Recently I have showed evidence that minimum variance optimizations can be expected to have better performance than equal weight portfolios when the number of trading systems used is high enough. This observation is made when system behavior remains similar – in terms of profits/losses – while correlations between systems vary significantly. However these observations were made using the Sharpe ratio on pseudo out of sample periods spanning 15 years but I made no effort to study shorter term statistics that could be useful in showing how strongly or frequently the minimum variance portfolios tend to out-perform the minimum variance portfolios and in what terms. On today’s post I want to share with you the results of the 12 month rolling return, standard deviation and Sharpe ratios over a pseudo out of sample period so that we can evaluate how the equal weight and minimum variance optimizations behave.

–

–

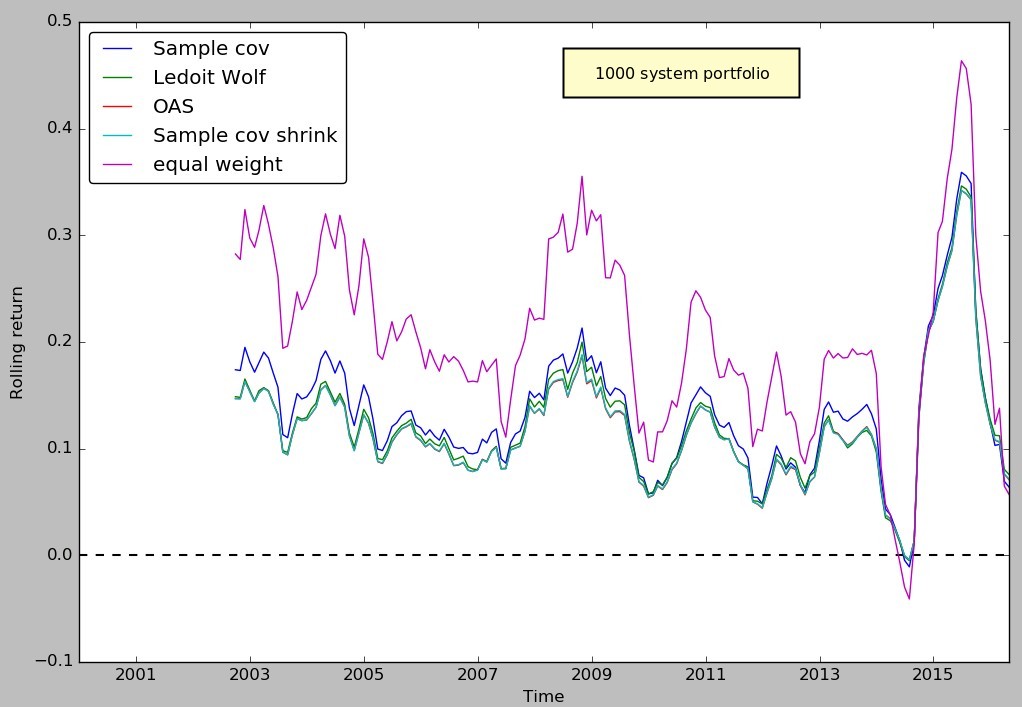

As in previous posts I have used data from 1986 to 2001 to calculate the portfolio weights using daily returns and different covariance matrix types and a simple minimum variance optimization after which I have then used the output weights to simulate the portfolios going from 2001 to 2016 (the pseudo out of sample period). The first thing I wanted to look at is whether the minimum variance optimization significantly reduces or increases the expected returns of the portfolios. As you can see in the image above all the minimum variance optimizations using different covariance matrix types have similar returns and all of them are lower than the equally weighted portfolio. This means that the minimum variance optimization has lowered the weight of high CAGR strategies and increased the weight of lower CAGR strategies such that in the end the 12 month rolling return is smaller.

Since we know from our previous evidence that the long term Sharpe is bound to be higher for the minimum variance optimizations there must therefore be a reduction in the standard deviation which can justify this movement. Looking at the rolling standard deviation we can see that this is indeed the case. There is a substantial drop in the standard deviation when compared with the equally weighted portfolio. This is significantly constant through the entire data set with the overall differences being in the 1-2% range the whole time. The variance of the rolling standard deviation is also much smaller for the portfolios, showing that the reduction is not only in the rolling standard deviation but also in how the rolling standard deviation changes, which is consistent with lower longer term Sharpe ratios.

–

–

The Sharpe ratio is however the most interesting statistic to look at since it expresses the amalgam of the two rolling graphs showed above (note that this Sharpe ratio values are not annualized, to annualized multiply them by sqrt(12)). The third graph in the post shows how the Sharpe ratio is consistently better for the 1000 system minimum variance portfolios across the entire test, showing that the drop in the returns is compensated by an even deeper drop in the standard deviation. It is also worth noting that the 12 month rolling Sharpe ratio of the all equal portfolio does become better than the Sharpe ratio for the minimum variance portfolios at several points within the graph, meaning that under some circumstances the equally weight portfolio will show a better 12 month Sharpe. It is therefore not possible to always expect the minimum variance portfolio to perform better across a 12 month window. The probability of this happening may be significantly larger when considering real out of sample tests where the difference between both portfolios might be even tighter.

According to our previous tests this difference is expected to expand as the number of systems grows larger as the long term Sharpe ratios start becoming bigger for the minimum variance optimizations. This is exactly what we observe for the rolling chart as well with the gap between the rolling Sharpe ratio for the equally weighted and minimum variance optimizations becoming even larger. The graph below shows the Sharpe ratio rolling graph for a 2000 system portfolio where it is evident that the gaps have become bigger. Nonetheless we can still observe several periods where the equally weight portfolio outperforms the minimum variance optimizations in terms of Sharpe ratio, showing that larger portfolio numbers may not imply a constantly better performance when compared with naive portfolios.

–

–

It is also important to notice that the different covariance matrix types have rather small differences between each other, in agreement with our previous observations where long term Sharpes between the different minimum variance optimizations was small. In this regard it might not be easy to choose between the different types, although Shrinkage methods do seem superior to using the simple sample covariance as they tend to under-perform less frequently when compared to the equally weight portfolio. It is also clear that using minimum variance optimizations would imply under-performing the equally weight portfolios at the same risk in terms of returns while in terms of Sharpe ratios results should be better. Ideally someone trading these portfolios might want to compare the results of both portfolios in equalized standard deviation terms so that proportional gains in the returns can be attained. If you would like to learn more about portfolio trading and how you too can build large trading portfolios using all these different optimization techniques please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies

Hi Daniel,

Interesting stuff as always. A trendline on the last chart would pass through ~ 1.5 in 2000 and 0.5 today. Do you think this relates to increasing market efficiency or something else?

Thanks,

Tom

Hi Tom,

Thanks for writing. I am glad you like my posts! Yes, I also noticed that, it can become quite more evident when you look at the long term graph – even including the in-sample results obtained when balancing the portfolios.

As you can see the long term non-annualized monthly rolling Sharpe for a 1000 system portfolio was around 1.0 (around 3.45 annualized) and it then shoots up tremendously in 2011 and then moves down, swinging around the 0.5 (around 1.7 annualized) region as you have correctly observed. This seems to match the timing of operation twist. As you can see when looking at the big picture this looks like a regime change, rather than a downtrend. My best guess is that continued market intervention by central banks has made the market more unpredictable and hence more efficient since then (this is reinforced by the fact that drops in the rolling sharpe are suspiciously aligned with these events). This is not surprising since central bankers are by far the most powerful market agents and unpredictable behavior from their part immediately means more efficient markets. Although the results show that it is still very possible to obtain positive performance it is undoubtedly harder now. The 4500+ system portfolios show a more interesting picture, but I will leave that for a future post ;). Thanks again for writing and for reading my blog,

Best Regards,

Daniel

Thanks, this makes a lot of sense and is worth a blog post in itself! Looking forward to the 4500+ system post (hopefully with some info on how much computing power is needed to run such as portfolio in an account :-).

Tom