Atinalla FE was my Christmas Gift to the online trading community for the year 2010 (checkout the system’s release page here). It is a three system portfolio for the EUR/USD that is available completely for free following this download link. These strategies are coded using Asirikuy’s F4 programming framework and can be traded in the MT4 platform build 600 or greater. The F4 framework performs data refactoring processes of your broker’s live or back-testing data to ensure that the candle structure used by the systems to trade is exactly the same as that used within our back-testing design data (Monday 4 GMT +1/+2 to Friday 19 GMT +1/+2). All the systems were designed to be used on the EURUSD 1H timeframe. The three strategies are described below:

Watukushay FE RSI: This is a simple RSI trading strategy that attempts to follow trends based on the value of this indicator. The idea here is simply that high RSI values indicate strong momentum towards the upside while low RSI values indicate strong momentum towards the downside. When there is a break towards either side the program enters a long/short trade that is handled through the used of fixed SL and TP targets that are adjusted as a function of market volatility. The system also has a closing logic related with RSI returning to more neutral territory.

Watukushay FE BB: This program uses Bollinger bands to follow trends. The system waits for a break above a given multiple of the ATR away from the upper or lower Bollinger bands and enters a trade in the direction of the movement. Trades are handled through the use of SL and TP targets in the same manner as for Watukushay RSI.

Watukushay FE CCI: This program takes a similar approach to the RSI expert and enters breakouts when the value of the CCI exceeds a higher or lower threshold, the idea is also to follow trends as they develop. Trades have SL and TP targets that are also adjusted against the daily ATR.

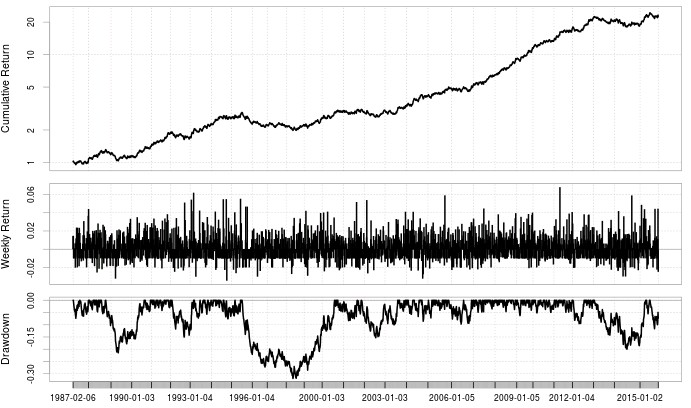

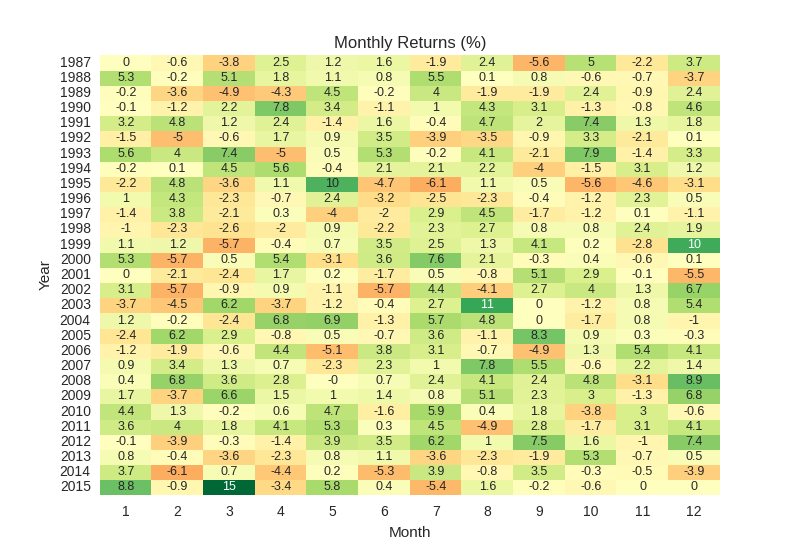

Here is a back-test of the 3 strategy portfolio made using our Asirikuy back-tester (1987-2015). Parameters for the strategies have not been optimized since 2012 (as we no longer live trade them at Asirikuy since we have moved to better setups since then). To back-test the strategies in MT4 make sure that you set the value of the HISTORICAL_DATA_ID value to 0 and then make sure you setup the line for your broker platform in the broker-tz.csv line located in your MQL4/Files folder(in your MT4’s platform data folder) to match the DST and GMT offsets of your historical data.

–

–

To load the strategies make sure that you enable both external libraries and DLL usage within MT4 . Each strategy must be loaded on its own EUR/USD 1H chart and each one must have a unique INSTANCE_ID parameter value. If you have problems with loading/running the systems please read the FAQ below:

The default parameters for the systems give me lots of errors.

The systems are not meant to be run with their default parameters. The default parameters are all set to null or void values. To use the parameters used in the back-test above load the set files located in the F4.4.27-FE folder that was installed within the presets folder of your MT4 data folder.

I get a broker mismatch error.

The name of your broker is either missing or has not been set properly within the broker-tz.csv file or your local time is set incorrectly on that same file. From your MT4 platform go to File->Open Data Folder then browse to MQL4 -> Logs and open up the AsirikuyFramework.log file using notepad or notepad++. You can then see the exact error that the framework has encountered and what the problem is. If the broker is not found the F4 framework will tell you the company name and tell you it’s missing while if it’s a problem with time mismatching the framework will tell you the reference and local times as well as their corrected values. You can then go to MQL4->Files and open the broker-tz.csv file to either add a missing line or correct your broker line to match the proper GMT/DST information. Note that you should never modify the broker-tz.csv file using excel as this program will corrupt the file when saving it back (will change separators and make unreadable for the framework).

I get a null pointer error.

These errors are generally caused by a lack of historical data for the program to load. Just make sure you zoom out of the charts as much as possible and scroll back as far as you can before loading the systems. After you do this scrolling restart the platform and retry loading.

I get another error and have no idea what to do.

From your MT4 platform go to File->Open Data Folder then browse to MQL4 -> Logs and open up the AsirikuyFramework.log file using notepad or notepad++. The log will give you further details about what might be happening. You can also modify the AsirikuyConfig.xml located within the MQL4/Files folder in order to increase log severity or tweak additional F4 framework settings (such as NTP synchronization).

This system portfolio is a good introduction for novice traders interested in algorithmic trading but has been since replaced by far more sophisticated trading methods at our trading community. If you want to learn more about algorithmic trading and how you too can learn how to search for, discover, evaluate and trade using automated setups please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.

[…] Atinalla FE […]

Dear Daniel,

Thank you for your effort to have this gift. However the password in the video is not correct. I have tried many times already. Also, is there any “:” or space between the word? Please email me directly the password. To prove I did watch the video, may I reveal the first password here. That is “********”

Thank you

Rapheal

Hello Rapheal,

Thank you for your comment :o) I have just verified that the password works perfectly, the password has THREE PARTS with NO SPACES or other characters between them, the three parts are shown within the video. I used the free winrar sofware from rarsoft both to compress/encrypt and enter the password to verify that it works correctly, you might want to try this software and/or double check the password. Also the password is 15 characters long so you are missing the third part according to the number of asterisks on your comment. Thanks again for your comment Rapheal :o)

Best Regards,

Daniel

I saw the video and still trying passwords…! It’s not clear if use capital or not, anyway, the password is not working, or it’s not 15 chars!

Maybe the password is hidden in the audio and not in the words on the video?!

Please, need help!

Thanks in advance.

Hello Gianni,

Thank you for your comment :o) The password is shown directly as images within the video – not as audio – and it is 15 characters long as I have said before. Many people have already used the password successfully so I am 100% sure that the password is correctly displayed within the video and working correctly within the zip file. Please remember that the password is case sensitive :o) Thanks again for your comment,

Best Regards,

Daniel

Cannot find the right password….

Anyway I decided buy subscription to “asirikuy”.

Paypal payment is for 1 year.

How can I pay just first month to try your service?

Thanks.

Hello Gianni,

Thank you for your comment :o) I decided to change to a yearly subscription model so that only people who are truly committed to the website and who want to get into this long term join, there is no monthly subscription available at the moment for this reason. However you can go into the Asirikuy website and watch the introduction video on the home page plus a sample video on the join page which show and explain what the website is about and what you should expect by joining. Please only join if you are absolutely sure that this is what you want and feel free to ask any questions before you do :o) Thanks again for your comment Gianni and for considering to join Asirikuy,

Best Regards,

Daniel

Thanks you very much for charing.

In the first version you talked about initial balance settings, but I can`t see this option in the second one, is it important or maybe you did something the other way so it is not needed anymore??? Thank you.

Hi Rimas,

Thank you for your post :o) This has been automated for the second version so it is no longer needed. Thanks again for your comment !

Best Regards,

Daniel

Hi Daniel

I apreciate very much your kindness and vilingness to forex comunity.

One question. Does it increase the risk significiantly if to trade this EA on the same account with other EA. Sure it does in general, but what I mean is it important for the culculation of the initial balance thingy. Thank you for your time.

Hi Viktor,

Thank you for your comment :o) The EA will set its risk independently of other systems. Provided that the EA always has enough margin and the other systems won’t be using a very large percentage of your available margin there should be no problem. I hope this helps,

Best Regards,

Daniel

Hi,

Can you please tell us the different settings of AccountRiskUnit = 2 or something else? What does it mean 2 or 1?

Thx for your effort.

Best regards,

Guest

Hi Guest,

This is the multiplier of the lot sizing equation, higher AccountRiskUnit means higher profits AND draw downs. Please perform backtests with different AccountRiskUnit values until you find a level which matches your risk aversion level. I hope this helps,

Best regards,

daniel

Hi Daniel or anyone,

I tried to download DivX Codec or Xvid Codec,

but still I cannot watch the video, I m using

Window Vista Home premium.

Please can anyone help me how to download the

correct player so that I can watch Atinalla FE,

many thanks.

Daisy

Hi Daisy,

Please download the DivX Web Player from divx.,com in order to watch the video, you might also want to try another browser (try IE, firefox or chrome) to get it to work. note that the Codec is NOT enough, you need the WEBPLAYER which you can download for free from their website. I hope this helps,

Best Regards,

Daniel

Thanks for replying Daniel,

after several tries, i download offline divx again, at last I got the plus player.

But after I refresh this page, the video still

doesnt show. Where should i go to?

thanks

Daisy

At last I click on “download video directly”

and open file, now i m watching your video,

thanks again

Daisy

Daniel.

I liked the video and the download. I looked at the performance and I understand that there is an iherent risk in such things on shorter timeframes. I looked at the performance of the system. One account has a couple of £k exposed but the return so far isnt covering such an open position and the other is losing money.

I respect what you are trying to do but if after a year it isnt making money should that not then be time to stop? I would be interested to know what you think.

Dean

Hi Dean,

Thank you for your post :o) The historical statistic results of the system show that it WILL have losing years, therefore anyone willing to trade the system should accept that it will have such periods of losses. As I mention on the video periods of draw down are bound to be long and deep. Please remember to always keep a focus on the long term statistics of the strategy and only stop trading when the strategy goes beyond its worst case thresholds as determined by formal statistical methods (such as Monte Carlo simulations). Thanks again for posting,

Best Regards,

Daniel

Ok thanks for replying Daniel.

Am I correct in thinking that to spread risk you chose a number of instruments over a number of timeframes and then use multiple automated software.

Would you consider using mean price levels as valid longer term trend entries?

Dean

Hi Daniel,

First of all I would like to compliment you on this website. I have only discovered it very recently but I really like your approach of UNDERSTANDING things instead of just trying to make a quick buck. Being a scientist myself, this is the way I also try to approach forex as a newbie. I am looking forward to following your posts in future.

I have a question about this Atinalla FE system: In the post above, you put two widgets, each with a real account trading with this system. The Atinalla system has fixed trading rules. However, the trading results and profit from the two accounts are very different. Why is this the case? It seems that the accounts are at different brokers. Surely the difference in performance cannot be explained by something like the slightly different spreads offered by the two respective brokers? What is your opinion on this?

Kind regards,

Edward

Hi Edward,

Thank you for your post :o) I am glad you like my approach to trading and I hope you find the information within the website very useful. Regarding the systems, you should bear in mind that the differences between brokers cause broker dependency which means that the results of a system vary from broker to broker due to the differences in feeds, weekly starting/closing times, etc. Since indicator values are not the same between both brokers the above greatly affects trading characteristics. Does this mean that broker A is better than B? Hardly. In order to know if a broker is better than another for a particular system you would need YEARS to gather statistically relevant results (right now it could only be better in the “short term” and then the roles could reverse). In Asirikuy.com we have developed mechanisms to tackle this dependency, such as libraries that trim and modify feeds so that they always match our backtesting data´s structure. I hope this helps,

Best Regards,

Daniel

Hi Daniel,

Would you be interested to be an IB for ThinkForex and to earn a great commission?

No, thank you.

Hello Daniel!

I have installed ATINALLA FE, and I would like to test it. Operation Mode is set to 2(testing), but when I run test – nothing happens (no trades).

What to do?

Oskars

Hi Oskars,

Thank you for your comment. Make sure you have the instance ID set to a number different than -1. Also make sure you check the “experts” and “jounal” tabs for any errors. I hope this helps,

Best Regards,

Daniel

Thank you, Daniel!

I changed Instance ID numbers, and now it’s working:)

The minimal account balance for testing this EA is 10000? However the error 131(invalid trade volume) appears.

Oskars

The minimum account size depends on your minimum lot size and account contract size. Perhaps your back-testing account contract size is 100K, in case you need a 100K balance.

Yes, contract size is 100K. Ok on demo I can test 100k balance, but how to trade then with this EA on real account with 5K balance?

Maybe you can give me your e-mail address, because I have a lot of stupid:o) questions and some ideas of trading strategies.

Thanks.

Hi Oskars,

Thank you for your reply :o) Personalized support through email messages is only available to Asirikuy members. If you’re interested in learning more about system development/testing you might want to take a look at our community. If you want to trade on a 5K balance you simply need an account that allows you to trade down to 0.01 lots (1000K contracts) on a 100K contract size per standard lot. You can even trade on 100 USD if you have an account with a 10K contract size per standard lot (if you can trade down to 0.01 lots). I hope this helps,

Best Regards,

Daniel

Hi Daniel,

I run setup and it shows weird chracters.

Can I (use some key to) force English?

Thank you.

Hello Daniel,

I have a problem with the password.

I can only open backtesting by password from your video, but with exe this password doesn’t work.

I found the Atinalla_FE on another site, but now i have a comment

ATR not initialized correctly (zero devide).

I suppose that in this exe file there are also indicators.

I’m very interesting how looks and work the robot written by a professional.

I would be grateful if you could help me with run your Expert Advisors.

Regards

Ewelina

Hello Daniel

First thanks for opening up so much contents. I’ve been tweaking for a while with Python + Pandas, and was glad to experiment a little more with Openkantu while reading some of your posts.

I did try the installer you provided for watukushay, but unfortunately despite having set it up properly, I end up with MT4 crashing, on all my machines (Win7 or Win10). Were you reported such problems before ? Or is there some requirement on the OS level that I don’t know of ? (XP mandatory, or whatever)