Atinalla FE was my Christmas Gift to the online trading community for the year 2010 (checkout the system’s release page here). It is a three system portfolio for the EUR/USD that is available completely for free following this download link. These strategies are coded using Asirikuy’s F4 programming framework and can be traded in the MT4 platform build 600 or greater. The F4 framework performs data refactoring processes of your broker’s live or back-testing data to ensure that the candle structure used by the systems to trade is exactly the same as that used within our back-testing design data (Monday 4 GMT +1/+2 to Friday 19 GMT +1/+2). All the systems were designed to be used on the EURUSD 1H timeframe. The three strategies are described below:

Broadstairs Watukushay FE RSI: This is an RSI trading strategy that attempts to follow trends based on the value of this indicator. The idea here is simply that high RSI values indicate strong momentum towards the upside while low RSI values indicate strong momentum towards the downside. When there is a break towards either side the program enters a long/short trade that is handled through the used of fixed SL and TP targets that are adjusted as a function of market volatility. The system also has a closing logic related with RSI returning to more neutral territory.

http://davidpisarra.com/whats-your-one-inspirational-motivational-tips Watukushay FE BB: This program uses Bollinger bands to follow trends. The system waits for a break above a given multiple of the ATR away from the upper or lower Bollinger bands and enters a trade in the direction of the movement. Trades are handled through the use of SL and TP targets in the same manner as for Watukushay RSI.

Watukushay FE CCI: This program takes a similar approach to the RSI expert and enters breakouts when the value of the CCI exceeds a higher or lower threshold, the idea is also to follow trends as they develop. Trades have SL and TP targets that are also adjusted against the daily ATR.

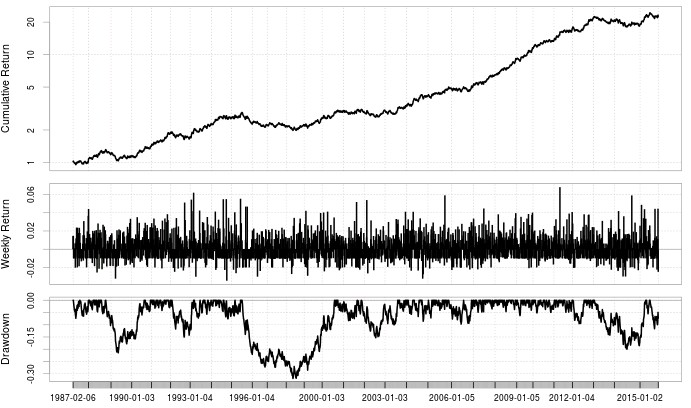

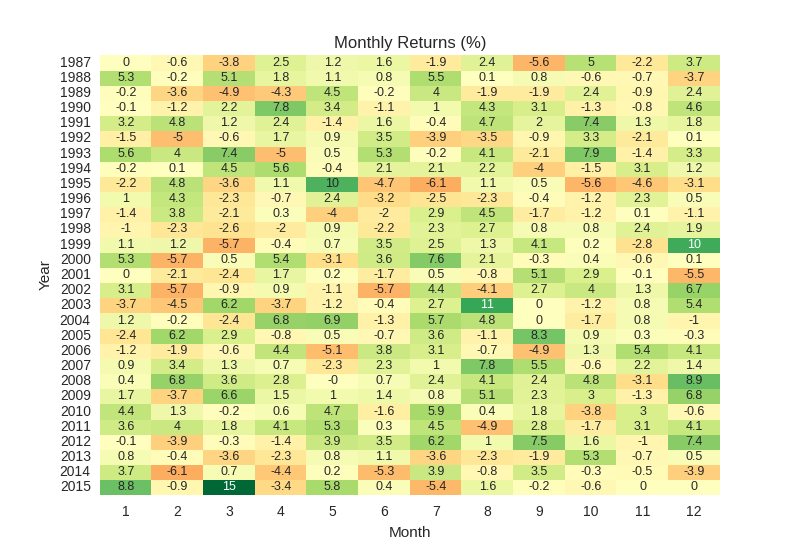

Here is a back-test of the 3 strategy portfolio made using our Asirikuy back-tester (1987-2015). Parameters for the strategies have not been optimized since 2012 (as we no longer live trade them at Asirikuy since we have moved to better setups since then). To back-test the strategies in MT4 make sure that you set the value of the HISTORICAL_DATA_ID parameter to 0 and then make sure you setup the line for your broker platform in the broker-tz.csv line located in your MQL4/Files folder(in your MT4’s platform data folder) to match the DST and GMT offsets of your historical data.

–

–

To load the strategies make sure that you enable both external libraries and DLL usage within MT4 . Each strategy must be loaded on its own EUR/USD 1H chart and each one must have a unique INSTANCE_ID parameter value. If you have problems with loading/running the systems please read the FAQ below:

The default parameters for the systems give me lots of errors.

The systems are not meant to be run with their default parameters. The default parameters are all set to null or void values. To use the parameters used in the back-test above load the set files located in the F4.4.27-FE folder that was installed within the presets folder of your MT4 data folder.

I get a broker mismatch error.

The name of your broker is either missing or has not been set properly within the broker-tz.csv file or your local time is set incorrectly on that same file. From your MT4 platform go to File->Open Data Folder then browse to MQL4 -> Logs and open up the AsirikuyFramework.log file using notepad or notepad++. You can then see the exact error that the framework has encountered and what the problem is. If the broker is not found the F4 framework will tell you the company name and tell you it’s missing while if it’s a problem with time mismatching the framework will tell you the reference and local times as well as their corrected values. You can then go to MQL4->Files and open the broker-tz.csv file to either add a missing line or correct your broker line to match the proper GMT/DST information. Note that you should never modify the broker-tz.csv file using excel as this program will corrupt the file when saving it back (will change separators and make unreadable for the framework).

I get a null pointer error.

These errors are generally caused by a lack of historical data for the program to load. Just make sure you zoom out of the charts as much as possible and scroll back as far as you can before loading the systems. After you do this scrolling restart the platform and retry loading.

I get another error and have no idea what to do.

From your MT4 platform go to File->Open Data Folder then browse to MQL4 -> Logs and open up the AsirikuyFramework.log file using notepad or notepad++. The log will give you further details about what might be happening. You can also modify the AsirikuyConfig.xml located within the MQL4/Files folder in order to increase log severity or tweak additional F4 framework settings (such as NTP synchronization).

This system portfolio is a good introduction for novice traders interested in algorithmic trading but has been since replaced by far more sophisticated trading methods at our trading community. If you want to learn more about algorithmic trading and how you too can learn how to search for, discover, evaluate and trade using automated setups please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.