A few days ago I posted about Amachay, a new Watukushay system in development which uses Fibonacci levels as a way to profit from counter-trending moves. This system forms part of a new set of experts being developed which tackle the issue of counter-trending strategies which are currently scarce within Asirikuy. Today I am going to write a post about another one of these new systems which has some very surprising characteristics that will make it our most impressive weapon against the counter-trending problem. On today’s post we will be discussing Sumaq, some of its results, its trading tactics and why it will be such a great new addition to the Asirikuy community.

Do not try to catch a falling knife. This is definitely one of the most sound and well known pieces of advice in the world of trading which relates to the fact that you should simply never try to go against a prevailing trend because chances are you will never be able to get enough expectancy to guess a turning point correctly. Is this true? For the most part it is, whenever you try to capture reversals (market turning points) you will get burned most of the time as the market likes to trend (not to reverse). If you think about it in terms of probability when the market starts a trend there is only one important turning point (at the very end) and therefore your chances of being wrong are huge while your chances of being right are very slim.

–

Sumaq is a strategy which was developed thanks to an idea by Franco -an asirikuy member who posts comments very frequently (thanks for that by the way!) – which attempts to profit from the very idea that you can – when certain conditions appear – adequately forecast trend reversals in such a way as to generate a high enough mathematical expectancy to be profitable in the long run. When you look at Sumaq – which uses an oscillator for entries – you see that it tends to be very wrong most of the time. Sumaq’s trades are often closed with losses, so often that the winning ratio for this strategy is in average about ONLY 20%. This aligns perfectly with our notion that capturing trend reversals is hard since the trend tends to continue most of the time. How does Sumaq achieve profitability then?

The answer relates with Sumaq’s exits and the extent of the reversals at play. This EA uses a Donchian channel trailing stop which ensures we use as a stop the high/low (depending on trade direction) of the past X periods, allowing us to exit only at a test of what is meaningful support/resistance almost by definition. This move trailing mechanism makes our SL be very close to our entry price a good percentage of the time so in essence we have a risk to reward ratio which is close to 1:5-10 on most cases. Sumaq is a system which exits trades with tremendous ease, knowing that it is wrong most of the time and being perfectly happy about it.

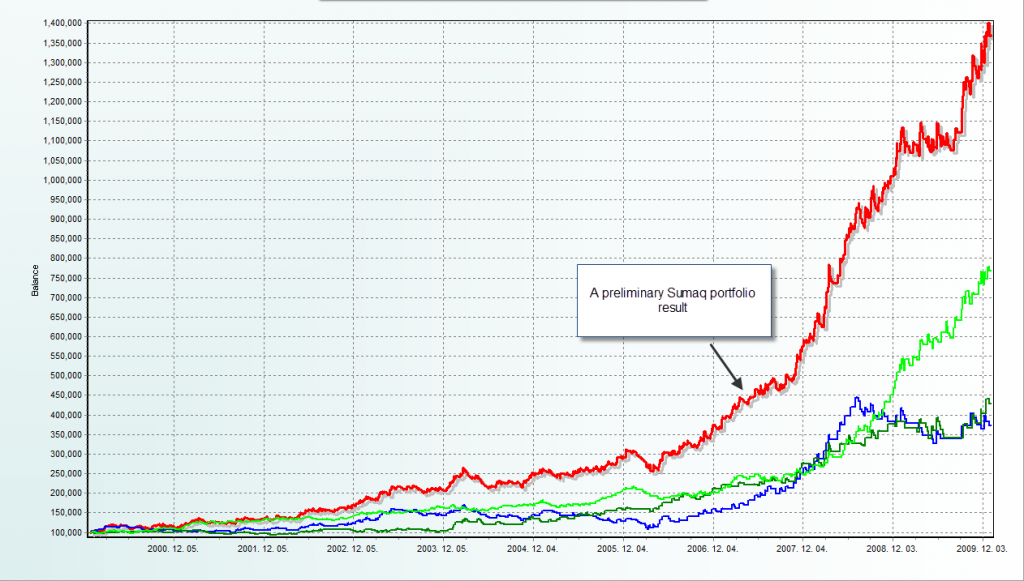

Being a strategy with such a poor winning percentage and such a high reward to risk ratio you would expect results to be quite medium to low performing but the great thing about Sumaq is its quite high profit achievements on a wide variety of currency pairs. This reversal strategy has profitable parameters on many different instances, profits that are meaningful due to the 2 years of out-of-sample testing used outside of the optimization process and the fact that the optimization procedure is exactly the same for all pairs. Although I am still in the development and improvement phase of this strategy it already shows clearly that it is able to profit under many different market circumstances on very different pairs.

–

For me Sumaq is an important achievement for Asirikuy because it tackles a problem that I had never seen tackled so efficiently, an EA that manages to receive “minor cuts” each time it fails to “catch the knife” but which achieves extremely large successful trades whenever it is fortunate enough to get a grip on the falling blade. Sumaq is therefore a very efficient counter-trending strategy which counter trends in a very long term efficient manner with the strong psychological penalty of having a large majority of trades be losers. To tell you the truth this is the first counter-trending system I come across with such interesting characteristics, a very low winning percentage with an impressive reward to risk ratio. Definitely Sumaq is a very sound strategy and within the next month we will have its introduction to the Asirikuy community coupled with the release of at least 2-3 live accounts to start evaluating its potential in live trading.

For those of you curious about the name, it derives from Franco’s (as Amachay derives from Wilson’s). Franco in Spanish is an adjective denoting honesty and honesty in Quechua becomes Sumaq. This naming convention therefore reflects Franco’s contribution to the Asirikuy community :o). As I said before the EA is now within its final stages of development and code-refining and within the next few weeks it will be released to the community within the F3.66 framework. If you would like to learn more about my work in automated trading and how you too can learn to develop and evaluate your own trading strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hey Daniel,

Glad you like the strategy :) Thanks for your time and contribution…

This strategy works phenomenally well on the USDJPY pair, so maybe we should look into building a USDJPY only portfolio consiting of different settings.

When doing a genetic optimization today I got 25000 results, the farthest I have ever seen the genetic optimization goes, just showing how many different sets of settings there can be for this EA…

Just an idea :D