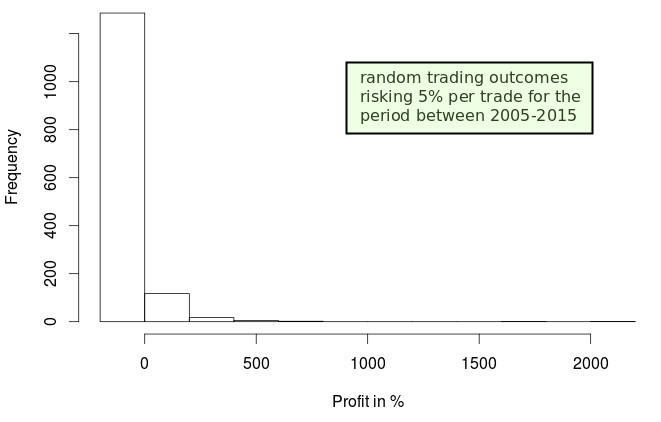

I want you to consider for a second how amazing such a trader would look. If one person through a year of trading achieves a 1000 fold increase in equity then it will certainly look as though this trader has some sort of crystal ball. It is therefore not surprising that so many people strive to reach this goal because when someone achieves something along these lines they are bound to look like messiah in the eyes of those who want to go from rags to riches. The same case can indeed be expanded to much longer trading on lower risk. Indeed someone trading a 5% risk over a 10 year period can achieve the same result out of chance (see the second distribution above). In this second case the trader would seem even more amazing because we intuitively believe the trader has more idea of what he or she is doing – longer time has passed – and that the probability to achieve this from randomness is much lower, when in reality it’s in fact similar to a shorter lived, higher risk case (trading frequency per year would have to become much higher for the probability to drop very significantly).

Given the above it’s not surprising that we have such a hard time selecting traders that perform well because they really have an edge. Given that there are millions of currently active retail traders the law of large numbers predicts that such outcomes will happen and will actually not be that uncommon (0.01-0.05% from a few million is a lot of people). Given that these outcomes will get far more exposure than the large majority of losing outcomes we would then expect most people to actually get a distorted view of their probability. Of course the expectation of these traders to be able to continue their profitable runs is extremely low, reason why you see such a high top trader turnover on social trading sites like zulutrade and etoro where such outcomes present themselves from time to time.

–

–

How can we distinguish then between randomness and real edges when looking at track records? If we want to do so we must make sure that whichever outcome we choose to follow has an extremely low probability to happen due to random chance. To be sure – given the amount of people who trade Forex – we would need to have a confidence above 99.99999% to ensure that we aren’t being fooled by a track record which is an expected case from the law of large numbers (which although rare we expect that it will get a lot of attention). You can do this by being more astringent about your criteria to choose what to trade. For example – assuming well behaved money management where all trades risk a fixed percentage of the account – you would expect the combination of high linearity with high Sharpe ratio to be exceedingly uncommon when trading randomly, especially at significantly large trading intervals. In fact if a track record has 5 years, with more than 300 trades, a Sharpe ratio above 0.6 and an R² above 0.9 (in log(balance) vs time) we would expect the probability of this to come from randomness to be about 1 in one trillion. This is low enough such that the probability that it shows up by chance – even with all the traders that currently exist – is extremely low.

I hope that the above helps you better understand the role of chance in Forex trading outcomes and how apparently amazing results can simply be the result of chance, even if they seem rare and precious. Simply having made money does not mean that someone knows what they are doing in this market, as you see above there is a material chance among a huge population that this will happen. Before you trust an outcome to have an edge make sure you do the math to ensure that whatever you’re seeing is not an outcome you would expect from chance given the amount of traders currently active in Forex trading. If you would like to learn more about algorithmic trading systems and how you too can design your own trading systems with a historically measurable edge please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.