During the past month I have written several posts about the importance of knowing system failure and why adequate criteria need to be devised in order to understand when a system’s trading needs to be stopped. On today’s post I am going to talk about a very important mistake new people to automated trading make which might not be apparent to them, the lack of an appropriately built statistically sound criteria for the evaluation of the on-going performance of automated trading strategy. I am going to write about the consequences this lack of knowledge in statistics have, how this affects the focus of new traders and why this inevitably leads to failure in long term results.

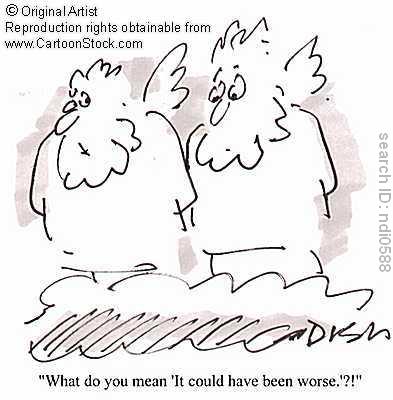

I decided to write this post after analyzing the way in which less experienced traders approach the performance of trading strategies. Usually there is an absolute ignorance about statistics and system development and this leads people to develop intuitive criteria for system following. People usually decide to “test systems” for a few months to see “if they are profitable”, then running them under live market conditions and dumping them whenever they “fail to work” for a few months. Many of these traders find the idea of running a system which has been losing for 6 months or more absurd and they consider the idea of going through 2 year long draw down periods inconceivable. Most even regard this as a potential “excuse” for bad system development, thinking that this will allow anyone to say “oh, just wait, the system will start working again in a few years”.

–

These problems all come from the same root. Since new traders do not have a clear statistical criteria to say when a system has stopped working, they do not understand why draw down periods need to be tolerated or to what extent this needs to be done. For most of these new traders, draw down tolerance is not determined by statistics but by what they “can take”.

In practice this means that new traders will always fight with their psychology as there is always a “fear” that a system will turn “sour” in an inevitable draw down spiral. Since this type of trader will not be able to tolerate extended draw down periods they will not be able to trade long term profitable systems and in the end, only failure will come out.

It is therefore extremely important for traders to have a criteria for when a system needs to be stopped. The most important thing however is to make this criteria based on sound statistical principles and NOT on the simple draw down tolerance of the person running the system. New traders should understand that professionals can withstand draw down because they know the extent to which draw downs will happen within a systems long term statistical characteristics and the deviations that could happen from it (which are generally derived from Monte Carlo simulations).

It is not that people are trading a system through a 2 year draw down period through faith alone, it is that there are some SOUND statistical criteria which tell the trader that this draw down length is a reality and that tolerating it will be vital to use the system successfully in the future. There are CLEAR targets in which systems are run and this often – if not always- requires to run through draw down periods which are long and deep. The important thing here is to understand that these decisions to run systems through bad periods are not based on some “faith” that recovery will come but on a statistically based criteria that tells us that the system is still behaving like it has shown to behave in the long term. While long term statistics are held, there is no reason to stop running a system.

So for new traders out there, advice here is simple. You should learn everything about the statistical characteristics of your system and you should learn how to derive worst case criteria from them which are independent of what you “feel” is tolerable as a trader. You should have a clear mathematically based threshold for a system “not working” and you should NEVER EVER rely on faith for running a system through a draw down period. Understanding is KEY to successful long term trading, something which you will NOT be able to achieve if you do not acquire the necessary knowledge to evaluate and track your strategies.

If you would like to learn more about my work in automated trading and how you too can learn to adequately design and evaluate strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)