Up until now we have carried out price action based entry logic mining in pKantu using simple open/high/low/close (OHLC) comparisons where systems are demanded to be symmetric – mirror patterns create opposing signals – and completely ignoring some price aspects to prevent mining from becoming too complex. However – thanks to some advances we have made since we started price action based mining – it is now possible for us to implement more complex mining and to allow for the creation of asymmetric trading strategies. Today I am going to be talking about the above, how it will likely change our price action based mining and what it will mean for us in terms of the development of the price action based systems.

–

–

Our simple price action based mining finds entry logic patterns by using OHLC comparisons. This means that entry logic rules are always of the form OHLC[X] >< OHLC[Y] where X and Y are different shifts and we use combinations of these rules to form system entry logic sets. These rules can also be expressed as a case of the form OHLC[X]-OHLC[Y] >< 0 where it becomes clear that this is just a simple case of a much more general equation of the form OHLC[X]-OHLC[Y] >< N where N is some magnitude in absolute price terms. This change of the mining logic to include price magnitudes – which are completely ignored if you only compare price A to price B – expands our mining to be able to read much more information from price data since magnitudes are an important component of what price is doing.

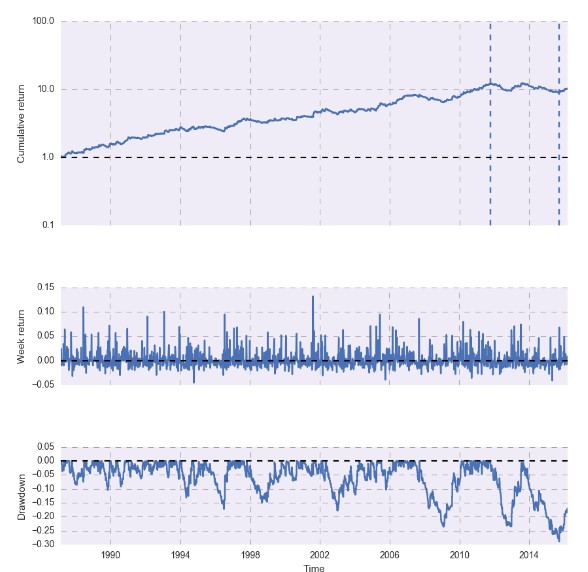

The above implies a big increase in mining complexity as well. It is clear that if you had a space that had some number of possibilities before, once you add 2 possible magnitudes per rule you expand the total number of systems by 2 and the number of combinations expands even more. For example if you have 1000 possible rules and you want to mine 2 rule systems then you have 499,500 possible systems, if you add 2 potential magnitude values that increases your initial rule number to 2000 which increases the amount of strategies to 1,999,000 systems. For each magnitude value you want to evaluate there is a huge expansion of the space. Magnitudes are also volatility adjusted because absolute price magnitudes would bring skewed results depending on how volatile the market is. Above a mined 2 rule sample strategy that contains magnitude comparisons.

–

–

Luckily for us our cloud mining at Asirikuy is currently programmed to properly size spaces regardless of complexity so that they have between 150 and 300 million strategies. The evaluation of these spaces is also possible thanks to our use of GPU technology which allows us to run large number of back-tests in the amount of time it would take a normal computer to just run a fraction of the strategies we evaluate. Using these technological advancements we will be able to mine for spaces with price magnitudes without the fear of an immense increase in mining complexity. As a consequence of the above we will be mining spaces that will be tighter in terms of shift and OHLC variations but which will contain more variability in terms of magnitudes, which will lead to potentially many more new and uncorrelated strategies with our current price action based repository.

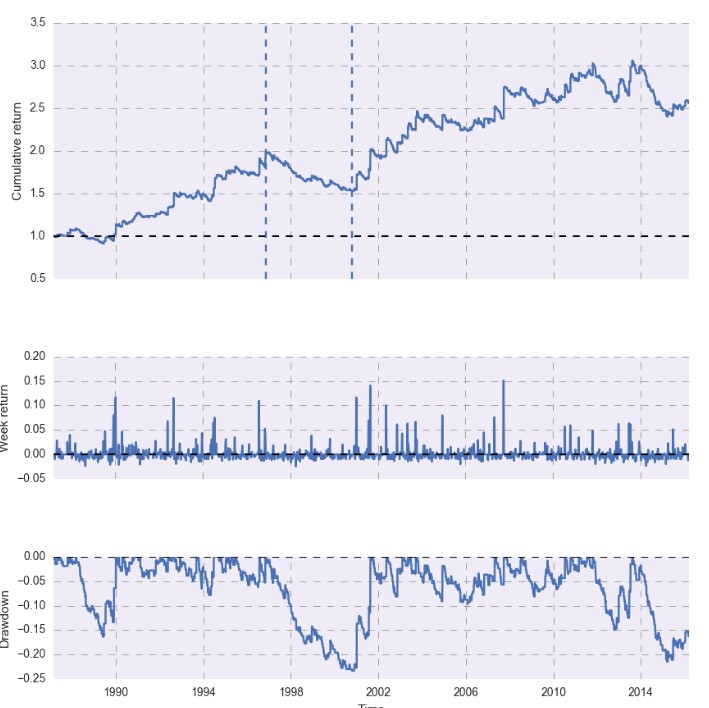

Another important change to our mining is the inclusion of strategies that will have the possibility to trade in a long-only or short-only manner. This can be quite dangerous if you are mining without any sort of mechanism to evaluate for mining bias – see here – but in our setup, since our tests adequately control for this, we can go into the world of long-only and short-only strategies without the fear of having heavily biased strategies without ever realizing this to be the case. Mining strategies that are long-only or short-only opens up a whole new array of strategies for mining and allows us to potentially exploit differences between how movements behave in different currency pairs. The second image in this post shows a long-only strategy mined on the EURUSD with relaxed filters.

–

–

The above two are the most radical expansions we have carried out in our mining since we introduced non-standard timeframes earlier this year. These expansions will lead to whole new worlds of systems and will increase the degree of diversification within our trading repository. They will also allow us to gather more information and see which type of trading strategy has the most potential to deliver stable results under live trading conditions. If you would like to learn more about our trading repository and how you too can trade portfolios using hundreds or even thousands of strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies