On yesterday’s post I spoke about my first efforts to create trading systems using hourly shifted daily timeframes using machine learning. The results were so encouraging when using this type of algorithms on the daily timeframe that I decided to take this whole concept into our price action based cloud mining effort in order to start constructing strategies that trade shifted variations of the timeframes we’re currently mining using GPU technology. On today’s post I want to share with you some information about how this will greatly expand our ability to generate strategies, how it will allow us to find strategies that have been completely inaccessible up until now and how I had to modify the mining process in order to make this possible. I will also go a bit into the state of our current mining operations and how I envision our future going forward.

–

–

Since the idea of shifted timeframes came while meeting with my fellow partners and Asirikuy members in New York I have been very exited by the potential it could bring to our trading. After working on the initial coding implementations to actually generate and test the timeframes – which led to my first post about shifted timeframes earlier this month – I was finally able to show some proof that the idea is as good as I though on my last article. Given that the improvement in the amount of systems generated and their statistics when using machine learning was so big, I was very excited about the notion of taking this concept to our current price action based strategy mining using pKantu.

Currently our price action based cloud mining focuses on strategies trading within the 1H timeframe, this has been necessary due to the memory constrains we have when using GPU technology as using lower timeframes becomes much more computationally expensive and mining timeframes like the 5M and 15M is at least an order of magnitude slower. However the problem of trading the 1H is that we are mainly constrained to only 24 entry points each day and we lack an ability to exploit better entry opportunities that may surface at different times of the day, particularly between hours. This way of trading also accumulates our liquidity needs at certain points in time and makes it difficult for us to expand our number of systems much further without bumping into limitations related with return correlations and trading volumes. With shifted timeframes all these problems are ancient history.

–

–

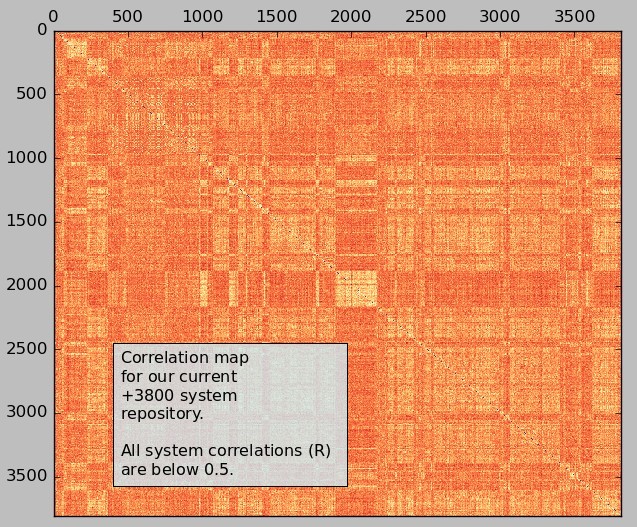

With the implementation of one minute shifted one hour timeframes we gain the ability to enter trades at any point during the day (since we can enter trades with minute resolution, 1440 possible entry points each day). However since the data is still sliced in 1H chunks we have the ability to continue mining at the same speeds only that we will now have access to trading systems in 60 hourly timeframes (instead of 1) for each symbol we trade. Given the fact that we currently trade on 6 highly liquid pairs we will now have access to 360 different timeframes where we can generate uncorrelated strategies instead of the 6, 1H timeframes we have been using up until now. With our repository now breaching the 3800 system mark being able to access all this additional information and performing system generation through all these new timeframes will hopefully generate a great increase in the amount of diversification within our largest trading portfolios. Our trading possibilities are expanding tremendously.

Implementing this has also been no easy task and there is still a way to go before these strategies on shifted timeframes are fully operational within our live trading. Today I am releasing our mining software (pKantu) update enabling the mining process on these shifted timeframes but the entire testing and implementation of the software to trade the generated systems will take a bit longer since the use of these non-standard timeframes requires custom refactoring using the one minute data obtained from the broker and several modifications to the way in which our software works. As I have mentioned in past posts this is possible because we have full source code access to the software we use for the back-testing and trading of our strategies, using a black box implementation like MT4 back-testing strategies like this would be far more complicated and error prone if not absolutely outside of what the software can do.

–

–

With all that said it feels like a new era in our mining is starting today. By greatly enhancing our mining capabilities and opening up the road to time shifted mining we hope to greatly increase the grasp and scope of our price action based strategy repository. With these modifications it seems perfectly reasonable to expect we will reach 10,000 uncorrelated strategies from low data-mining bias processes by the end of the year. Of course if you would like to learn more about price action based strategies and how we control for issues such as data-mining and curve-fitting bias please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.

Thank you, Daniel, for bring this to our attention.

I think the importance of Time frame is highly exaggerated, why not to trade 20 minutes bar or other intervals. As long as we found an inefficiency in the market, and the strategy is profitable (as per our acceptance policy). We can divide the week worth of data into equal intervals, which might be 1h or 2h or 20 or even 40 minutes, depending on data provider.

And then shift each interval. As long as we have enough computer power to mine the data.

There are my thoughts from 2007, but have not seen article which touches the subject.

I hope it makes sense.

What are your thoughts?

Thanks for posting! Well the importance of the timeframe is indeed exaggerated in the sense that timeframe divisions are somewhat arbitrary. However certain time divisions might show things that others do not. For example simply because markets open at 00:00 an hourly timeframe might show things that a 50 minutes timeframe might miss. In the end timeframes are just ways to represent the underlying tick data and different ways of doing this are bound to lead to different things. In the end the timeframe you can use simply represents the level of computational effort you can carry out. If you had infinite computational power then you would always use tick data since this is the underlying true market data and you could construct all possible OHLC formations from it.

Also you can try this with correlation with multiple instruments, across multiple time frames / shifts . there is no limit for complexity. :-)

Just for sake of testing the concept. (Just throwing thoughts to the public – brainstorm) When there is GPU involved it is worth to try.