Although my blog has been mainly focused in the trading of the spot FX market by retail traders using proprietary tools it is nonetheless interesting to consider other options out there that may allow investors to put money into currencies without having to worry about which strategies to trade or how to manage them. Currently there are a number of financial ETFs that allow investors to fulfill these goals by investing in one of several different strategies focused on carry trades, momentum, commodity holding countries, etc. Today I want to take a look at these ETFs, how they have performed, how they might be useful and how they are different from regular Forex speculation.

–

–

Exchange traded funds (ETFs) have become very popular during the past few years. They represent a variety of different investment strategies and allow investors and traders to gain exposure to complex instrument arrangements without the need to purchase a large variety of different shares. This means that ETF trading is efficient – you only purchase one share type and gain exposure to potentially many things – and it is also extremely convenient. Another advantage is that the ETF market is regulated and exchange traded, meaning that you can have more peace of mind regarding where your money is and how it is protected by regulatory bodies. From the many number of things that ETFs allow you to trade, currency strategies are definitely among them.

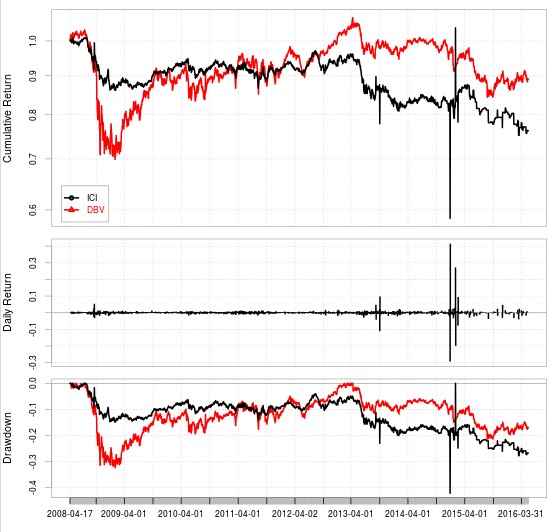

There are very simple ETFs that allow you to gain short/long exposure to certain currencies while there are others that allow you to follow more complicated strategies. The DBV ETF – all time performance chart showed above – is a G10 carry trade strategy that buys high interest rate currencies against low interest rate currencies in order to take advantage from both the interest differential and the fact that high yielding currencies tend to appreciate over low yielding currencies. The fund has been basically break even since 2006 since carry trade strategies have not been able to gather significant momentum since the financial crisis ended. However the ETF will probably start pulling some returns when central bank rates start to normalize in the medium term. While central bank rates remain all close to or below zero it will be hard for these and other similar carry trade ETFs to show any interesting performance. The ICI ETF – also showed above – follows a similar strategy and has seen overall worse performance than the first ETF.

–

–

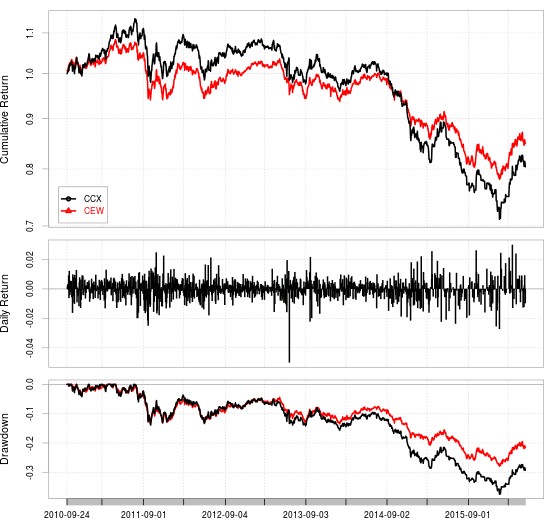

There are other ETFs that follow strategies that simply purchase baskets of currencies to gain exposure to certain market types. For example the WisdomTree Commodity Currency Strat ETF (CCX) purchases a basket of commodity dependent countries that is heavily reliant on the price of several different commodities. It allows an investor to gain exposure to a large variety of commodity products and producing countries with a single asset purchase. The WisdomTree Emerging Currency Strat ETF (CEW) follows a similar philosophy with emerging countries, allowing a trader to gain exposure to a large variety of different emerging market economies in one go. Of course with the recent drop in commodity prices and dollar gains these ETFs have seen really poor performance since 2010, being only marginally profitable for a small period – around 2 years – since their inception. If the dollar devalues significantly these baskets of currencies stand to gain a significant amount of profit.

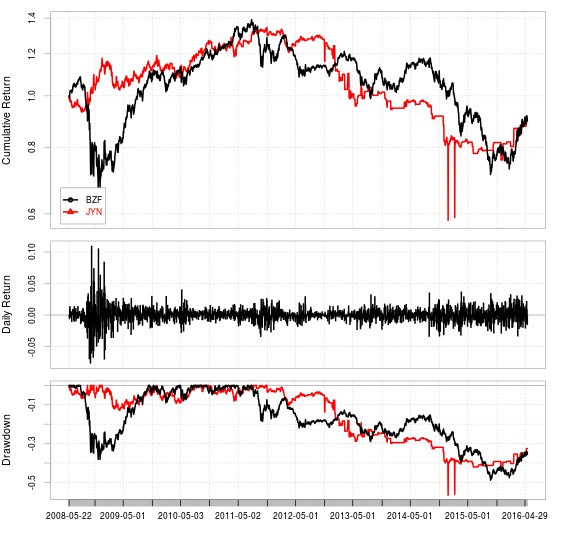

There are also myriad of currency ETFs that seek to track currency spot or future rates of single pairs. These are useful if you wish to speculate with currencies in a stock exchange environment. The CurrencyShares company offers many different ETFs tracking virtually all G10 single currencies. Some of these ETFs, like the BZF (WisdomTree Brazilian Real Strategy Fund) have already made almost 18% this year as the price of some currencies has increase significantly since the beginning of the year. The JYN iPath JPY/USD Exchange Rate ETN has also made an 11.6% profit so far this year.

–

–

Although most of the above instruments would be considered poor choices for a buy-and-hold portfolio (except perhaps the DBV ETF which is largely uncorrelated to bonds and stocks) they can become interesting instruments for speculation, given that they are both traded in exchanges and offer degrees of exposure that would be difficult to achieve with spot or futures trades. For example the CEW ETF allows you to gain exposure to some emerging market currencies that are not available through regular future exchanges or spot Forex brokers, giving you lots of potential opportunities for speculation that simply won’t be accessible to those who limit their trading to spot FX. If you would like to learn more about currency trading and how you too can learn how to create large currency portfolios using spot FX trading strategies please consider joiningAsirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.