One year ago I wrote a post talking about the release of Watukushay FE, an expert advisor based on an RSI strategy which was released for FREE to the whole internet trading community (you can checkout the EA and its current results here). After one year of live testing and a lot of learning through Asirikuy this year I will be releasing a new free EA for all aspiring traders out there called Atinalla FE. This new system has many improvements over Watukushay FE, being a perfect addition for anyone who wishes to trade a suite of systems on the EUR/USD. On today’s post I will talk about Atinalla FE, what it is about, what it improves over Watukushay FE and how you can get it right away :o)

When I released Watukushay FE my aim was to help people see that there was a free trading strategy with 10 year reliable backtests and investor-access verified results that they could access without paying a single penny. Through its first year of live testing Watukushay FE has ended the year with a slightly profitable outcome and in line with its long term statistics as deduced from the ten year backtests. Profitable trade distribution as well as draw down period lengths have – up until now – aligned with what is expected from the backtests. Through this evaluation lens I consider this EA to be a big success, showing that there IS in fact a free solution to likely long term profitable automated trading.

–

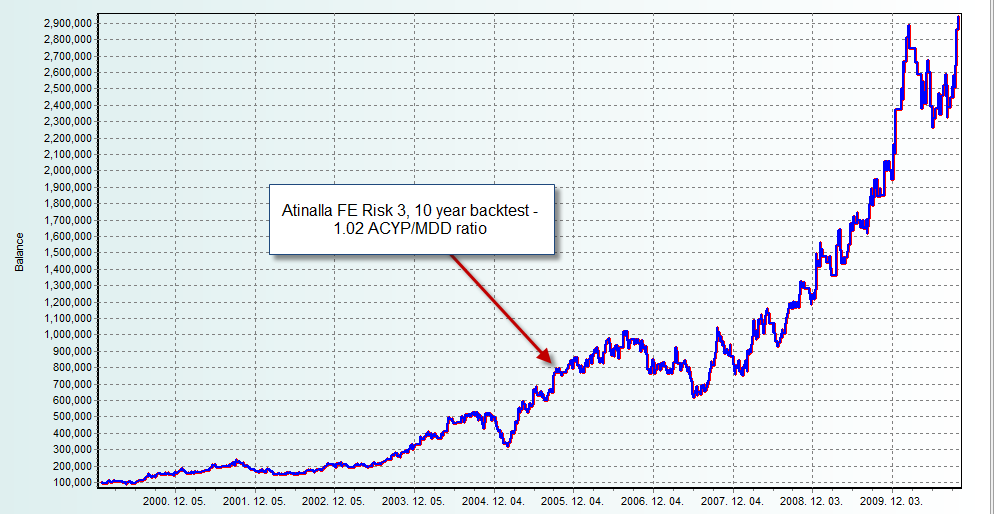

Today I improve on this concept by releasing Atinalla FE. This EA is derived from the Atinalla Project in Asirikuy which seeks to develop portfolios in order to reduce risk, increase robustness and improve statistical characteristics in the long term. Atinalla FE is a combination of three different systems, Watukushay FE, a Bollinger Band strategy and a Commodity Channel Index strategy, all on the EUR/USD one hour charts. Through the use of different systems the EA is able to hedge its risk and increase its profitability overall while reducing its draw down to profit ratio to a level far lower than that of Watukushay FE.

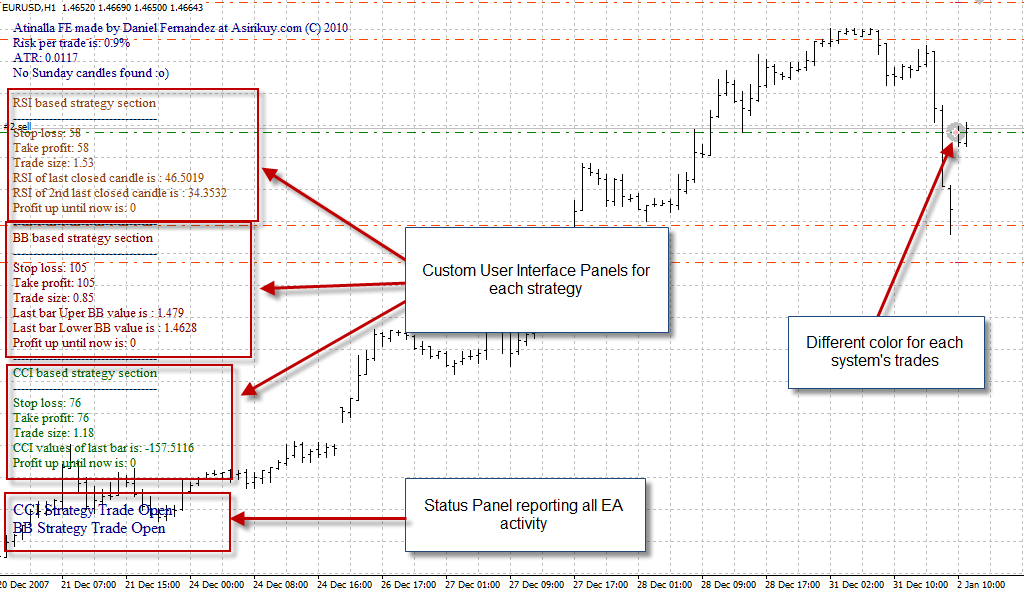

This new “portfolio EA” has been built with all Asirikuy concepts in mind, the EA uses appropriate error handling and a professional programming framework coupled with a strong separate evaluation of each strategy to ensure separate 11 year backtesting profitability. The portfolio was also developed WITHOUT using 2010 for the system’s optimizations showing that the system can also produce in-line results outside of the initial 10 year backtesting optimization data. The EA also incorporates a cool User Interface which shows all information for the three strategies simultaneously allowing the user to know which strategy has trades opened, when signals are triggered, etc. The backtests were carried out on RELIABLE 1 minute data (2 pip fixed spread) obtained from Alpari through a DIRECT request, ensuring that simulations are as reliable as possible. All optimization were carried out within separate systems in a very coarse manner (only single parameter, 5% step optimizations).

The profit and draw down targets for this portfolio EA are quite good with the EA achieving an Average Compounded Yearly Profit to Maximum Draw Down Ratio of around 1, improving on the much smaller ratio of Watukushay FE and the other single systems with this data. Probably the EA may yield better results on Metaquotes data but this shouldn’t be trusted as it has many holes which significantly affect the reliability of performance, especially in the year 2004 and in 2010.

–

The EA is available in this page in the form of an encrypted zip file which can only be opened with the password that is shown (in three parts) during the video available there. The idea here is that ALL people who download the EA will HAVE to go through the video to learn more about how it trades, its long term statistical characteristics, its parameter settings, etc. The EA is installed using an installer file which copies the ex4 to the specified directory, making the process (and future updates) easier for any potential users.

It is also worth commenting that although this “bundled approach” may seem appealing to some, it is not the best thing to do as it complicates the code, makes debugging more difficult and is only truly useful when all systems trade the same pair (reason why it will not be done with any Asirikuy systems, except for this portfolio). This portfolio was bundled so that anyone could fully backtest and analyze its trades without the many tools we have available within Asirikuy.

If you would like to learn more about my work and how you too can learn to build your own systems based on sound trading tactics and realistic risk and profit targets please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)

–

!! MERRY CHRISTMAS !!

–

Hi Daniel,

Wish you a Merry Xmas and Happy New Year.

Winter

Hi Winter,

Thank you very much for your comment and good wishes :o) I also wish you a very merry Christmas and a happy new year. Let me know what you think about Atinalla FE,

Best Regards,

Daniel

Merry Christmas Daniel and Thanks for everything!! :)

Regards,

Jim

Best wishes,a very good 2011 ,and thank you very much for sharing all your work with us!

Rob

Can you make the source code available as well? I am not using MT4 and would convert this if I want to use it.

Hi Frank, source code is only available to members at Asirikuy.com.