Most new retail Forex traders get into this game for a simple reason, to take some change and turn it into millions of dollars using very high risk trading tactics in the shortest possible amount of time. The reason why they do this is the same reason why thousands of people lose at roulette tables every year, there is a thrill and there is a mathematical possibility of success.But how good are their chances? Are traders better off spending that money on the lottery or the roulette? Is Forex trading a better “gambling offer” when approaches in this manner than these other choices? On today’s post I want to go a bit deeper into the probabilities of success in the simple scenario of taking 50 USD to 1 million when trading Forex. We will analyse the math, compare it to other similar bets and find out how good or bad the probabilities to perform the above task actually are.

–

–

First of all, let’s eliminate the delusions of grandeur. New Forex traders have no real trading skill, no discernible long term positive expectancy and no crystal ball. No edge in trading is of a large enough magnitude to allow you to make symmetrical bets with high certainty within a very small number of trades and all that Forex traders who trade high risk have in their favor is the random probability that prices will move towards their target. As I have discussed previously returns obtained in this fashion are sometimes difficult to distinguish from random chance but – don’t get confused – there is no way these feats are ever repeated or their “secret” taught to others. This of course does not eliminate the very real possibility of taking 50 USD to 1 million dollars doing Forex trading. Something that can be done in a matter of days/weeks doing simple random bets in the market.

So what are the chances? Let’s imagine the simplest possible game. A trader has 50 USD and he wants to make all-or-nothing 100 pip bets using his or her money. After every trade the person will either reach the 100+spread pip profit or take a loss that wipes the account. Now here is where you need to pay special attention to how trading actually works. A trader won’t be able to take that entire loss (100 pips to reach 0 balance) but he will actually get a margin call that happens before depending on the leverage he has. If we assume we’re trading with a regulated broker – because what would the point of this be if you couldn’t withdraw funds after – then you’re most likely getting stopped automatically somewhere close to 90 pips for a 90% loss. Given that your margin call stop is at 90 pips and your take profit for a 100% gain is at 100+spread, assuming a very generous spread of 1 pip, your probability to win the trade is actually 47.12%. You can start to see how far this is from the 50/50 scenario that some people generally portray when you consider the actual real probability to walk away with the win versus the loss.

–

–

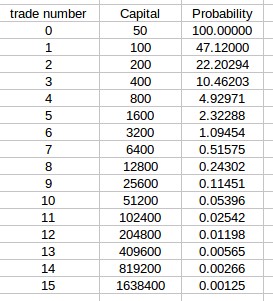

If this is the same probability you have on each trade then achieving a 1 million dollar profit takes 15 bets and gives you a final capital of 1,638,400 USD. If you want to quit slightly before 1 million then you can stop at 14 bets with a 819,200 gain. The table above shows you the amount of capital you would have at each consecutive bet and the probability that you will get to this level without receiving a margin call. In the end the probability that you will get to the 1 million dollar mark is 0.00125% or about 1 in every 80 thousand. You can see that the probabilities to get there are actually quite low. The next interesting thing is to compare these chances with some other means of betting to see if what you have is actually a better or worse proposition than what you could get otherwise.

For example winning the New York lottery with a 1 USD bet gives you a probability to win in the order of 1 in 22.5 million. Since the minimum jackpot available is 2 million dollars and we can make 50 bets using the initial 50 USD we can adjust the probabilities accordingly to match our 15 bet trading experiment that ends up with 1.6 million. In the end the probability to make the same amount of money with the same risk in the New York lottery is around 1 in 360,000. If you consider the simple bet being made and you do not bet again with whatever you have left after you are margin called then the probability that you make it in trading to the 1 million dollar mark is higher than the probability to make it in the New York lottery with the minimum jackpot. Of course this does not consider the probability that you might get other prizes beyond the jackpot when playing the lottery.

–

–

Consider also how the New York lottery and other lotteries can have jackpots that far exceed the 2 million minimum mark and your trading scheme starts to look far less attractive. If the New York lottery jackpot was at 20 million the same risk adjusted bet would already be at 1 in 36,000 which would be a much more attractive bet than anything that you can potentially come up with when trying to gamble using the Forex market. In this sense you are far better off waiting for a big enough jackpot in a lottery like this and betting all the money you wish to put into high risk trading rather than making these type of bets in the market. Of course the randomness in market returns fools many into believing that they have “skills” above randomness when performing this type of trading but in reality the New York lottery is a much better choice for this type of “trader”.

Of course if you’re not a high risk trader but you’re in this for the long haul, attempting to achieve realistic risk adjusted returns using adequate risk controls using systems with strong historical statistical edges, then please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.