Two weeks ago I posted some twitter picks showing the performance of several legacy Asirikuy systems that were created several years ago with the idea of long stability in mind. After this twitter post I received several messages asking me to expand on these results on my blog to take a closer look at how some of these systems have behaved during the past few years. Today I want to show you the past two years of results for the GG ATR – which was last optimized in January 2013 – so that we can see if this system was actually profitable and how it behaved during this trading period. We will also discuss some of the reasons why it behaved in this manner and why it still would have been very hard to trade this strategy through this period.

–

–

The God’s Gift was one of the first strategies I ever discovered on the internet that I saw could be modified and turned into a long term profitable strategy. Back when I first tested the strategy in 2007 it looked like a reliable system, the first I ever found which was able to give some sort of stable back-test. After examining the strategy I noticed several problems with it – related mainly with a lack of adaptability to volatility – and therefore decided to create the God’s Gift ATR which is nothing but an revised version of the strategy to use ATR adapted take profit and stop loss values. After the years passed we also discovered other problems with our systems – mainly asymmetry and trade chain dependency – reason why this system was last modified in 2012 in order to account for these issues. The last optimization for the EUR/USD and GBP/USD, as I mentioned above, was carried out in January 2013.

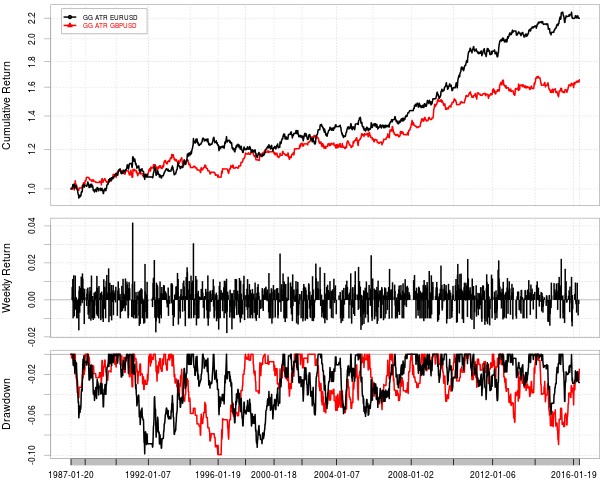

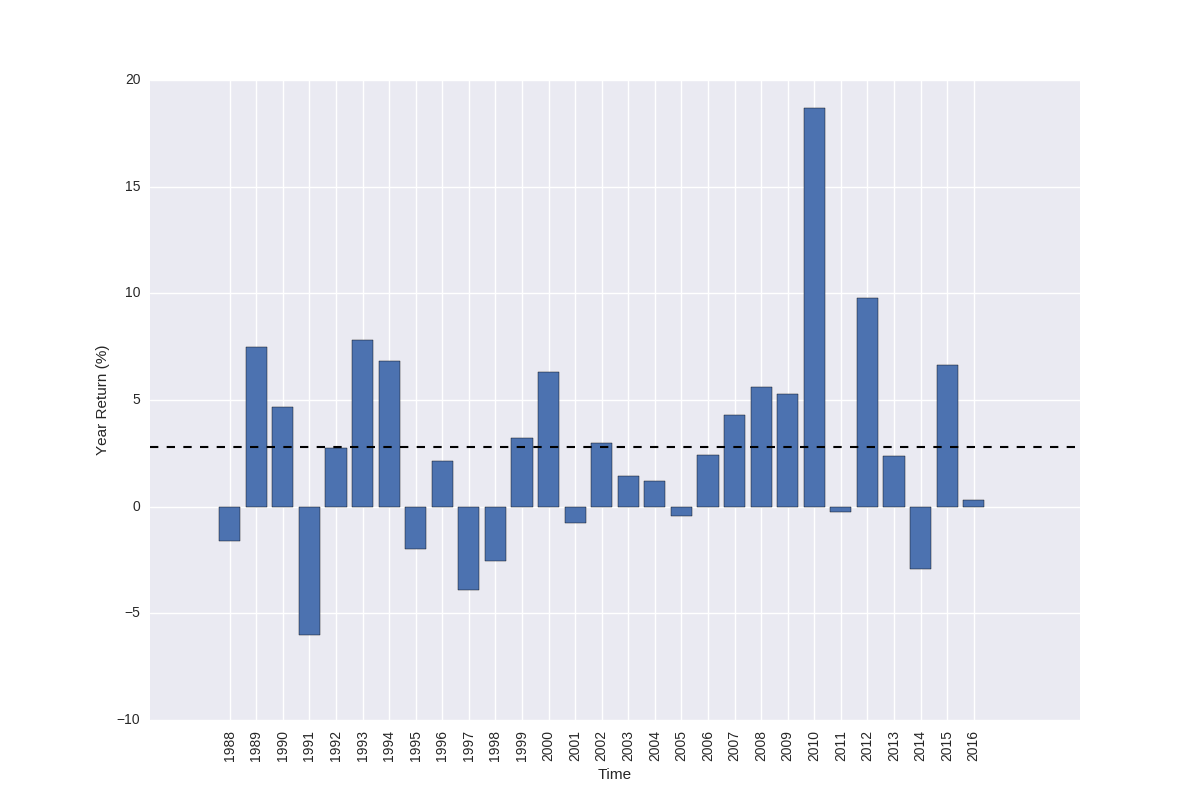

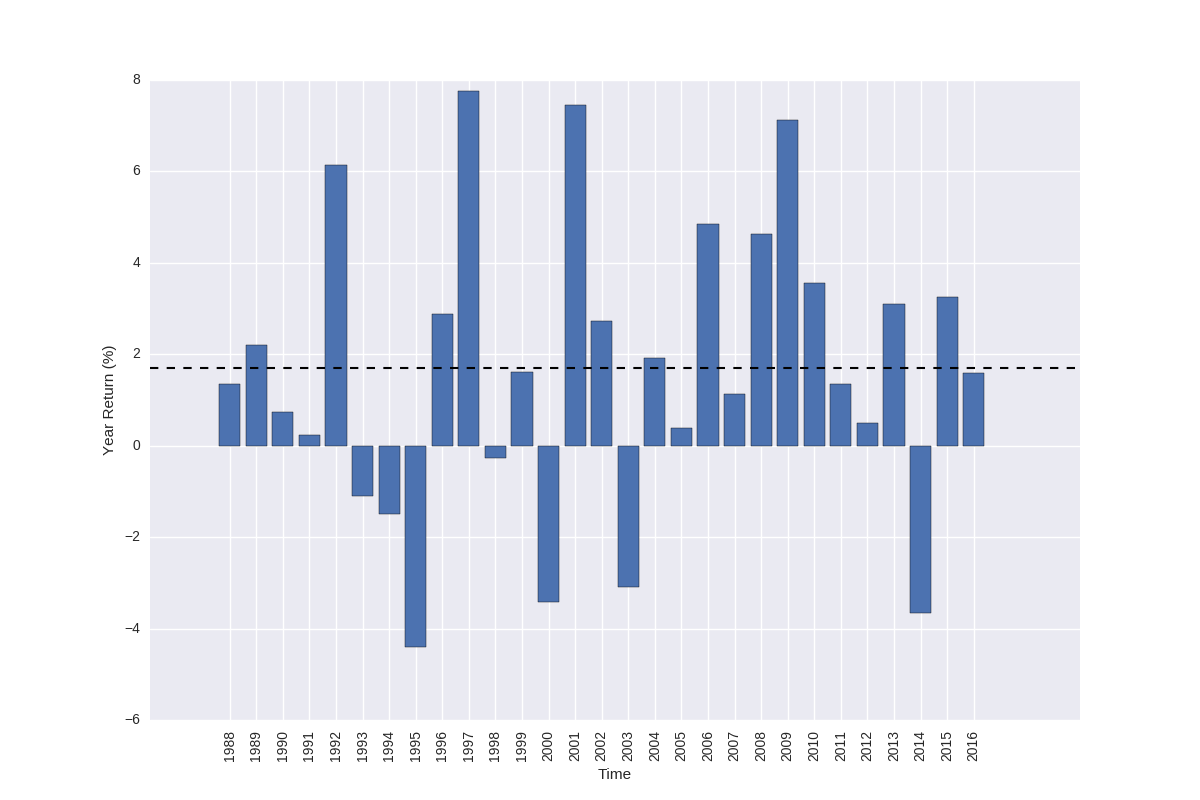

Fast forward three years and the balance curve for the God’s Gift ATR on both symbols looks as showed above (at a 1% risk per trade). The system has been profitable on both the EUR/USD and the GBP/USD as a whole, although the system has indeed faced one losing year on both symbols since then. Since at a 1% risk the system would have given a relatively small profit – the CAGR at this value is just 2.75% – most people would have traded it at a much higher risk, possibly around 5%, in order to obtain a significant benefit from it. However aiming for a 13.75% CAGR would have meant that the drawdown faced in 2014 would have reached close to a 30% loss, which would have possibly been too hard to bear for most people, especially when aiming for this type of long term average yearly return.

–

–

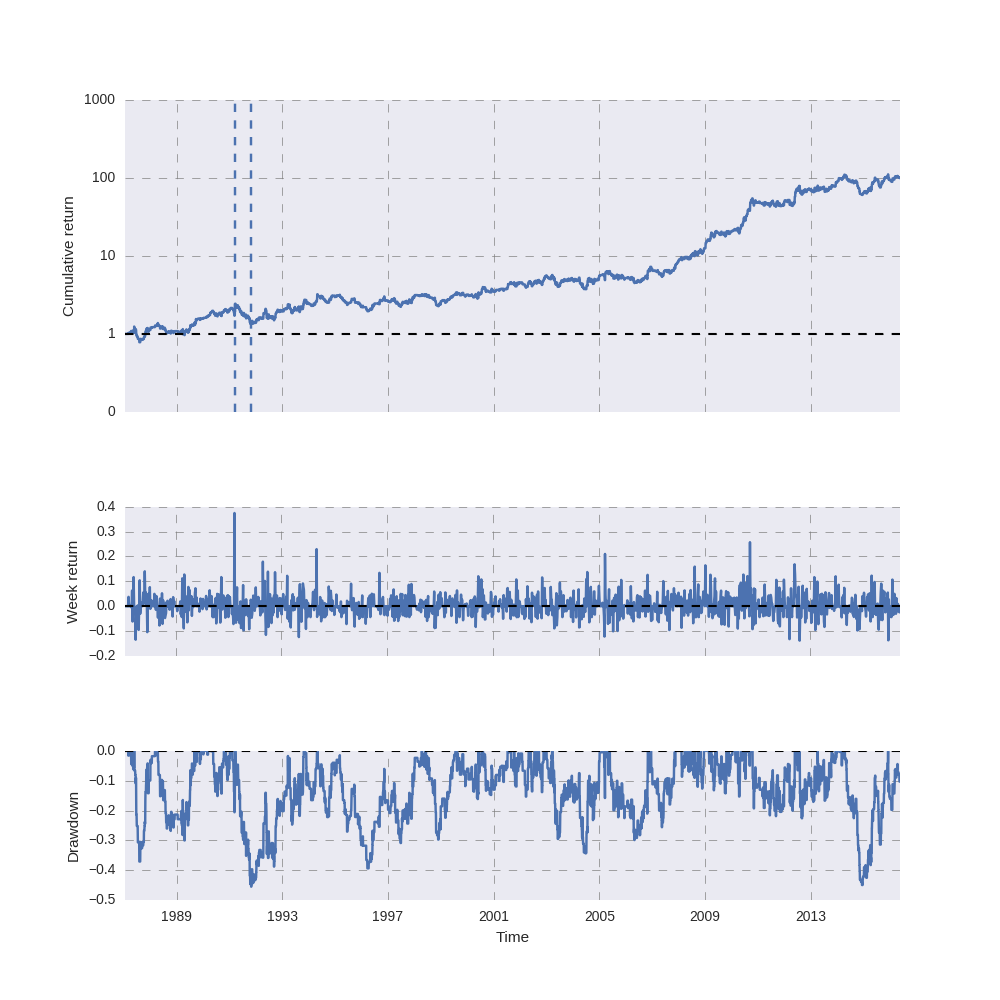

Someone who would have constructed a portfolio aiming at a 20% CAGR would have obtained the equity curve showed below. As you can see the account reached a drawdown near 50% in 2014, owing to the large correlation between the same strategy trading on both symbols. Such a portfolio would have returned around 20% in 2013, -25% in 2014, +45% in 2015 and currently around +5% in 2016. Meaning that the person would have made a significant amount of money after 3 years but having gone through a very important drawdown period.

It is also important to highlight that both of these strategies have behaved entirely within their statistically expected behavior within this period. Both systems remained above their Monte Carlo 99% confidence worst case balance lines and never crossed the worst case for either CAGR or Sharpe ratio during this period. However it is evident that the strategy is psychologically very challenging to trade due to its inherent characteristics and therefore – even if it does not fail – the user is expected to go through very significant periods of drawdown to achieve a reasonable return on investment. However the God’s Gift ATR continues to work, three years after last being optimized, as it was simply designed to give long term profitable results on the EUR/USD and GBP/USD through more than 20 years of market data.

–

–

Right now at Asirikuy we have moved away from systems of this sort – they are available as legacy systems but we no longer live trade them – as they are difficult to replace, they were manually designed, they were created without controlling for mining bias and their statistical characteristics are below our current standards. At the moment we create systems using machine learning or price action by performing community based mining efforts using GPU technology. If you would like to learn more about the automatic creation of trading systems and how you too can learn how to create systems using sound statistical criteria please consider joining Asirikuy.com, a website fiAsirikuy.comlled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.