Many months ago I wrote a post about the Barclay currency traders index and how it gave us an idea about how well professionals perform in forex trading and how good or bad we do compared to the world of the “big boys”. You can read the article explaining what the index is and what information it gives us here. Definitely the information provided by the Barclay index is one of easiest and most convenient ways in which a trader can compare himself to other people and measure whether or not his performance is any good. Today I will talk about a very interesting finding I made which is a summary of the top performers of the Barclay Index within the last few pages of Currency Trader Magazine. Although I have been reading the magazine for more than 2 years this is in fact the first time in which I come across this information (I always skipped the last few pages which I thought were only quotes and other fundamental data).

Why is this information important ? Many people deem comparisons unnecessary because they believe that you should just do as “good as you can” without worrying about the performance of others, however new traders may find this information very useful because of the simple reason that it provides a true account of what people who attempt to “achieve the best they can” in the longer term can actually achieve. Certainly this doesn’t mean that you couldn’t do better than the top Barclay index traders but it does show you what you can expect to be a realistic rate of average compounded yearly return if you do an effort as high as the effort they do.

–

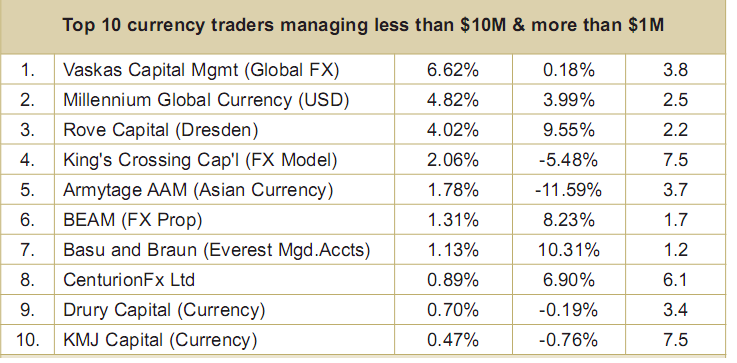

Another interesting thing is that the Barclay Index data provided in Currency Trader Magazine is conveniently separated to give us a good idea about how accounts with less money perform when compared with accounts that trade much more money. The index shows us the top ten performers above 10 million dollars and the top ten performers between 1 and 10 million dollars. This debacles one of the most common myths in forex trading which is that the larger the account the smaller the return you can expect. This is nothing more than a myth since the 1 to 10 million dollars funds are often much less profitable than the much larger funds. The reasons could be many but they are probably a consequence of better execution and much more funding for research and development.

The reason why people with small accounts can have much larger (yet unsustainable) returns with lower amounts of capital is merely because they are willing to take a much higher risk. A person can multiply a 100 USD account by 10x within a week (wiping everything within a few months) while a professional managing one million dollars will never take the change – neither would his/her investors – to lose all trading capital attempting to multiply it by ten. Sure, some small traders do get lucky and achieve to multiply their investment by 10 or 100x to then lower their risk but the reality is that the initial “burst” is nothing but a very risky venture which – much more often than not – ends up with a costly loss of capital.

If you can manage 1000 USD and make a consistent 10% profit for 10 years, you can do the exact same thing with one million dollars (probably he would do even better on one million due to the added flexibility). The important thing here is that forex trading – as it is shown by the Barclay index- is not a “make it or break it” game. Forex trading is about making very calculated investments with capital preservation and risk management in mind with the aim of surviving in the market. Surviving is the most important thing for a trader and the reason why capital preservation should be defended in a very aggressive manner.

So for the next few times you read my currency trader magazine articles – or any of the other really interesting articles written by fellow traders – make sure you go to the last few pages to compare your trading skills and returns with those of the Barclay Index crowd. If you follow this index for a few years and you consistently outperform the top hedge funds then you can call yourself a very successful trader because you have shown that with your limited capital resources (compared to them) and simply by using your brain you can out-perform some of the best and most consistent professionals in the world.

If you would like to learn more about my work and how you too can start designing and using mechanical trading systems to succeed in the long term please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)

I liked this article and I would like to know more.

Could you provide the link to the article about the Barclay currency traders index and how we compare to the “big boys”.

Great work, I like your style.

Interesting article .

I have been looking for the Barclay currency trader index and could not find it even on the Barclay website.

I would be very interested in consulting this list of best currency traders …and possibly to check some claims ( most probably true) that individual X is ranked first and second etc….only i can not find any official information/ confirmation…

If you can publish part of it or send it via mail ( or the link ) i’d be most grateful

many thanks in advance